Key Takeaways

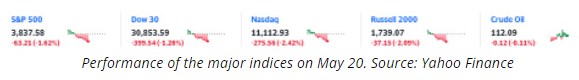

- The S&P 500, a stock index that tracks the performance of 500 large companies listed on US stock exchanges, fell to 3,811 yesterday, a drop of more than 10% in May and 20% from its all-time high ( ATH). The drop reduces enthusiasm for Bitcoin and other cryptocurrencies.

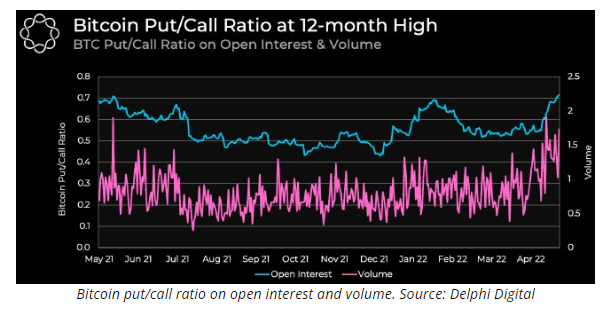

- A high call ratio indicates that investors are speculating on whether Bitcoin will continue to fall in value, or that venture capitalists are trying to hedge their portfolios against a drop.

- The S&P 500 fell 1.62 percent on May 20th, representing a more than 20% drop from its all-time high in January 2022 and stoking recession fears.

- The index is presently closing at 3900, the same level it opened at on May 19; if this threshold continues to fall, a bear market will emerge next week.

On Friday, the S&P 500 Index entered the bear market.

The term “bear market” is used by investors to characterise a severe and long-lasting downturn in the economy. Technically, it represents a 20% or greater drop from recent highs.

Investors commonly use the phrase to refer to a broad stock index, such as the S&P 500 or Dow Jones Industrial Average, but it also applies to individual stocksThe phrase “sell in May and go” has a profound impact in the current situation, and the effectiveness of the crypto and equity markets over the last three weeks has demonstrated that the phrase remains true.

Stocks took an average of 14 months and 58 months to recover after those drops. The previous bear market took place In february and March 2020, when the S&P 500 fell 34%. However, by mid-August, stocks had recovered.

If the index closes the day down 20% from its all-time high, the benchmark index will officially be in bear market borders.

The Nasdaq Composite stock index, which is heavily weighted toward technology, is also already in a bear market. Many variables are currently causing concern on Wall Street, including rampant inflation, rising interest rates, the war in Ukraine, and the threat of a recession.

The 20 percent dividing line used to classify a bear market isn’t particularly noteworthy. It is more of a symbolic and psychological barrier for investors.

Based on its historical price performance following a death cross, some analysts believe BTC could fall to $22,700.

The put/call ratio for BTC open interest reached a 12-month high of 0.72 on May 18, indicating traders’ low expectations, as per cryptocurrency research firm Delphi.

According to Delphi Digital,

“A high put/call ratio suggests that investors are speculating on whether Bitcoin will continue to fall in value, or that investors are hedging their portfolios against a downward move.”

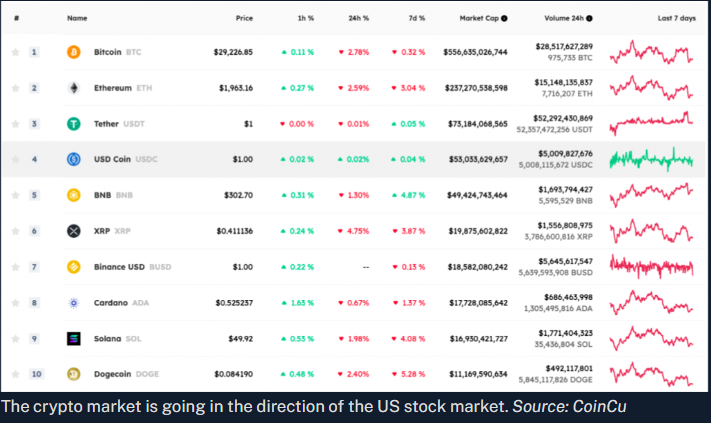

Altcoins also fell sharply as BTC, Ether, and stocks retreated, reversing earlier-day gains.

Ellipsis (EPS), Persistence (XPRT), and 0x (ZRX) were among the few bright spots, rising 30 percent, 13.92 percent, and 12.34 percent, respectively.

The total cryptocurrency market cap is now $1.234 trillion, with Bitcoin dominating at 44.6 percent.

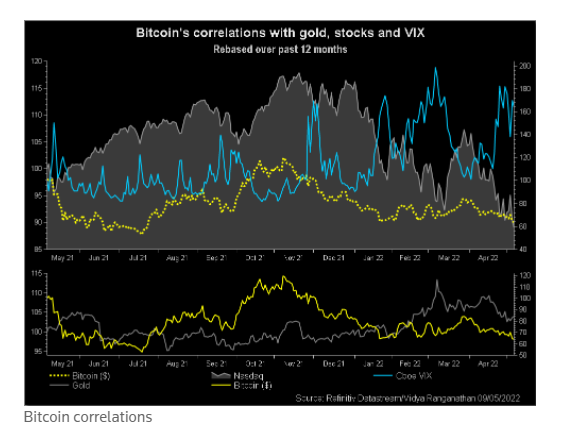

One part of the recent crypto sell-off is crypto’s significant relation with stocks.

Some investment companies are liquidating cryptocurrency because they are divesting other assets, and they need to make it up on their books for this quarter to demonstrate that they’re not dropping dead in everything and that they have some money on the side to get back into equities when they bottom out.

However, according to Plan B, the Bitcoin Bear Market is just about over.

During the recent Bitcoin catastrophe, the price of BTC fell below $30,000, a negative feeling roadblock for the asset. Proponents of Bitcoin have noted that the current 8-week decline is the first of its kind in the asset’s history.

Plan B identified key indicators indicating a bullish comeback in Bitcoin price. The Relative Strength Index (RSI) is an oscillator that indicates whether an asset is overbought or oversold.

According to Plan B, the RSI currently indicates that the bear market is nearly over and that the Realised Price/Moving Average (RPMA) and the Relative Strength Index are poised to begin rising again.

While iconic investor Peter Brandt predicted a massive 90% drop in Bitcoin and altcoin prices, Plan B believes a trend reversal in BTC is more likely.

Having followed an 8-week losing streak, Bitcoin is poised to recoup its losses. Bob Loukas, a trader and entrepreneur, believes Bitcoin is on the verge of a comeback. Notwithstanding the retest, the analyst is confident that Bitcoin will not end up losing its $28,500, lower support level.

BTC has entered a new cycle. Lower support has been retested, and the bid must now be found. It’s impossible to lose $28.5k this early in a cycle because it’s game over.

If the Bitcoin price rises above $31,500, it will quickly reach $37,000.

For on-demand analysis on any token or coin at any time, you can join our Telegram channel.

Closing Thoughts

Discipline and Patience are the most important components of a successful trade. According to the above analysis, the coins we just discussed about might make you decent gains if other market conditions prevail favorably. Again, it’s your hard-earned money that you’ll be using. Do Your Own Research before investing.

Disclaimer: Our analysis is for educational purposes.