Key Takeaways

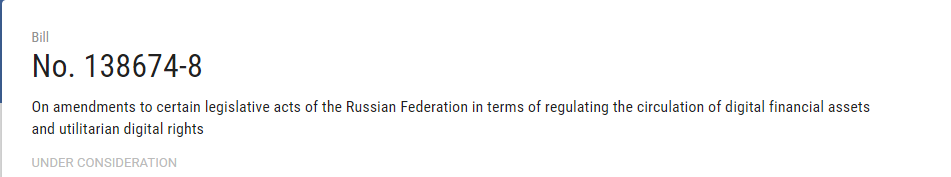

- The bill, which was introduced a week ago in Russia’s lower house of parliament, the State Duma, quickly passed its first reading.

- It will be illegal to use “digital financial assets” (DFA) to pay for goods or services if it becomes law.

- The bill was was endorsed by Anatoly Aksakov, the head of the State Duma’s Financial

- The bill has been criticised by lawyers for stiffening regulation of digital rights and tokenized assets.

Despite the fact that Russia’s law does not specify what constitutes a monetary substitute, the government continues to oppose the use of DFAs.

From an official statement issued on June 14, the bill to prohibit the use of digital assets in Russia, which was introduced by Anatoly Aksakov, the head of the State Duma’s Financial Markets Committee, passed its first reading.

Despite the fact that the document suggests that DFA exchange managers must withhold any deals involving the use of tokens as a monetary alternative, the restriction could be lifted in cases “prescribed by federal laws.”

The announcement comes after Aksakov proposed a week ago that digital assets should be prohibited as a legal payment method:

“The ruble is the Russian Federation’s official monetary unit (currency).” The aforementioned article prohibits the introduction of any other monetary units or monetary surrogates on Russian Federation territory.”

One of the primary theoretical flaws in the bill is that it treats DFAs, which are known as tokens rather than cryptocurrencies, as a payment option when they are most commonly used as security tokens. Another omission is the phrase “monetary surrogate”; while the bill aims to preclude the use of DFAs as a monetary surrogate, Russian law lacks a clear interpretation of the term.

The bill also defines an “electronic platform,” which is vaguely defined as a financial platform, investment platform, or information system that issues digital financial assets. Electronic platforms would be identified as participants in the national payments system and would be required to register with the central bank. Every major DFA operation, including emission, circulation, exchange, and trade, would have its own registry.

The bill’s authors also emphasise that the Russian ruble is the country’s primary legal tender. In a logical twist, they demand that the boycott forego the risk of using computerised resources as “financial proxies.” They intend to compel coin and token backers, as well as traders and venture capitalists, to refuse to handle cryptocurrency exchanges.

In addition, the bill was sabotaged by Ivan Chebeskov, the director of the Russian Ministry of Finance’s financial policy department. He suggested that cryptocurrency usage in Russia should not be restricted, as it could be an excellent way for the country to improve its competitive position in the global tech sector. According to Chebeskov, citizens of the state should also be able to pay for goods and services using various cryptocurrencies.

The current law on digital financial activities took effect in 2021. The tax amendments on DFAs were first read in the State Duma in May 2022. Separately, two other significant bills are still making their way through the legislative process.

Evgeny Grabchak, Russia’s Deputy Minister of Energy, announced in March that crypto mining would be legalised on a “regional level” at designated “sites.” On the contrary, the New York State Senate passed a bill prohibiting crypto mining earlier this month. Katy Hochul, the governor of New York, has yet to say whether she will support or oppose the bill.