Key Takeaways:

- Yoon Suk-yeol, a conservative presidential contender from South Korea, has won the country’s election.

- Yoon promised to de-regulate the country’s crypto business throughout his campaign. During a speech in Seoul, Yoon remarked, “We must revise regulations that are remote from reality and unreasonable.”

- Crypto was a prominent policy concern in South Korea’s presidential election. Both Yoon and his Democratic Party opponent Lee Jae-Myung issued campaign-related non-fungible tokens throughout the campaign, which may be a new vision.

After a harsh and fiercely fought campaign characterised by claims of corruption and depravity, conservative opposition candidate Yoon Suk-yeol has won South Korea’s presidential election, signalling a major shift for the world’s tenth-largest economy.

With 98 percent of ballots counted, Yoon, 61, a veteran prosecutor who only entered politics last year, knocked out his progressive Democratic Party opponent Lee Jae-myung by less than 1%. In the early hours of Thursday morning, Lee accepted defeat.

During the election, cryptocurrency was one of the strongest arguments. Yoon and Lee both unveiled crypto-friendly positions in an effort to appeal to younger people.

Many young Koreans have turned to the stock market and crypto investment to get ahead due to rising household debt and stagnant salaries, but the present government, led by President Moon Jae-In, has clamped down on crypto. In 2021, approximately 70 Korean exchanges were forced to close due to strict regulatory measures, leaving only a few running.

More than five million individual crypto accounts exist among South Korea’s top three exchanges, accounting for nearly 10% of the country’s population.

Yoon’s triumph comes after a campaign driven by domestic economic and social issues, including a widening income gap, increasing housing prices, and gender tensions.

Yoon, who will take office in May for a single five-year tenure, will oversee an economy that gained 4% in 2021, the strongest annual growth in 11 years, because to a record increase in exports.

Yoon vowed to de-regulate the cryptocurrency industry throughout his campaign. Yoon stated laws “that are far from reality and unreasonable” must be revised in effort to “realise the unlimited potential of the virtual asset market” during a crypto conference in January.

Yoon believes that unless rules are specifically forbidden, the industry should be permitted to run without them.

We must modify laws that are distant from reality and illogical to achieve the maximum potential of the virtual asset market,he explained at a virtual asset symposium in a Seoul hotel.

Yoon stated that he wants to recruit and build crypto “unicorns,” or startups worth $1 billion or more.

Yoon also promised to raise the proposed capital gains tax threshold on cryptocurrency revenues from KRW 52.4 million (US$42,450) to KRW 52.4 million (US$42,450). Crypto earnings exceeding KRW 2.5 million ($2,024) generated in less than a year will be subject to a 20% tax beginning in 2023.

Yoon has also stated that he will “take legal action to collect crypto gains obtained through unlawful ways and refund them to the victims.”

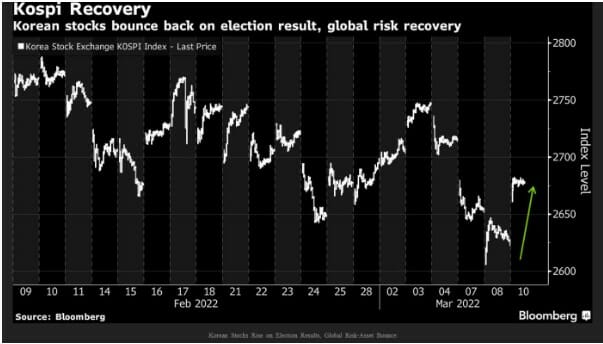

Korean stocks rise as election results are announced, and global risk assets surge:

The election result improved mood by putting an end to a period of investor uncertainty brought on by the close contest. The stock market’s smaller businesses also climbed, with the Kosdaq, which is heavily weighted in technology and healthcare, rising as much as 2.6 percent. In New York trade, the iShares MSCI South Korea ETF gained 4%, the largest one-day rise in more than a year.

“If you look at Yoon Suk-interviews, you’ll notice that he’s really willing to enact market-friendly policies,” said Hong Chunuk, CEO of Richgo Investment in Seoul. “We can expect the government to act as a neutral judge.”

As of 0147 GMT, the benchmark KOSPI had risen 54.46 points, or 2.08 percent, to 2,676.86, its highest intraday gain since Dec. 1, as markets hailed former top prosecutor Yoon’s victory, which signalled a shift toward deregulation in Asia’s fourth largest economy’s financial markets.

A regional bounce also aided sentiment, as the halting of commodity price increases prompted speculation that weeks of market gyrations had priced in the fiscal implications of the Russia-Ukraine conflict. Yoon, who is restoring the conservative opposition to power after a five-year absence, has promised to eliminate capital gains taxes on stock sales and to rein in the industry’s long-standing practices that favour institutional investors over regular stockholders.

Kookmin Bank, one of South Korea’s major banks by net assets, has announced the launch of cryptocurrency investment products for retail investors. In addition, the bank has established a Digital Asset Management Committee with the goal of launching a crypto exchange-traded fund (ETF) and future products as soon as the country’s regulatory framework permits.

CODE, a joint venture designed to meet the Financial Action Task Force (FATF) travel restriction, has formally begun cooperating with around 30 South Korean crypto and blockchain enterprises. Dunamu, the operator of South Korea’s largest crypto exchange Upbit, is not a member of CODE and has built its very own travel rule solution, VerifyVASP.

For all transactions above a million Korean won South Korea has required the travel rule, which will take effect on March 25.