A mining pool is a group of cryptocurrency miners who pool their computing resources over a network to improve their odds of obtaining a block or successfully mining for cryptocurrency.

Individual members of a mining pool contribute their processing power to the endeavour of discovering a block. The pool is compensated if its efforts are successful, typically in the shape of the cryptocurrency involved.

To distribute awards among those who contributed, the proportion of each individual’s processing power or effort compared to the overall group is commonly employed. In some cases, individual miners may be asked to present proof of work in order to get their rewards.

Crypto mining is indeed one of the most popular recurring revenue projects in the crypto sector. Most miners join mining pools in order to increase their ability to solve more blocks and make even more money.

However, bad actors have grown increasingly prevalent in this industry, luring naïve victims into phony mining pools and defrauding them of their earnings. Scams like these have become rather common in the crypto world nowadays, particularly online.

In general, there are two types of mining strategies. One is mining pools, where people can pool their processing power to earn cryptocurrencies. Mining pools have evolved into cloud mining. Cloud miners, in this scenario, rent cloud computing power, which is analogous to cloud computing.

Table of Contents

Cloud Mining:

Cloud mining has both benefits and drawbacks in terms of security. It is easy to set up a realistic-looking crypto mining service that is actually a scam, owing to the convenience and agility of cloud computing.

Pooling is a typical mining approach in which miners pool their resources and computational power in an attempt to solve more blocks and gain more rewards and reputation. Miners in mining pools are rewarded based on how much effort they put into solving a block.

Mining pools have grown into cloud mining in the same way as on-premises data centre computing has. Cloud mining allows miners to rent computational power for their mining projects rather than incurring the expenditures of purchasing, establishing, and maintaining a mining rig, which incurs hefty electricity bills. Basically, cloud mining is the rage in the mining sector at the moment.

Cloud mining companies that use robots on Telegram or WhatsApp are some red signs to be aware of. Users must not take this seriously because very few people mine substantial amounts of cryptocurrency using their phones, let alone these or other messaging apps.

Miners in the industry should be careful of mining firms that want greater investments in order for consumers to receive better returns. Furthermore, organisations who have an active referral programme should be recognised, as referrals are a frequent way for businesses to reward their customers.

Miner Extractable Value (MEV)

By including, excluding, and modifying the order of transactions in a block, maximal (previously “miner”) extractable value (MEV) refers to the greatest value that may be harvested from block production in excess of the regular block reward and gas fees.

Maximum extractable value is also known as “miner extractable value” in a proof-of-work scenario. Since miners govern transaction inclusion, exclusion, and ordering in proof-of-work, this is the case.

Miners are the only entity who can ensure the execution of a successful MEV chance (at least on the present proof-of-work chain — this will change after The Merge), hence MEV accumulates completely to miners in theory. In practice, however, autonomous network participants known as “searchers” extract a major chunk of MEV.

An analytical coder and long-time algorithmic trader operating under the pseudonym Pmcgoohan initially spotted the MEV vulnerability in Ethereum in 2014, a year before Ethereum launched. When the protocol became online, Pcgoohan realised that miners had complete control over the transaction inclusion and ordering process, which meant they could utilise this authority to take value from unwitting users.

While several saw the flaws in Ethereum’s planned design right away, Pmcgoohan was sadly ahead of his time, and his warning fell on deaf ears. That is, until a group of researchers published a study called Flash Boys 2.0 in 2019, in which the word “MEV” was first established to characterise the problem Pmcgoohan had mentioned years before.

MEV is often associated with miners, but it is not a Proof-of-Work nor an Ethereum-specific problem. Furthermore, the term “miner extractable value” is a little deceptive. In actuality, the majority of MEV extraction now comes from so-called “searchers”—typically arbitrage traders and bot operators—who constantly seek and find MEV chances on-chain and capture them in various ways, while miners only benefit passively from these traders’ transaction fees. MEV can be found on any smart contract-enabled blockchain that has a party in charge of transaction sequencing, such as validators in Proof-of-Stake systems like Ethereum 2.0 and rollup providers in Optimistic Rollups.

How Mining Pools Steal Hundreds of Millions from ETH Miners?

Prior MEV income was split with miners, mining pools kept 100% of it. This lowered Miners’ block rewards while directly benefiting pool owners. Most large Chinese mining pools, like 2miners and EZIL, intentionally scammed their miners, profiting in the millions.

Micah reported this covert income on behalf of the ETH Developers, who were dissatisfied with most mining pools stealing their miners’ earnings and funnelling it into their own coffers.

Most pools did this with the help of a MEV firm, the most well-known of which was Archer DAO, which provided MEV income that was even lower than the gas that would have been on the block, resulting in a net loss overall but a net gain for the mining pools, who typically only got 1%.

Not only did Archer DAO supply MEV, but it also allowed anyone to send ETH transactions for less than the cost of gas, allowing pools to defraud their miners by disguising free transactions that they were selling privately to others in their “1 GWEI” payouts. Most pools that were scamming their miners in secret have suddenly indicated that MEV profits will be shared. The majority of them are lying about their proportion in the market.

A new fraud has emerged that allows pools to advertise sharing MEV income while covertly profiting handsomely. This is accomplished through Archer DAO’s new “EDEN” token. The highest slots in blocks are typically offered as MEV or for high tips. EDEN works by requiring pools to set aside certain slots for EDEN.

The EDEN network:

Instead of paying tips or MEV ETH (ETH that goes to miners), EDEN sends its own “EDEN” currency straight to a private hidden wallet maintained by these pools.

Eden Network is a migration from Archer DAO, not a new project. Archer was created by an unknown team, according to the description, yet some of its members can be located on platforms like Medium, Discord, and official websites.

Archer DAO token ARCH was 1:1 swapped to EDEN after Archer DAO transferred to Eden Network, and the total value was altered from the previous limitless to a total of 250 million.

Eden’s key selling point is its two headline features: 1) priority transactions via the Eden RPC (in exchange for staking 100 EDEN tokens) and 2) slot auctions, in which potential slot occupants bid with EDEN in a continuous auction to reserve priority blockspace (namely, the first three slots in every eden block).

Slot tenants must outbid the previous slot owner by at least 10% and then pay a 3.3 percent charge on that bid on a daily basis so that the amount is spent in about 30 days.

The miner fee isn’t expressly paid in ETH to the miner address during transaction inclusion, unlike regular transactions and Flashbots bundles, making it difficult to track Eden’s economic data. It is paid in EDEN tokens to a different address after the fact. One of the main points we want to raise is how this leads to pool managers not allocating EDEN income to individual miners on a pro-rata basis. It’s also more difficult to reconcile with the network blockspace’s security budget because rewards aren’t paid in ETH.

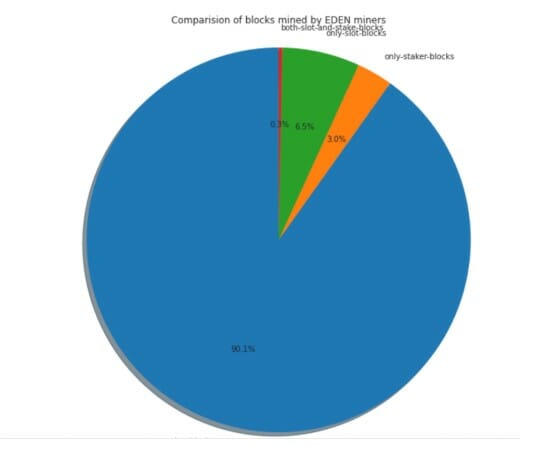

It’s crucial to remember, however, that just because Eden miners have 50% hashrate doesn’t mean Eden blocks get 50% of the network’s hashrate. This is due to the fact that a miner might choose to mine flashbots (or just normal blocks) during periods when Eden blocks are less profitable (either automated to turn off Eden-Geth based on token price or with their own discretion). You can see the most current example of this happening here. While Eden’s slashing should prohibit this, we’ve only seen 0 slashing instances thus far, so we can only infer they’re not being enforced (given their discretion) or miners are just receiving lower payments if they do so.

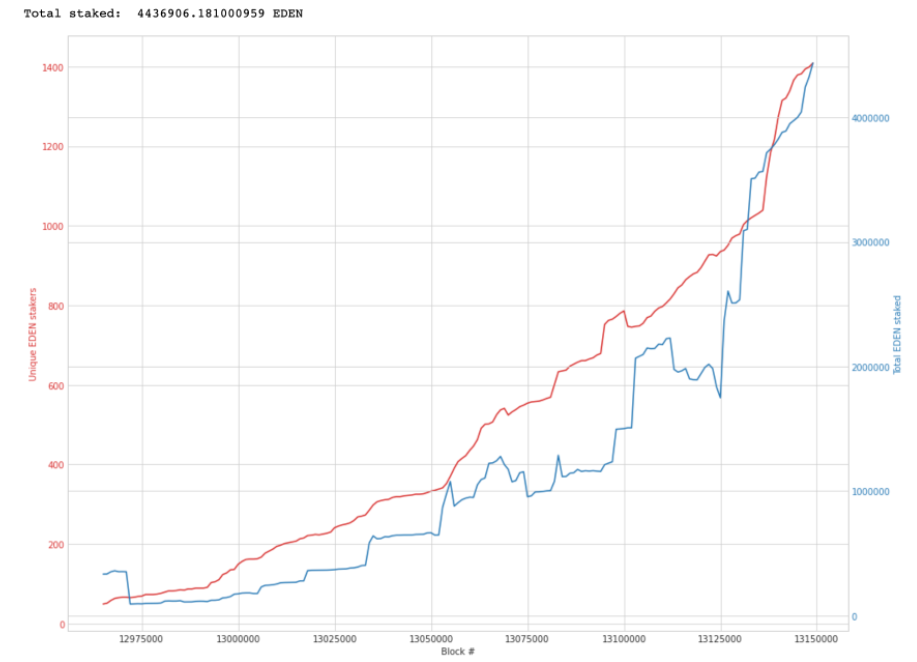

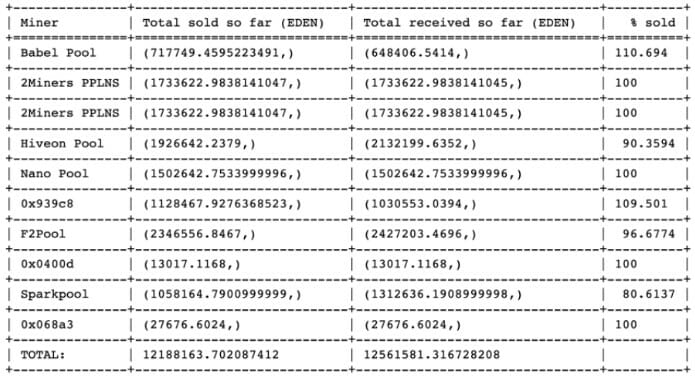

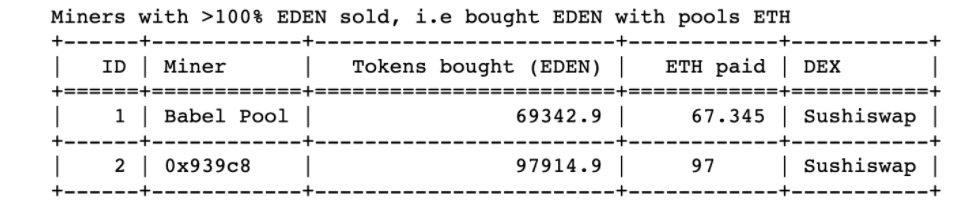

Tracking how much miners received and how much they ended up selling to the EDEN-ETH Sushi Swap pool to get a better idea of what they’re doing with their claimed EDEN tokens (DEX with the most liquidity for that pair).

Predictably, 100% of the EDEN claimed has been sold for ETH in the majority of cases. While pools haven’t stated explicitly how they plan to handle/redistribute EDEN rewards, we assume they’ll sell it for ETH and distribute it to their pool miners .

- In the Dark Forest, Illuminating the Garden of Eden:

On Ethereum, the Dark Forest is already a popular topic.

This is due to Ethereum’s design process, which places all transactions in the mempool, which resembles a dark forest. Miners sort and pack according to the gas fee paid by the transaction in normal conditions. However, if miners or arbitrageurs keep an eye on the mempool, they can profit by altering transaction order.

Non-miners have fewer options than miners and can only strike by growing gas wars. Miners can profit from numerous ways such as block restructuring and transaction reordering, such as rush-running, back-running, and sandwich attacks.

Miners have generated additional earnings in the blocks they have dug through block rearrangement, transaction reordering, and other techniques (this behavior is also known as the maximum extractable value MEV) 136,600 ETH since January 2020, according to MEV-Explore statistics, and the MEV is worth 6,800 ETH.

Eden claims to protect its users from MEV by supporting direct to miner transactions, but this is actually just a simple direct to miner relay capability, like MEV Alpha Leak’s RPC endpoint. Sparkpool has, in fact, been providing an RPC endpoint for private transactions over the Taichi Network for quite some time. Users can currently get frontrunning protection without having any token exposure or staking, and this will only become more common as new protocol wrappers (like as MistX) are constructed to send transactions as bundles.

Worse, you discover EDEN stakers could still be frontrun if someone uses a bundle to sandwich them.

This is due to the fact that in EDEN blocks, the tx sequence is slots first, then bundles, and finally stakers txs. Eden’s single innovative feature is the ability for protocols to sponsor users. While this is novel, it does not require a token, and it is simply another example of Eden seeking to lock down things that should be open to all.

Three options for MEVs

Private Transaction, MEV Auction, and Front-running as a Service are MEV’s three main offerings (FaaS).

The primary premise of private transactions is to circumvent the public mempool and place the transaction in the private mempool, where it will wait for the miners to pack before being broadcast to other nodes. Private transactions are typically given by 1inch Stealth Transactions, Taichi Network, and bloXroute.

Consider, for instance, Taichi Network. The Spark Mine Pool, which is presently Ethereum’s second largest mining pool, developed it. Through the Taichi Network interface, users can transmit transactions straight to the Spark Mine’s privacy mempool. Because the transaction is broadcast online, the status of the transaction cannot be determined until the transaction is completed.

Karl Floersch, CTO of Layer 2 Optimism, proposed the MEV Auction in early 2020. MEV Auction divides the two powers of miners, “transaction decision rights” and “transaction ranking rights,” in terms of design. Miners only have the authority option of choosing transactions in the MEV Auction mechanism; the right to sort transactions is provided to another figure, Sequencer. MEV Auction isn’t a perfect option, of course. The activities of Sequencer, as well as collusion, are all possibilities.

Mining pool operators receive an out-of-band payout that they are not required to disclose with their miners. Retail investors who are desperate to invest in something with a MEV plot (while pools unload 100% of their tokens for ETH), miners who are not going to receive their good proportion of the hashpower they contribute, and the Ethereum network as a whole is compromising , as these rent-extracting tokens are created for no real reason other than to enrich their creators and VCs eager to throw money wherever they think may produce a return.