Key Takeaways:

- Saylor to serve as executive chairman, while MicroStrategy President Phong Le will take on the CEO post.

- MicroStrategy reported a net loss of $1.06 billion, or 94 cents a share, which included $917.8 million in digital-asset impairment charges.

MicroStrategy co-founder Michael Saylor resigned from the chief executive officer(CEO) post following the firm reporting a second-quarter loss of $1 billion after taking a $917.8 million impairment charge in its BTC holdings.

Saylor would continue to serve as executive chairman, while MicroStrategy President Phong Le will take on the CEO post. Saylor, who has been CEO of MicroStrategy ever since its inception in 1989, will now devote his time to the firm’s cryptocurrency acquisition strategy and related advocacy initiatives.

“As global adoption of digital assets accelerates, this is becoming an ever more expansive job, and I am comfortable increasing the scope of my advocacy efforts knowing that the execution of the MicroStrategy business plan rests in the capable hands of Phong,” Saylor said.

Taking over as new CEO, Phong said “With total revenue growth on a constant currency basis, and 36% year-over-year growth in subscription services revenues, our business remains resilient even in light of the continuing macroeconomic uncertainties.”

Saylor believes splitting the roles as chairman and CEO will enable them to pursue better their two corporate strategies of acquiring and holding bitcoin and growing our enterprise analytics software business.

Saylor, who is an ardent believer in the potential of Bitcoin, started investing in Bitcoin with MicroStrategy in mid -2020. His investment in BTC was fueled by the belief that BTC would be used as a hedge against inflation.

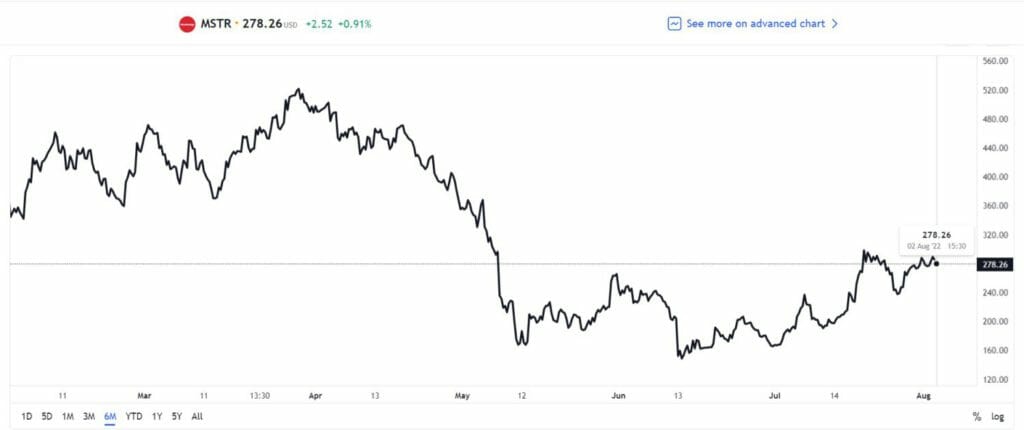

The company’s shares surged that year by over 170% as the value of the Bitcoin jumped. MicroStrategy’s Bitcoin stash was worth about $5.9 billion at the end of the first quarter which gradually tumbled following Bitcoin’s price dipping even below $20,000.

MicroStrategy recently posted results for its second quarter, reporting a net loss of $1.06 billion, or 94 cents a share, which included $917.8 million in digital-asset impairment charges.

In 2021, the company reported a loss of $299 million, or $30.71 a share, reflecting $424.8 million in impairment charges. Between May 3 to June 28, MicroStrategy purchased Bitcoins at around $10 million – an average price of $20,817 per coin.

Earlier, Saylor has defended every BTC purchase of the firm stating that BTC would need to fall to as low as USD 3,562 before a loan it has with Silvergate Bank would require additional collateral.

MicroStrategy revealed that the carrying value of its digital assets, representing about 129,699 bitcoins BTCUSD, stood at $1.988 billion as of June 30 when accounting for cumulative impairment losses of $1.989 billion.

As per the Q2 report, the firm’s gross profit slid to $96.9M in Q2 from $102.3M in Q2 2021. Digital assets on its balance sheet totaled $1.99B on June 30 compared to $2.9B in December 2021. Following the Q2 report becoming public, shares of MicroStrategy fell about 2.3% in post-market trading.