Key Takeaways:

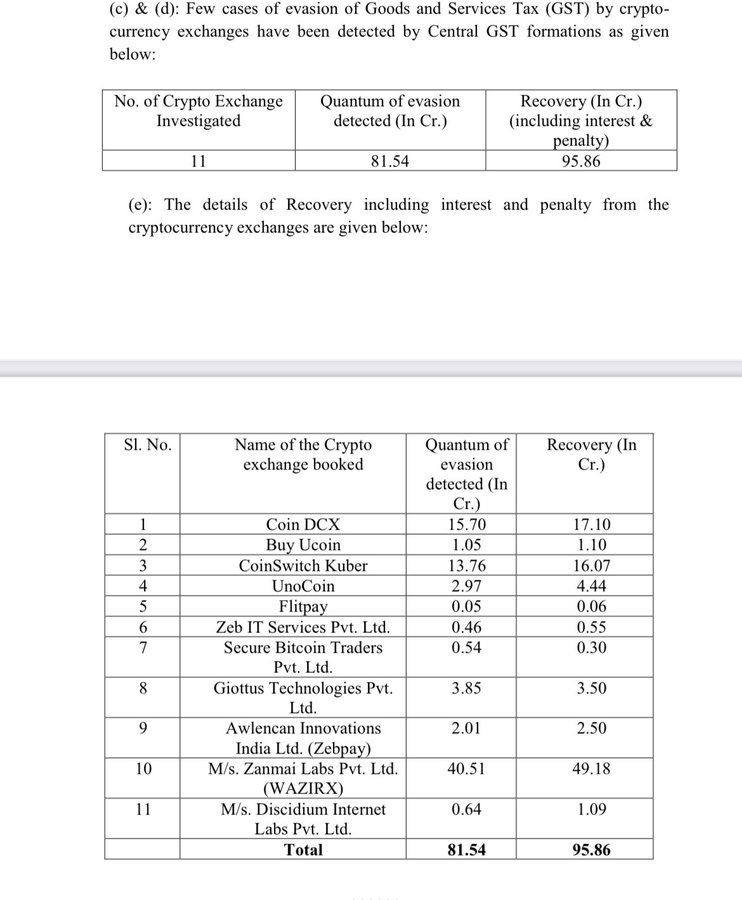

- Minister of State for Finance Pankaj Chaudhary stated that the government had initiated action against 11 crypto exchanges in India for tax evasions totaling Rs 81.54 crore.

- The total amount recovered from crypto exchanges, including interest and penalty charges, is Rs 95.86 crore.

According to our sources, in a written reply to the Lok Sabha today, Minister of State for Finance Pankaj Chaudhary stated that the government had initiated action against 11 cryptocurrency exchanges in India for tax evasions totaling Rs 81.54 crore. MoS Chaudhary also stated that the total amount recovered from cryptocurrency exchanges, including interest and penalty charges, is Rs 95.86 crore.

The response also clarified that the government did not collect any information on cryptocurrency exchanges. It was asked to the government if crypto exchanges were involved in GST evasion, the MoS stated that the central GST formations had detected only a few cases of GST evasion by crypto exchanges.

According to the report presented before Lok Sabha, 11 such exchanges were investigated for Rs 81.54 crore of evasions, and Rs 95.86 crore was collected, including interest and penalty charges as can be seen in the image given below.

Experts say that nearly two months after the government proposed a taxation policy for income from trading in virtual digital assets (VDAs), there is still a lack of clarity on a variety of problems.

Some days back the government proposed tightening the rules for crypto taxation by prohibiting the offset of losses with gains from other virtual digital assets. According to the amendments to the Finance Bill, 2022 that have been circulated among Lok Sabha members, the ministry proposes to remove the word ‘other’ from the section relating to the set-off of losses from gains in virtual digital assets.