Key Takeaways

- Genesis Global Capital had over 100,000 creditors and liabilities ranging between $1 billion and $10 billion.

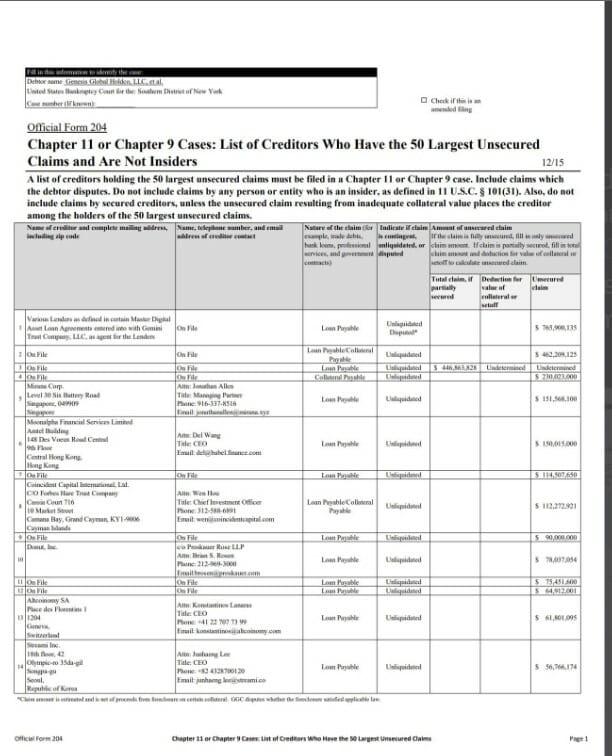

- Genesis biggest creditor isGeminii with debt standing at $765 million

- Mirana, MoonAlpha Finance, and Coincident Capital are other top creditors

Genesis Global Holdco, LLC and its subsidiaries Genesis Asia Pacific Pte. Ltd and Genesis Global Capital, LLC-which all fall under Barry Silbert’s crypto empire Digital Currency Group, had filed for Chapter 11 bankruptcy in the Southern District of New York.

As per the filing, Genesis Global Capital had over 100,000 creditors and liabilities ranging between $1 billion and $10 billion. Genesis’s top creditors include Crypto exchange Gemini, trading giant Cumberland, Mirana, MoonAlpha Finance, and VanEck’s New Finance Income Fund, among others. Genesis’ bankruptcy filing states that Genesis owes Gemini, the platform owned by Cameron and Tyler Winklevoss, around $765 million.

After Gemini, the second-largest named creditor is a Singapore-based Mirana Corp, which has an outstanding debt of approximately $151.5 million. Crypto fund Mirana’s name is notable since it is known to have invested in the leading crypto exchange ByBit. Moonalpha Financial Services Limited, which is widely known as Babel Finance, is their largest creditor, with an outstanding debt standing at $150 Million.

Hedge fund Coincident Capital secures the fourth position, with the debt standing at around $112 million. DeFi App-Donut was the fifth largest named creditor with an outstanding debt of $78 million. VanEck’s New Finance Income Fund is also owed $53 million. Several other big creditors remain unnamed.

As part of the restructuring, Genesis Capital is now considering a “dual track process,” which will include pursuing a “sale, capital raise, and/or an equitization transaction” that would apparently enable the business “to emerge under new ownership.”

In its filing, Genesis claimed it had over $150 million in cash on hand that it believes “will provide ample liquidity to support its ongoing business operations and facilitate the restructuring process.”

Genesis first showed signs of liquidity issues following the collapse of FTX in November. Following the FTX implosion, Genesis Global Capital suspended withdrawals which in turn hurt customers of a yield product offered by the Winklevoss twins’ crypto exchange, Gemini. Earlier this month, Genesis had laid off 30% of its workforce, citing unfavorable market conditions.

Following the Genesis bankruptcy filing becoming news, Gemini’s Cameron Winklevoss tweeted stated that the bankruptcy was a crucial “step towards us being able to recover your assets”. In December, anticipating potential bankruptcy, Genesis had appointed investment bank Moelis & Co. to assist with exploring options.

The bankruptcy filing is expected to negatively impact Barry Silbert’s Digital Currency Group-the umbrella empire under which Genesis falls. Gemini founders have publicly made accusations claiming that crypto broker Genesis Global Capital and its parent company, DCG, owe Gemini’s clients $900 million.