Key Takeaways

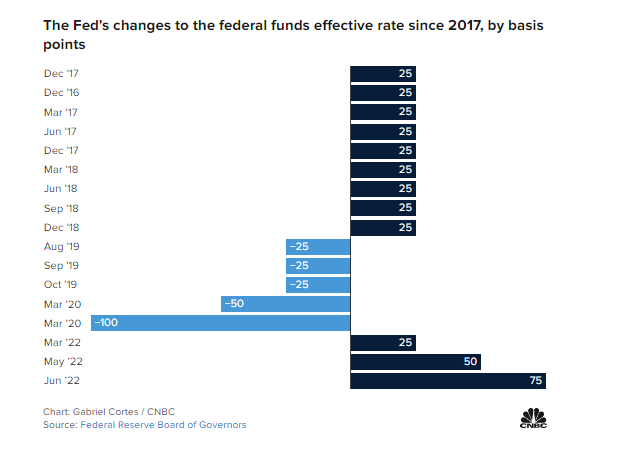

- The Federal Reserve increased its short-term interest rate by 0.75 percent.

- The Fed is attempting to control inflation by raising borrowing costs, and this is the largest increase in 28 years.

- More rate hikes may be on the way in 2022, according to the central bank.

- The steeply higher interest rates are expected to stifle an already sluggish economy.

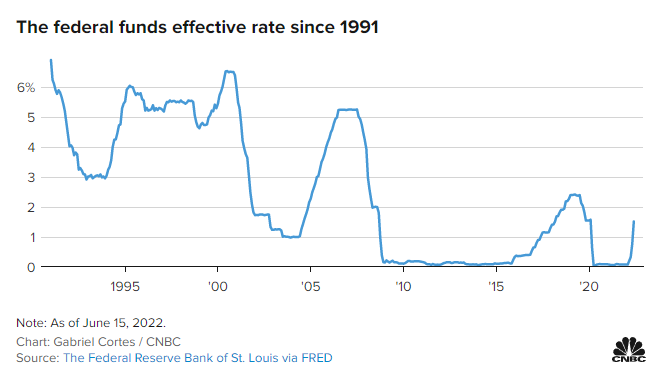

With surging inflation and the threat of recession looming over the United States, the Federal Reserve raised standard interest rates by three-quarters of a percentage point on Wednesday, the most combative increase since 1994.

The Fed had been set to announce a slight increase until this week. The Fed chair, Jerome Powell, said at a press conference that the central bank had made the decision that a greater hike was required in context of current economic news, including last week’s declaration that inflation had reached a 40-year high.

The Federal Open Market Committee, which sets interest rates, raised its benchmark funds rate to 1.5 percent -1.75 percent, the highest possible level since just before the Covid pandemic began in March 2020, putting an end to weeks of speculation.

After the decision, stocks were volatile, but they rose as Fed Chairman Jerome Powell spoke at his post-meeting news conference.

If price rises do not moderate, a similarly large rate hike is expected at the Fed’s next meeting in July, according to the chair. “We at the Fed are aware of the difficulties that inflation is causing,” he said. “Until inflation flattens out, it can’t go down.” That’s exactly what we’re looking for.”

After the decision, stocks were turbulent, but they rose as Fed Chairman Jerome Powell spoke at his post-meeting news conference.

“Clearly, today’s 75 basis point increase is unusually large, and I don’t expect similar moves in the future,” Powell said. He did say, however, that he expects a 50- to 75-basis-point increase at the July meeting. The Fed will “continue to communicate our intentions as clearly as we can,” he said, adding that decisions will be made “meeting by meeting.”

Powell admitted that the Fed’s efforts to curb spending are likely to result in job losses. As it seeks to put inflation back down to its target rate of 2%, the Fed expects unemployment to rise to 4.1 percent from the current rate of 3.6 percent.

Powell stated, “We never seek to put people out of work.” “You can’t have the kind of labour market we want without price stability,” he added.

More bad news on inflation sent US stock markets into a death spiral late last week, putting the Fed and the Biden administration in an intensifying crisis amid concerns that hyper inflation has now dispersed throughout the economy.

As per the midpoint of the target range of individual members’ anticipations, the Fed’s benchmark rate will end the year at 3.4 percent. In comparison, the March estimate was revised upward by 1.5 percentage points. The committee predicts that by 2023, the rate will have risen to 3.8 percent, a full percentage point higher than what was predicted in March.

Powell initially called rising prices “transitory,” but has since changed his mind and stated that the Fed intends to raise rates aggressively to bring the price situation under control.

BTC remains above $20k ahead of the US Federal Reserve’s meeting on inflation.

The crypto markets saw little relief yesterday, with Bitcoin displaying slight signs of improvement. The most popular cryptocurrency is currently trading for just over $21,000, down 5% in the last 24 hours.

BTC skipped to lows of $20,514.10 in the early hours of Wednesday, according to CoinMarketCap data.

Other major cryptocurrencies have also continued to struggle to reclaim ground lost in Monday’s sell-off, with Ethereum down another 7% since yesterday’s close. The value of the second-largest cryptocurrency is currently around $1,130. After the previous day’s thrashing, stocks were calmer, with the S&P 500, Dow Jones Industrial Average, and Nasdaq all roughly flat.

The accelerated contraction of financial standards, which is part of a push by central bankers to contain constantly increasing inflation, has squeezed liquidity out of crypto markets, and now cracks are showing up across the industry.