Key Takeaways:

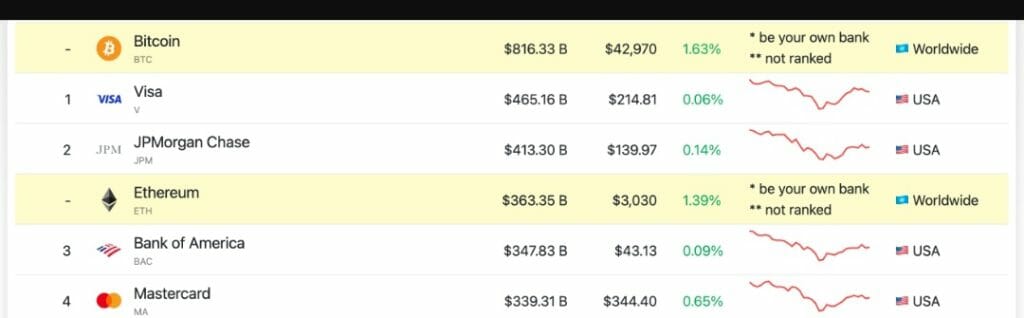

- The overall market capitalization of Ethereum has soared as it finally passes the $3,000 threshold. It has surpassed some of the largest financial companies in the world, including Bank of America (BoA) and Mastercard.

- The market capitalization of Ethereum has been steadily increasing in recent weeks, reaching $331 billion just one week ago, a rise of 10.47 percent.

Ethereum’s market value has soared as its price finally surpassed $3,000, overtaking some of the world’s most powerful financial institutions, such as Bank of America and Mastercard. According to figures obtained by Finbold from CompaniesMarketCap.com, the market cap of Ethereum was $366.13 billion at press time on March 24, while the market caps of BoA and Mastercard were $347.51 billion and $337.12 billion, respectively.

In terms of market capitalization, Ethereum is the second most valuable cryptocurrency. With a market capitalization of $816.33 billion, Bitcoin is the most valuable cryptocurrency, and its value continues to rise.

The price of ETH has hit a peak of $3,000 today after a three-week decline. Bitcoin, too, has been under the pine for two weeks.

It’s worth noting that, as things stand, only one bank has successfully avoided succumbing to Ethereum. At the time of writing, JPMorgan Chase had a market capitalization of $412.74 billion.

EIP-1559 had a total of 2 million ETH burnt. The “merge” from Proof-of-Work to Proof-of-Stake is the next protocol modification for the blockchain. With the effects of EIP-1559 and decreased emission levels from the switch to Proof-of-Stake, ETH could quickly become a deflationary asset.

Ethereum currently has two chains running in parallel: proof-of-work and proof-of-stake. While both chains have validators, only the proof-of-work chain executes user transactions at the moment. Once the integration is complete, Ethereum’s blockchain will entirely transition to the Beacon Network, a proof-of-stake chain that will make mining obsolete.

As a result, Ethereum’s energy usage is expected to be reduced by 99 percent. More institutional investors are expected to acquire Ether, fully utilize blockchain, invest in its network, and increase adoption as a result of the lower environmental effect.

The market capitalization of Ethereum has been steadily increasing in recent weeks, reaching $331 billion just one week ago, a rise of 10.47 percent.

It was previously reported on the enormous $20 billion inflow into Ethereum’s market cap in mid-March, suggesting the DeFi asset’s route to rebound marked a series of trading in the red.

EIP-1559 was intended to improve Ethereum’s fee market, which traditionally relied on an auction process, making transaction pricing uncertain. EIP-1559 mandates that users pay a “base fee” for transactions, as well as an additional tip to miners, in order for their transactions to be processed promptly during periods of high congestion.