Ethereum has yet to recover to former levels after collapsing with the market during the recent meltdown. The crash was marked by widespread sell-offs and liquidations, even as the price dropped further. This was spurred by investor fear of a bear market, as they wanted to get out before the price sank further lower.

After the giant Bitcoin crash, Ethereum followed the same path and lost 27% of its value between January 14, 2022, and January 22, 2022. This crash attracted the ETH whales (top cryptocurrency holders), who seemed to take advantage of the situation.

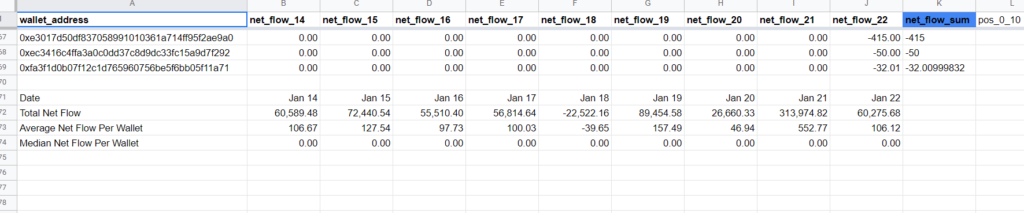

Xai Souphon, a Blockchain researcher, noticed this phenomenon and shared a detailed report on Market Zen. He raised the question, “Were the ETH whales collectively selling, holding, or buying ETH?” He has shared details of 5,000 wallets, excluding the ones that are non-exchange and non-contract wallets, to avoid any mistake while processing limitations. He was left with 4,787 wallets for the final calculations and noted each wallet’s inflows, outflows, and net flows.

This report revealed exciting information that 568 wallets, i.e. 88%, did not buy the crash. No activity was noticed in these wallets and therefore were ‘hodling’ during this panic situation.

However, there was a steady increase in the total net inflow of ETH into these whale wallets except for on January 18, when the outflow increased to 22,522 ETH. This is because the whales have been accumulating during the price fall and took the opportunity of the price drop on January 21.

When whales want to hold their investments for a long time, they frequently send cryptocurrency from exchanges. Unfortunately, storing significant sums of money on an exchange increases your chances of being hacked, as exchange wallets are the most popular target for cryptocurrency fraudsters.

Ethereum whales that maintain their validator nodes (cost 32 ETH each) must submit their Ether to the Ethereum 2.0 beacon chain, which is then locked up until Ethereum 2.0 launches in 2022.

Have a look at the large HODLers inflow from 22nd Jan, and guess who bought the dip?

Ethereum Whales Continue to Stack

According to on-chain analytics company Santiment, the top 10 Ethereum whales own only 5.83 million ETH, compared to 24.31 million ETH held by their over-the-counter counterparts. This, according to Santiment, could be attributed to the ongoing trend of Ethereum whale holdings removing cryptocurrency from exchanges.

As a result of the current price reduction, 302,092 ETH centres departed exchanges in January. On the other side, Whales take advantage of dropping market capitalizations to purchase cryptocurrencies at a bargain.

The top 20 Ethereum whales own 30 million ETH in total, both on and off exchanges. The top ten non-exchange addresses have 24.31 million ETH, whereas the top ten exchange addresses have only 5.83 million ETH.

Did NFTs Lead to ETH Price Drop?

Royalties and direct transfers from OpenSea are increasing as the selling of NFTs grows. The steep rise of the NFT sector could enhance Ethereum inflows to exchanges like Coinbase.

As for royalties, OpenSea distributed an additional 35,300 Ethereum to NFT issuers. Colin Wu, a Chinese journalist and crypto advocate, believes that the increase in selling pressure was caused by a surge in Ethereum inflows from OpenSea to Coinbase.

Over the last few weeks, OpenSea and NFT issuers have remitted 56,300 Ether to exchanges and royalties.

Experts believe that the dip in Ethereum price was exacerbated by increased selling pressure caused by OpenSea and NFT transactions.

Ethereum’s Whales are Stocking Up on the Crypto Asset: Shiba Inu

The Shiba Inu token has surpassed the Curve DAO Token (CRV) as the most traded coin among the top one thousand Ethereum wallets. In addition, the price of a Shiba Inu has risen over 50% in the last 24 hours, with increasing trading volume in so-called “whale wallets” explaining some of the surges.

Despite the bigger market’s recovery, with Ethereum seeing daily gains of up to 8% at press time, meme tokens like Shiba Inu continued to control the hearts of certain ETH whales.

According to data from WhaleStats, on February 11, ETH whale’ Juraiya,’ who is ranked 13th on the platform’s list of top Ethereum whales, purchased 50 billion Shiba Inu tokens for $1.079 million.

Whales have accumulated Shiba Inu tokens, according to data from Etherscan, a cryptocurrency tracker on the Ethereum network. Several whales bought Shiba Inu, bringing their total holdings to 63 billion tokens.

Etherscan tracks the 63 billion SHIB to four Shiba Inu wallets. The first two transactions were purchases of 6.1 billion and 1 billion Shiba Inu.

Shiba Inu’s on-chain activity has decreased, according to analysts. The Shiba Inu network’s transaction count has decreased by half, fueling a gloomy narrative for the meme coins price.

Activity has decreased despite new improvements in the Shiba Inu environment, such as the cooperation with Welly’s and whale buildup. Therefore, a decline in transaction volume is thought to indicate a drop in a token price.

As is typical of small-cap crypto coins, the recent $SHIB price gains are leaps and bounds above the rest of the crypto market. The top 1000 Ethereum “whale” wallets have an average of US$155 million in ETH cryptocurrency, smaller tokens, and an NFT.

Shiba Inu is also becoming more widely accepted as a cryptocurrency payment method by retailers such as Newegg, GameStop, Petco, Lowe’s, Bed Bath & Beyond, and AMC Theatres, boosting the coin’s trading popularity. Still, at US$0.00003378 per unit, Shiba Inu is trading at a fraction of its October peak of US$0.00008, and it is unclear whether its price will ever fully recover.

Shiba Inu Soars 22%

Shiba Inu (SHIB) has gained more than 22% in the previous 24 hours to $0.00002768, surpassing its closest competitor, Dogecoin, which has gained 7% in the same time frame.

The rise boosted the iconic meme coin’s market capitalization to $15.5 billion, relegating Polygon (MATIC) to 14th place in terms of market capitalization.

Before a Valentine’s Day event, a Shiba Inu (SHIB) rally is held. Shiba’s rally might not have had a better timing to launch off, coming just days after the company formally announced the launch of its fast-food chain and only days before its planned SHIB’ burn’ event for Valentine’s Day.

Bigger Entertainment debuted a limited-edition ‘Shib lovers merch’ campaign with SHIB inspired clothing on January 14th. On February 14th, the campaign will come to a close. 80% of all sales from ‘SHIB lovers merch’ will be “burned” as part of the campaign.

Bigger Entertainment is one of nine companies that have pledged to burn SHIB supplies regularly. On the other hand, unlike its competitors, Bigger Entertainment has codified its supply burn activities through a 2022 strategy. As part of these efforts, Shiba Inu has launched “SHIB Lovers’ Merch,” which will see the firm invest 80% of the sale earnings received before Valentine’s Day into Shiba Inu’s SHIB token. These tokens will subsequently be burned at a special ceremony on February 14th.

Bigger Entertainment, whining SHIB tokens constantly, said that they were only 1,200 tickets away from making this the largest burn party hosted to date.