Key Takeaways:

- White House Council of Economic Advisers states that their “recession indicator variables” have exhibited strong growth in the U.S. economy since the start of Covid.

- Even if the coming GDP report reveals another quarter of contraction, the economy is still broadly in good health, says the White House.

- In June, US inflation surged to a new 40-year high, reaching 9.1%

The United States is in a recession- a fact known and acknowledged by economists worldwide. However, the Biden Administration and its White House Council of Economic Advisers believe the GDP decline is not indicative of a recession.

On July 21, the White House posted a blog titled ‘How Do Economists Determine Whether the Economy Is in a Recession, which stressed that the U.S. is currently not in a recession.

The economist note that official determinations of recessions, along with economists’ assessment of economic activity, are based on a holistic look at data—including consumer and business spending, the labor market, industrial production, and incomes. “Based on these data, it is unlikely that the decline in GDP in the first quarter of this year—even if followed by another GDP declined in the second quarter—indicates a recession”, the blog reads.

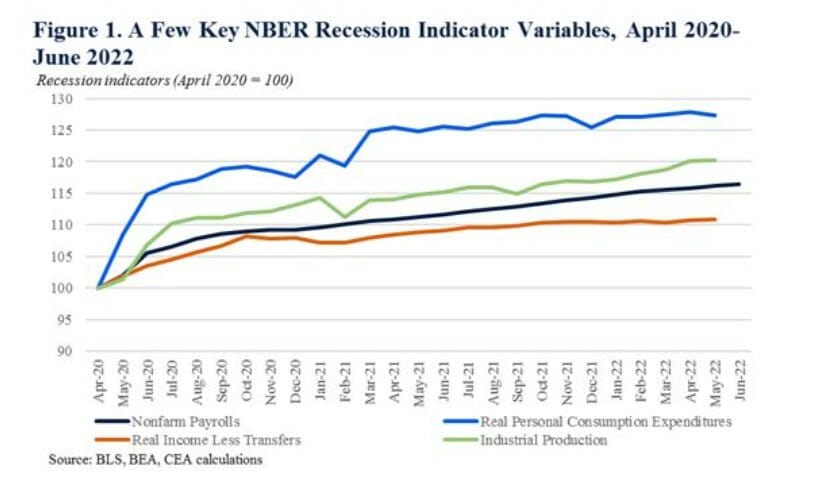

Citing figures, the economists state that the recession indicator variables of The National Bureau of Economic Research/NBER tracks have shown “strong growth” since the pandemic beginning and continued to improve through the first half of 2022.

The White House economists acknowledged that Inflation, rising interest rates, and easing demand all pose significant risks to the recovery while adding that even if the coming GDP report reveals another quarter of contraction, the economy is broadly still in good health.

Overall growth was dragged lower by temporary trends that say very little about the economy’s actual strength, the economists said. Further stressing that the country is not in a recession, the state that the drop in business inventories was only a reversion after firms invested heavily in inventory build-up at the end of 2021.

“Recession probabilities are never zero, but trends in the data through the first half of this year used to determine a recession are not indicating a downturn,” the post reads. The economist cited decreasing employment rate and monthly job creation as indicators to suggest that the country is not facing a recession.

Justifying the weak net export data, the White House Economists said the U.S. was importing plenty to match shoppers’ demand, but other economies weren’t buying the goods because their recoveries weren’t as strong.

The blog post comes amid the recent Consumer Price Index, which revealed that U.S. inflation surged to a 40-year high in June, reaching 9.1%. The first reading of the second-quarter GDP report is slated for July 28. According to the third estimate released Bureau of Economic Analysis, Real gross domestic product decreased at an annual rate of 1.6 percent in the first quarter of 2022.

Generally, experts declare a recession when a nation’s economy experiences negative GDP, rising levels of unemployment, falling retail sales, and contracting measures of income and manufacturing for an extended period of time. Therefore White Houses’ recent post “redefining recession” has invited slander and mockery from people all around the world.