Cryptocurrencies are a hot topic in the news and on social media. The price of cryptocurrencies has been steadily rising in recent weeks, and more people are looking for ways to invest in digital assets. There are new developments every day, and it cannot be easy to keep up with them all. We will be looking at some cryptocurrencies that you should look out for this week.

Table of Contents

Bitcoin (BTC)

Bitcoin holders are much stronger today than they have been in the past. Bitcoin just broke $47,000 again, and holders are now holding high balances at an all-time high. Since November, holders have increased their cryptocurrency positions and haven’t let up during Q1 of 2022. They seem to be accumulating more coins in anticipation of an eventual bull run.

BTC currently trades at $47,653.59 and has a market cap of 905 billion dollars with 21,000,000 coins in supply. It ranks #1 on CoinMarketCap.

On a 1D timeframe, BTC might make the next move upwards with an uptrend. However, the latest market downturn could be due to the 4th wave of the Triangle correction, and in that case, we should expect a drop to take prices below $28K while a bull run may begin. If this count doesn’t happen, values will not be more than $46.2K.

On the 4 hour timeframe, we can see that bitcoin has broken through the resistance point and is now on a high uptrend. This could be the next bull run if it continues to hold. The next target would be $52,000.

Ethereum (ETH)

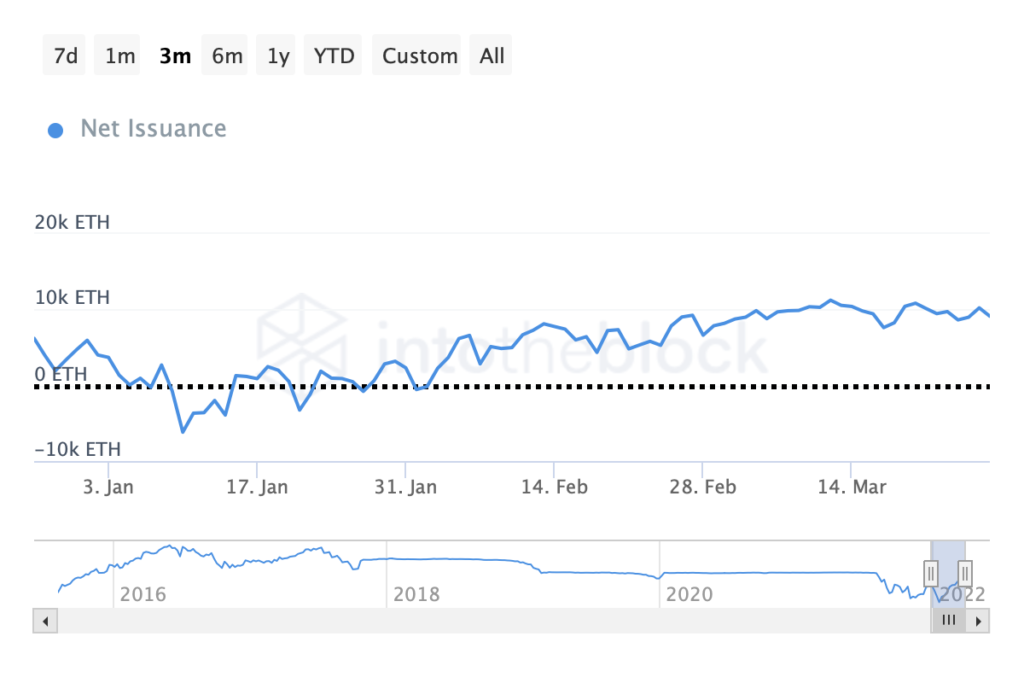

The trend for net $ETH emissions is finally going down. The increasing cost of maintaining the networks amidst a bearish market & declining usage has been counterproductive. While the demand for the network increases, its daily emission rate is decreasing. In March, the peak level was reached on the 12th without showing an overall increasing trend. ETH has not had a day without a loss in price since February 2nd, but this could change soon.

ETH currently trades at $3,426.84 and has a market cap of 411 billion dollars with 120,156,685 coins in supply. It ranks #2 on CoinMarketCap.

On the 1D timeframe, $ETH/USDT is forming out the Bearish Harmonic Bat pattern where the price action has to complete out the D leg, as well as the BOS, have also done which will lead to creating the new higher highs.

Zilliqa (ZIL)

Zilliqa is a cryptocurrency that aims to solve scalability issues with blockchain technology by splitting the mining network into smaller pieces. Zilliqa’s long-term potential is promising, even though it will be volatile in the short term. Investors can earn a 100% return within 2-3 years if they buy during dips.

ZIL currently trades at $0.1023 and has a market cap of 1.2 billion dollars with 21,000,000,000 coins in supply. It ranks #81 on CoinMarketCap.

In the 1W timeframe, $ZIL/USDT is trading downwards after its price has touched its all-time high. We can see the price action has broken out the resistance line of Descending Triangle, where the price action is will retest.

VeChain (VET)

VeChain is a platform that aims to provide a complete view of an organisation without the need for third parties. It also has the potential to become a leading enterprise blockchain provider and will release its own ICOs shortly. Vechain is one of the top cryptos to invest in for 2022, according to its technical analysis potential and solid fundamentals. This includes good technology, a great team, and many real-world use cases.

VET currently trades at $0.07441 and has a market cap of 4.7 billion dollars with 86,712,634,466 coins in supply. It ranks #36 on CoinMarketCap.

In the 4H timeframe, $VET/USDT has started trading in an upwards direction with Head and shoulder formation is continued, but the shoulder is yet to be formed out.

Convex Finance (CVX)

Convex Finance is a platform that helps CRV token holders and Curves liquidity providers earn more interest by locking their tokens in because they’re not being used. Options to earn extra Curve trading fees. The coin has been performing well, and the platform itself is one of the most popular on the decentralized finance scene. It’s always worth noting that crypto markets are highly volatile, so prices can move in either direction.

CVX currently trades at $30.94 and has a market cap of 1.7 billion dollars with 100,000,000 coins in supply. It ranks #67 on CoinMarketCap.

In the 1D timeframe, the price of $CVX/USDT has been trading in a very strong uptrend and has broken the market structure of lower lows.

For detailed Charts visit: Trading View