The cryptocurrency market has evolved over the last few years, with an undeniable surge in altcoins, meme coins, and tokens making waves in the blockchain ecosystem. In recent years, platforms like Binance Smart Chain (BNB) and Ethereum (ETH) have become epicenters of these emerging altcoin markets.

However, along with this influx comes an increase in crypto scams and malicious acts, causing billions in losses to unsuspecting investors.

MemeCoins Scam

As of now, meme coins are riding high on the crest of this wave. Meme coins like Dogecoin, Shiba Inu, and even the Pepe token, originally created as jokes, have surprisingly emerged as serious contenders in the crypto space.

Internet culture, powerful communities, and celebrity endorsements largely drive the popularity of these coins. But their volatility raises concern.

Pepe Token, for instance, is based on the Pepe the Frog internet meme, a popular yet controversial figure online. Born in the Ethereum blockchain, this token has become popular in various online communities, despite (or perhaps due to) its meme-oriented nature.

It’s an interesting case study of how internet culture and cryptocurrency have intermingled to create a new type of asset that combines humor, community spirit, and financial investment.

Many meme coins, including the Pepe token, are launched on the Binance Smart Chain (BNB) and Ethereum (ETH) platforms, which provide the infrastructure for creating and trading these new tokens.

According to CoinMarketCap data, the Binance Smart Chain currently hosts approximately 900 tokens, while Ethereum is the home to an astonishing 3700 tokens. This staggering growth highlights investors’ enthusiasm and belief in these digital assets.

However, this enthusiasm has come with a hefty price. With the increased activity on these platforms, there has been a surge in scam coins, rug pulls, and malicious token contracts.

Also read, Pancat Crypto:Scam or Goldmine

According to a recent report by Chainalysis, cryptocurrency scams have stolen nearly $2.5 billion as of Q1 2023. Another analysis by CipherTrace reveals that DeFi-related fraud, mostly happening on Binance Smart Chain and Ethereum, accounted for approximately 60% of this total. A study also reveals that 97% tokens listed on uiswap are scams.

According to Rekt, a platform that tracks DeFi exploits, more than $1.7 billion has been lost to rug pulls on BNB and ETH platforms since 2022. With the market being largely unregulated and the anonymity offered by blockchain, the barrier to entry for potential scammers is frighteningly low.

Despite these challenges, meme coins and ETH alts continue attracting a broad range of investors, partly due to their high potential returns. Investors see in them an opportunity to get in on the ground floor of the next Bitcoin or Ethereum.

However, every investor must exercise caution and perform due diligence before investing in these highly volatile assets.

How to Identify Crypto Scams?

But how would they expect a rug pull, scam, or anything that can make them lose all of their invested money?

One of the older rules is to check how old and popular a token is and how big of a market cap it has. But those indicators didn’t stop the project owners to scam the investors before, so what then?

The best way to check if there are any technical possibilities for project owners to scam you, and to check the experiences the users had with the token is to check the projects’ page on Fraudl.

Let’s look at Pepe for example.

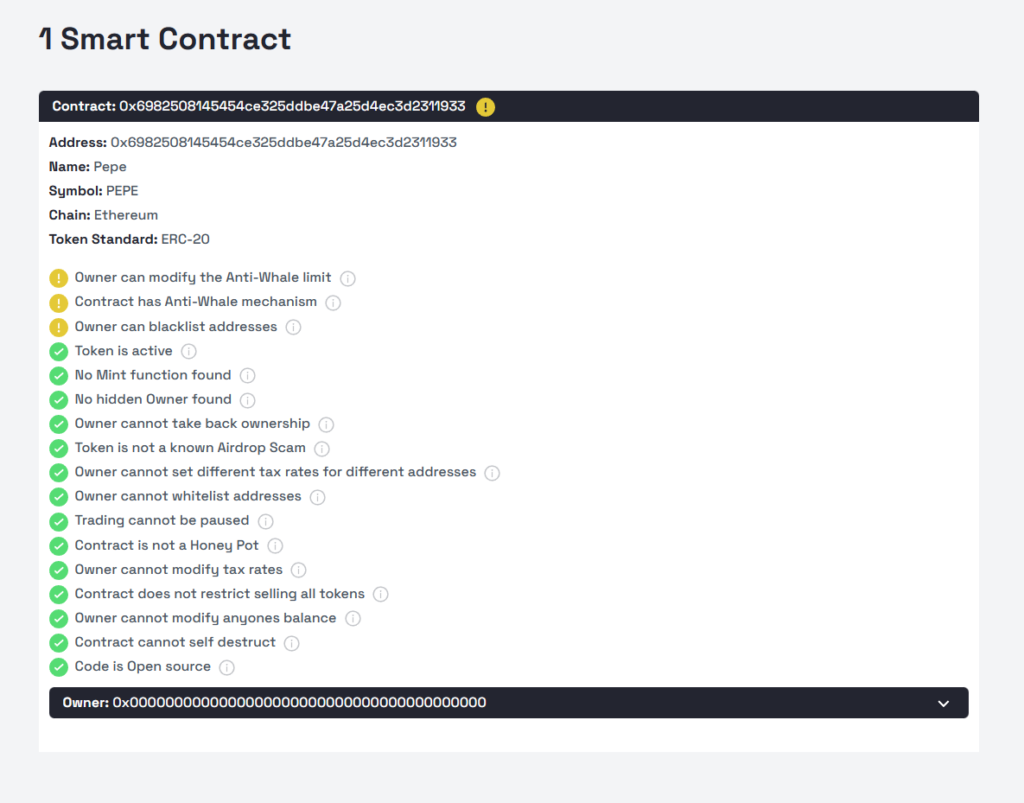

By examining the project’s page on Fraudl – Pepe Token – Scam check, Reviews & Contract Security Audit, we can see some concerning functions in the contract.

The owner can modify the Anti-Whale limit – this function lets the project owners modify the anti-whale limit of the mechanism. This means that they can set different limits, so one day they can change it, buy a bunch of tokens then dump them on the new buyers.

While having an anti-whale mechanism in place can be a good thing, cause no big player can control the value of the token, it can easily be manipulated, so it’s best to be careful.

Now this function should give investors a signal to tread carefully – Owner can blacklist addresses. This means that they can stop anyone from trading if they want to.

While this function can be used as a security measure, it can also be used in a malicious way. For example, let’s say you bought in early and you hold a substantial amount of Pepe tokens, they can notice that and prevent you from cashing out.

While not a clear red flag, this function should be a good warning for anyone that’s interested in buying in.

Conclusion

In conclusion, while the explosion of meme coins and ETH alts, like the Pepe token, offers exciting opportunities, it has also created a playground for potential crypto scams.

As investors, it’s crucial to stay updated, educated, and vigilant about the risks associated with these investments.

The best thing you can do is do your own research and use all the tools available to you to help you in that quest.

For on-demand analysis on any cryptocurrency, join our Telegram channel.