According to JP Morgan, the current volatility in the cryptocurrency market has proven to be both beneficial and discouraging. Following a significant drop, the market rebounded strongly. The cryptocurrencies were set to experience major rallies, massive gains, and market cap restoration. Nonetheless, this appears to be the end of it.

Cryptocurrency prices have been linked to a variety of factors. The value of Bitcoin and other assets has been linked to everything from laws to endorsements. JP Morgan, on the other hand, has started to link the value of cryptocurrencies to the market capitalization of stablecoins.

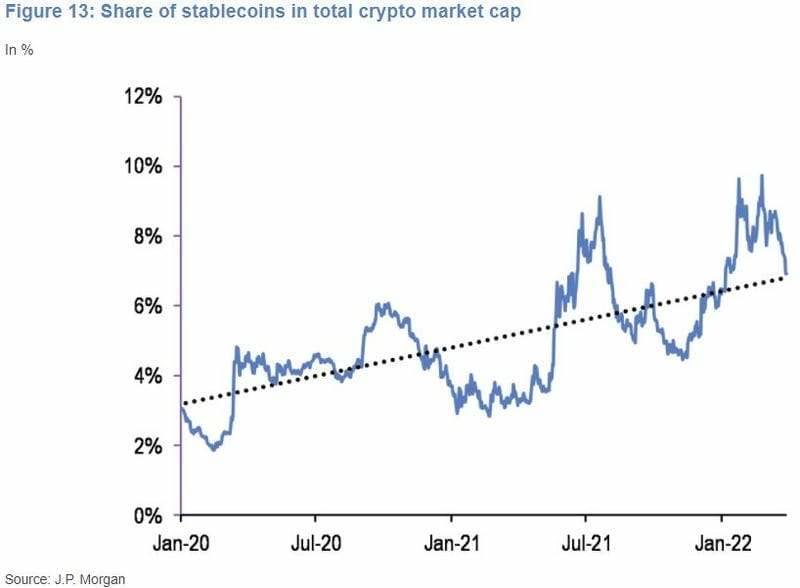

According to a recent report, JP Morgan identified that the chances of crypto markets experiencing a significant uptrend had been slightly reduced. Based primarily on data from a previous report, the banking giant concluded that when stable coins accounted for roughly 10% of the global crypto market worth, the property was on the rise.

Nonetheless, current research shows that stablecoins have a 7% market share in the cryptocurrency industry. As a result of this not being excessive, any future increase would most likely be limited.

JP Morgan said, “In different phrases, the share of stablecoins within the complete crypto market cap not seems to be extreme and consequently, we imagine that any additional upside for crypto markets from right here would seemingly be extra restricted.”

Bitcoin and ether have gained more than 30% since their February lows, thanks to a combination of short-covering and bitcoin fund inflows, with $210 million flowing into the Purpose Bitcoin ETF since March 7, according to the bank.

In this regard, JPMorgan said, “Short-covering has been more intense for ethereum than bitcoin in recent weeks… this short-covering helped to push our position proxy based on CME ethereum futures to overbought territory”.