Key Takeaways

- Since July 1, Celsius has repaid over $150 million worth of Dai (DAI) stablecoins across 5 separate transactions.

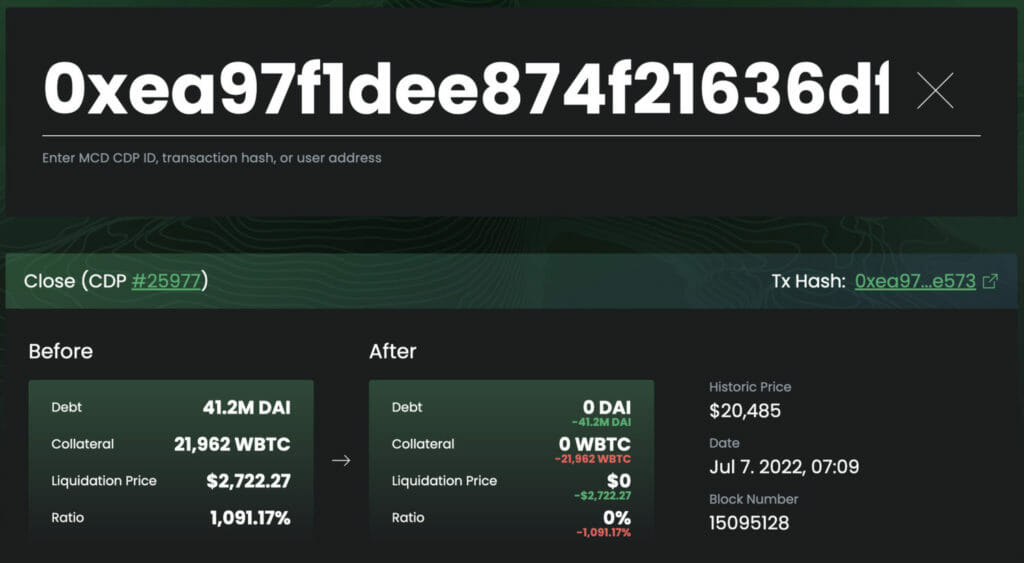

- On July 7, a wallet linked to Celsius repaid the remaining $41.2 million of the loan in DAI, the Maker protocol’s stablecoin.

The battered Celsius Network is slowly showing signs of recovery. The crypto lending platform has completely paid off its entire bitcoin loan, freeing Up $456 million collateral and dropping the liquidation price to $0.

Ever since Celsius halted withdrawals citing market conditions on June 13, the platform has been working tirelessly to pay off its Bitcoin Loan. Since July 1, Celsius has repaid over $150 million worth of DAI stablecoins across 5 separate transactions. On July 2, the lender paid off $67 million of its loans, according to crypto researcher Plan C. The debt was combined between AAVE, Compound, and Maker. On July 4, the lending platform paid over $114 million to clear its bitcoin loan.

Celsius paid off a $50 Million worth Bitcoin Loan on July 4, which was soon followed by payment of $64 million in DAI. The recent payment of $41.2 million against its bitcoin loan on July 7, cleared the debt and released the $453 million Collateral. The Maker Protocol loan is completely paid off now.

Defi Explore data shows that a wallet linked to Celsius repaid the remaining $41.2 million of the loan in DAI, the Maker protocol’s stablecoin. As a result, Maker protocol released 21,962 wrapped bitcoins(WBTC) which was pledged as collateral of the loan. WBTC, at the time of writing is trading at $22,059.66.

According to fundstrat analyst Walter Teng, by repaying the debt, Celsius is possibly freeing up collateral(Wrapped BTC) that then can be sold on centralized exchanges or via over-the-counter to meet creditor demands and customer withdrawals. The current market volatility and Bitcoin’s plunging prices had put Celsius (1.7 million users) on the brink of insolvency.

The latest development viewed as a liquidity boost for the beleaguered crypto lender’s finances will save the platform from bankruptcy. With this loan repayment, the crypto lending major which relied mostly on bitcoin to stake its fortune, is expected to resume activities and get back to normalcy CEL-native token of the Celsius platform, has tumbled 81% in 2022. However, the token spiked 10% after the loan repayment news went public.