Bitcoin opened the week trading near its five-month high as prices maintained the gains from the past weekend. Values increased close to $24k on Sunday, a result of surpassing a major resistance point. Conversely, Ethereum decreased below $1,600 on Monday after rising to a one-week peak during yesterday’s trading session.

Bitcoin (BTC)

The start of 2023 has seen a tremendous surge in cryptocurrency prices compared to the beginning of 2021. Bitcoin, in particular, has risen by 27% so far in January – potentially making this its most impressive monthly gain since October the year before.

Over the past 24 hours, the value of Bitcoin (BTC) has seen a 3.33% decrease in its rate. In addition, bitcoin transaction fees recently skyrocketed to the highest levels since the FTX-induced crash, resulting in an increased cost of transferring cryptocurrency. In the last fortnight, more than $400 million worth of Bitcoin has been withdrawn from CEXs, with almost $100 million leaving these platforms this week alone.

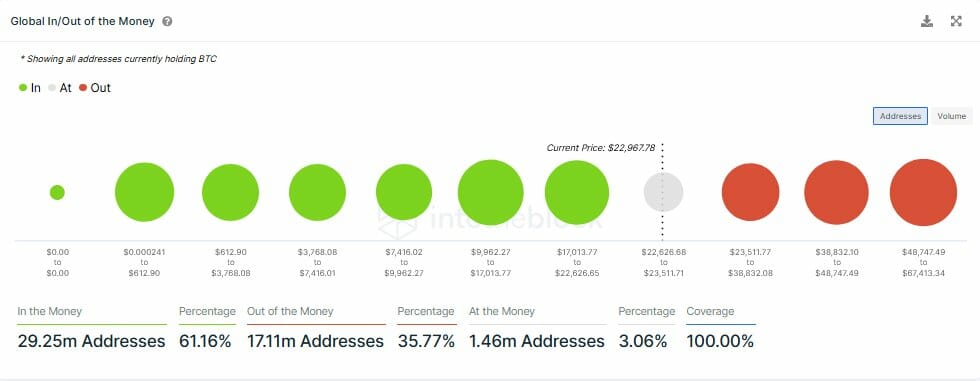

Roughly 60% of Bitcoin holders are making profits, increasing from its recent lowest point of 50%. This number is remarkable as 50% has long been seen as a marker to indicate the bottom.

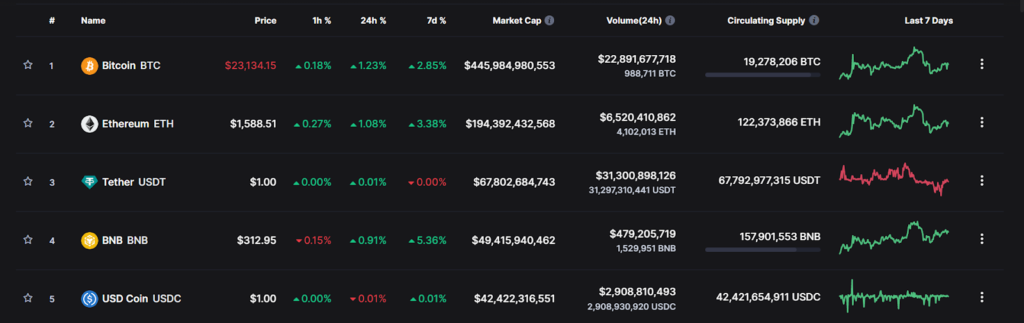

As of now, the value of Bitcoin stands at $23,133, and its market capitalization is $445 billion. It currently holds the top spot on Coinmarketcap, with a total supply of 19,278,206 coins and a 24-hour trading volume of 22 billion dollars.

In the 1D timeframe, the price action of $BTC/USDT is expected to decrease before an uptrend, as explained in the previous analysis that developed bearish divergence. The formation of a bearish crab could also be a possible scenario. Bearish divergence is in action, and we might see a last liquidity garb move before a downward move, or that move could be started from here.

Ethereum (ETH)

Ethereum fees experienced a dip after rising steadily for four weeks. In contrast, Ether recorded inflows of $262M in the same period and $667M over the last two weeks. This difference might explain why Bitcoin performed better than other digital assets.

Analyzing $ETH ownership, we can see that some large holders have decreased their holdings as the asset has become more expensive. But this decrease is offset by an increase of addresses with larger balances evaluated in terms of U.S. Dollars. Therefore, if the Ether price drops below $1500, it could weaken the current bullish momentum. The intraday trading volume of Ether is $7.7 Billion, representing a 13.6% decrease compared to before.

If the price of ETH breaks out above $1682, a bullish pattern will be formed, indicating that the upward trend will resume. If conditions remain favorable, this situation could lead to an increase of 40% in price, setting a target of $2300.

As of now, the value of Ethereum stands at $1,587, and its market capitalization is $194 billion. It currently holds the 2nd spot on Coinmarketcap with a total supply of 122,373,866 coins and a 24-hour trading volume of 6 billion dollars.

In a four hours time frame, the price action of $ETH/USDT bounces from the horizontal demand zone. If it breaks its mid-trendline, then it can go upward. Currently, the price is accumulating inside the rectangle channel. On the other hand, if it breakdown its demand zone and after a successful retest, it can go downward.

For any time, on-demand analysis on $HOOK or any other coin can join our Telegram channel.

Closing Thoughts

The Crypto market is known for its volatile nature. According to the above analysis, the coins we discussed might prove to be profitable if other market conditions prevail favorably. We suggest you engage in adequate research before investing in any digital assets.