Table of Contents

Bitcoin News: 30th September 2021

- 1inch blocks out the US trades in preparation to launch a dedicated platform of the USA.

- Exchanges are leaving China at the fastest pace. Coinex, a crypto exchange is set to remove all mainland China crypto users by October.

- Bitfinex went offline: One of the largest exchanges turns off trading and goes offline.

- Upbit bends its knees to South Korea’s regulations and is planning to mandate KYC.

- VISA after showing its interests in NFTs, is now eyeing to create a hub for CBDCs and stablecoins.

- Ever heard of a crypto postal stamp? It exists now! Switzerland national postal service is set to release the crypto stamp.

1inch blocks out the US traders

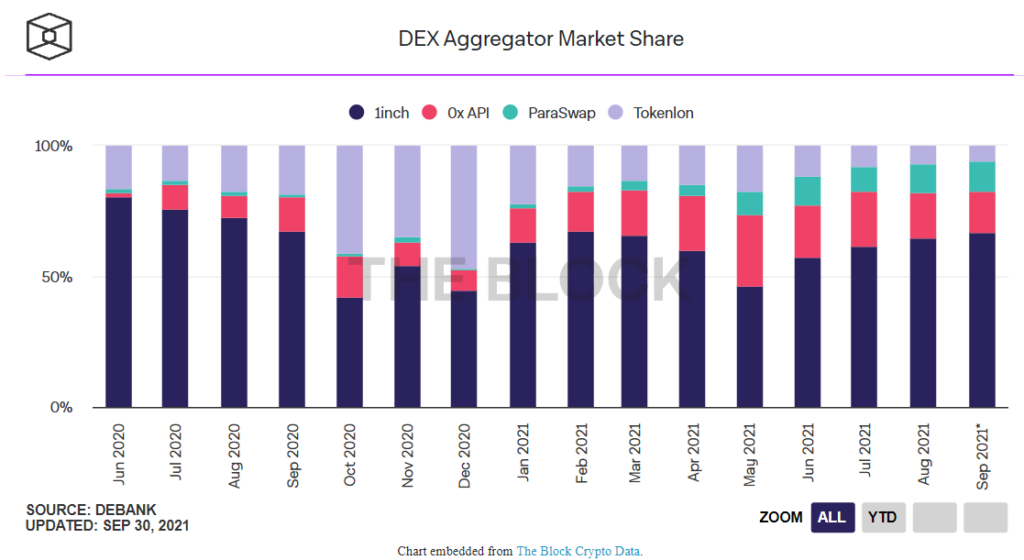

According to the Block, recently, the DEX aggregator, 1inch has begun geofencing traders from the USA. Although the platform’s terms of service have reportedly banned US users since April, the restriction has just lately become operational on a technological level.

“Today we’ve merely added one more pop-up notification and technical layer to control this,” Sergey Maslennikov, chief communications officer of the 1inch Network, told The Block when reached for comment.

The action is intended to prepare the way for the launch of a new product in the United States. According to the spokesman,

“The 1inch Network is in the process of collecting the Series B funding round that has now grown to $175M (instead of $70M as was planned before). A significant part of these funds will be used for the development and launch of the 1inch Pro product which is specifically designed for the US market and for global institutional investors in accordance with all the regulatory requirements.”

According to data from The Block, 1inch is the most popular DEX aggregator, accounting for over two-thirds of total volume.

Coinex set to remove all mainland China crypto users by October

According to Cointelegraph, to comply with local anti-crypto rules, the CoinEx cryptocurrency exchange is shutting down operations in mainland China. On Thursday, the business announced that user accounts verified as mainland Chinese citizens, as well as those linked to a mainland Chinese mobile phone number, would be completely retired.

Users from mainland China have been urged to withdraw their crypto assets from the platform by October 31, 2021. Starting on Thursday, Sept. 30, CoinEx aims to terminate accounts with no assets.

The exchange stated, “All-access will no longer be available to your accounts,” the exchange stated.

Despite CoinEx’s active steps to remove mainland Chinese customers, consumers will be able to withdraw funds after October 31.

Further, the platform explained, After the deadline, “only service available for these accounts will be withdrawal, that is, functions such as deposit and trading will be closed and only the withdrawal service is supported”.

Bitfinex went Offline

The Bitfinex cryptocurrency exchange fell offline! According to its Twitter account and status page, after traders were unable to access their orders and funds on the exchange. The Bitfinex team is currently investigating the problem and expects to resume trading at approximately 10:05 UTC.

The first complaints of platform issues surfaced at 7:30 a.m. UTC, however, the platform was still operational at the time, with trade paused. The maintenance of web servers, trading engines, and backend employees was ongoing earlier today.

The platform has resolved all the issues and is back to work now. You can use it without any further adieu!

Upbit is set to Mandate KYC

As Upbit, South Korea’s largest exchange approaches receiving its registration certification from the Financial Intelligence Unit (FIU) of the Financial Services Commission (FSC), it has announced the implementation of a stricter verification process in order to comply with the updated anti-money laundering regulations.

Upbit has informed its users that any trade worth more than 1 million won must go through KYC verification. Upbit will activate the ID verification procedure on all transactions of 1 million won and above, according to local news platforms in Korea, starting on the 1st of next month, i.e. tomorrow.

Starting next month, Koreans who trade more than 1 million won on Upbit, must pass KYC verification. Similar to the situation facing China, this will also cause some users to switch to DeFi.

coingape

VISA to Create a Hub for CBDCs and Stablecoins

Visa has made a huge commitment to cryptocurrency in the previous two years, forming partnerships with blockchain startups and even purchasing a CryptoPunk NFT on Ethereum. The corporation is now looking to broaden its crypto ambitions.

Visa unveiled the blueprints for a “universal payments channel” on Thursday, which will allow transactions between multiple stablecoins and central bank digital currencies (CBDCs).

The goal is to develop a digital currency akin to the existing international payment experience, which allows you to pay for anything in another country using a debit or credit card that draws funds from your home country’s account.

This procedure is based on national currencies and relies on legacy networks maintained by banks and credit cards, rather than blockchains. Visa is attempting to replicate that system for the blockchain era by launching its “universal” payments channel. This bet is based on the belief that stablecoins like USDC—a digital token backed 1-1 by the US dollar—and CBDCs, such as the one issued by China, will become mainstream.

Switzerland to Release the Crypto Stamp

Coming to today’s most exciting and final news, Switzerland is set to release a crypto postal stamp. By creating tradable digital stamps, Switzerland’s national postal office is attempting to bridge the gap between real stamps and the digital cryptocurrency market.

The Swiss Post officially announced the imminent launch of the “Swiss crypto stamp,” a digital collectable tied to a real stamp worth 8.9 francs that will be produced by the postal service.

The Swiss crypto stamp will be kept on a blockchain and will serve as a digital representation of a physical stamp. Through a QR code placed next to the physical stamp, buyers will be able to find a digital twin of their physical stamp online. The image of the crypto stamp will be one of 13 possible designs, and it will be available for collection, exchange, and trading online, according to the Swiss Post.

Because some of the stamps will have an uncommon design, the future Swiss crypto stamp is expected to deliver an experience akin to nonfungible tokens (NFT).

The Swiss post wrote, “Some are more common, while others are much rarer and more coveted. There are 65,000 copies of the most common digital design, but just 50 of the rarest. One thing is clear: the Swiss crypto stamp means collecting, exchanging and trading stamps has gone digital, too.”

Follow us on Social Media:

Join Our Telegram Channel for Technical analysis and Telegram group for free crypto signals.

Medium | YouTube | Twitter | Instagram | Reddit | Facebook | LinkedIn