Key Takeaways

- Customers of Binance US are not charged any fees on the spot market pairs for BTC/USD, BTC/USDT, BTC/USDC, and BTC/BUSD, and there are no volume requirements.

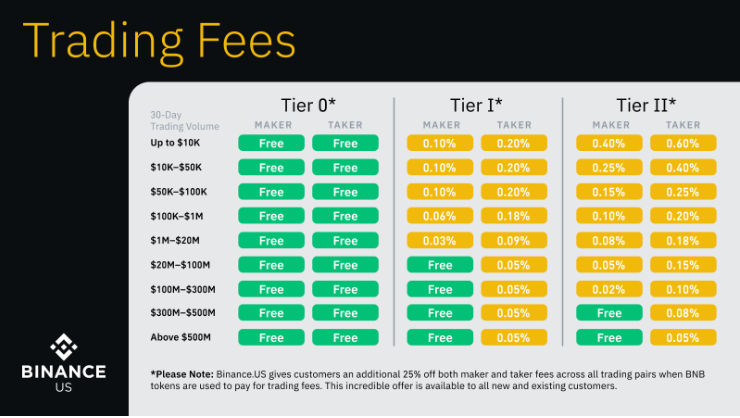

- The charges were brought shortly after Binance.US announced a new, three-tier trading fee structure that will go into effect in July.

- Zero fees translate into less money for Binance.US.

- The spokesperson for the exchange, however, claimed that spot trading is merely one of the many services it provides to customers and that there are more than 100 tokens listed on Binance.US besides bitcoin.

Binance. One of the biggest cryptocurrency exchanges in the world, US, is now providing zero-fee trading with spot bitcoin pairs.

Since our founding, we have become well-known for our incredibly low fees, “Brian Shroder, the CEO of Binance.US, said in an interview. Trading with no fees is “something we want to do because we can. This will increase user satisfaction and attract new users.”

Customers of Binance will be able to trade four spot market pairs for 0% fee:

- BTC/USD

- BTC/USDT

- BTC/USDC

- BTC/BUSD.

Additionally, users are free to use the over-the-counter (OTC) portal and convert funds between different cryptocurrencies without paying any fees. However, customers of the platform will still pay a 0.5 percent fee while using the Buy Crypto feature.

The action will put additional stress on other cryptocurrency exchanges, like Coinbase Global Inc., to reduce their fees. As competition intensifies, Wall Street analysts including Dan Dolev of Mizuho Securities have predicted that Coinbase will have to lower fees.

Around 11:40 a.m. ET, it was noted that shares of Coinbase were down more than 6%. Robinhood initially dropped but has since recovered, last falling by less than 1%.

According to Brian Shroder, CEO of Binance.US, “As an established leader on low fee trading, we are excited to be the first US crypto exchange to eliminate spot trading fees on numerous bitcoin pair trades for all users.”

“We see this as a chance to revolutionise the way fees are handled in our industry, broaden the market for cryptocurrencies, and assist our market and customers in difficult times”, Shroder said.

The company described the factors that led to the elimination of many of its fees in Binance’s breakdown explanation of the fee structure. “We believe in providing greater cost savings on Bitcoin and value to everyone in the crypto ecosystem as recession fears grow and inflation costs rise.”

According to Shroder, Binance.US is not profiting from no-fee transactions either. This contrasts with Robinhood Markets Inc., which provides no-commission cryptocurrency trading and makes money by getting rebates from the venues to which it routes orders from retail users.

According to Shroder, users of the platform can view a live order book for matching trades. Binance.US anticipates eventually expanding the number of tokens available for free trading.

Following a $200 million funding round led by Fundamental Labs in April of this year, Binance has adjusted its fee schedule. The fundraising allowed the company to speed up expansion, add new product offerings, and start marketing for the first time, Shroder said at the time.

The new initiative of Binance.US was also tweeted about by Changpeng Zhao, CEO of Binance.