Oh, we are again back at the startup boom aren’t we? As a college undergrad I find a lot of people everyday launching or thinking of launching startups, but it ain’t that easy, is it? We need a lot of resources and one of them being money, well we do require business banks for the same.

Business banking companies are financial institutions that offer a range of services tailored specifically to the needs of businesses. These services often include business accounts, loans, lines of credit, merchant services, cash management solutions, and business credit cards, among others. Business banking companies can be traditional banks, credit unions, or online-only banks that focus on serving the needs of businesses, from small startups to large corporations.

Table of Contents

What types of business accounts are offered by banks in India?

Banks in India offer various types of business accounts to cater to the diverse needs of enterprises. These include current accounts, savings accounts, salary accounts, and specialized accounts such as trade-specific accounts or foreign currency accounts.

What documents are required to open a business account in India?

The specific documents required may vary depending on the type of business entity, such as a sole proprietorship, partnership, or corporation. Generally, common documents include the business’s PAN card, registration certificate, identity and address proofs of authorized signatories, and business address proof.

How can businesses access financing options through banks in India?

Banks in India offer various financing options for businesses, including business loans, overdraft facilities, invoice discounting, and trade finance solutions. Businesses can typically apply for these financing options through their bank’s branch network, online banking platforms, or by directly contacting their relationship manager.

What are the security measures in place to protect business accounts from fraud?

Banks in India employ multiple security measures to safeguard business accounts from fraud, including two-factor authentication for online transactions, SMS alerts for account activity, secure encryption protocols for online banking, and regular account monitoring for suspicious activity.

How can businesses manage their cash flow effectively with business banking services?

Business banking services in India often include cash management solutions such as sweep-in facilities, liquidity management services, and digital payment platforms. By leveraging these tools, businesses can optimize their cash flow, manage receivables and payables efficiently, and make informed financial decisions.

Also Read ➤ ➤ AI-Based Stock Trading in India: Benefits and Challenges

The Main Agenda – Best Business Banking Companies in India

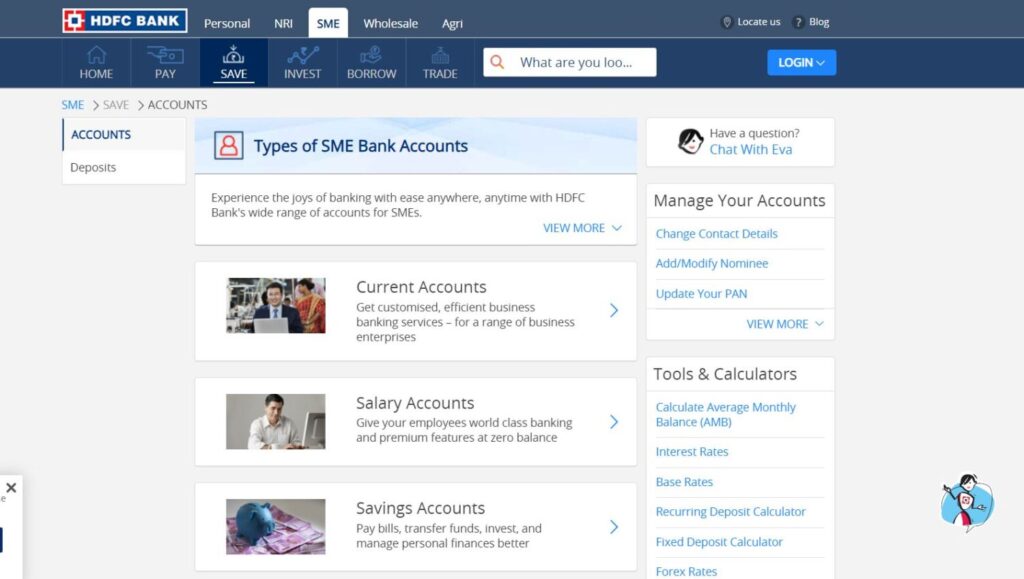

HDFC Bank

HDFC Bank’s business banking website provides a range of services tailored to small and medium-sized enterprises (SMEs), including various types of current accounts. The site is user-friendly, offering easy navigation and access to detailed information about different account options, features, and benefits. Unique points include HDFC Bank’s reputation as one of India’s leading private sector banks, its extensive branch network, and robust digital banking platforms designed to streamline business operations.

Pros of HDFC Bank’s business banking services include a wide range of account options catering to different business needs, user-friendly digital banking interfaces, and dedicated SME support. Additionally, HDFC Bank offers competitive interest rates on loans and other financial products.

However, some cons may include higher fees compared to smaller banks and potential challenges in accessing specialized services for niche industries. Additionally, some users may experience occasional issues with customer service responsiveness.

Also Read ➤ ➤

Which are the Top 10 Share Brokers in India? | Check out NOW!

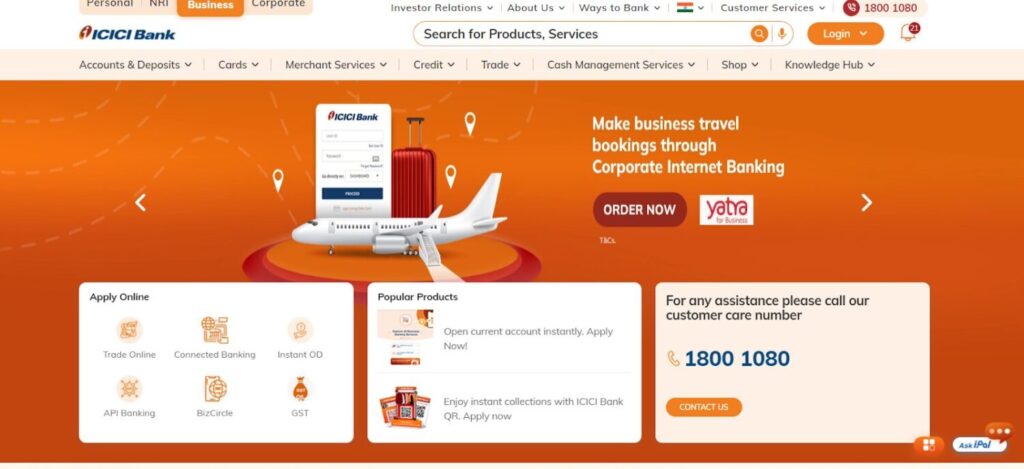

ICICI Bank

ICICI Bank’s business banking website offers a comprehensive suite of banking solutions designed to meet the diverse needs of SMEs. The site provides detailed information about various business accounts, loans, trade finance, and treasury services. Unique points include ICICI Bank’s emphasis on innovation and technology, with user-friendly digital banking platforms tailored for business customers. The bank’s extensive branch network and reputation as one of India’s leading private sector banks contribute to its appeal for SMEs.

Pros of ICICI Bank’s business banking services include competitive interest rates, flexible loan options, extensive branch network, and robust digital banking platforms. Additionally, ICICI Bank offers personalized banking solutions and dedicated support for SMEs.

However, potential cons may include complex fee structures and eligibility criteria for certain products, as well as occasional issues with customer service responsiveness.

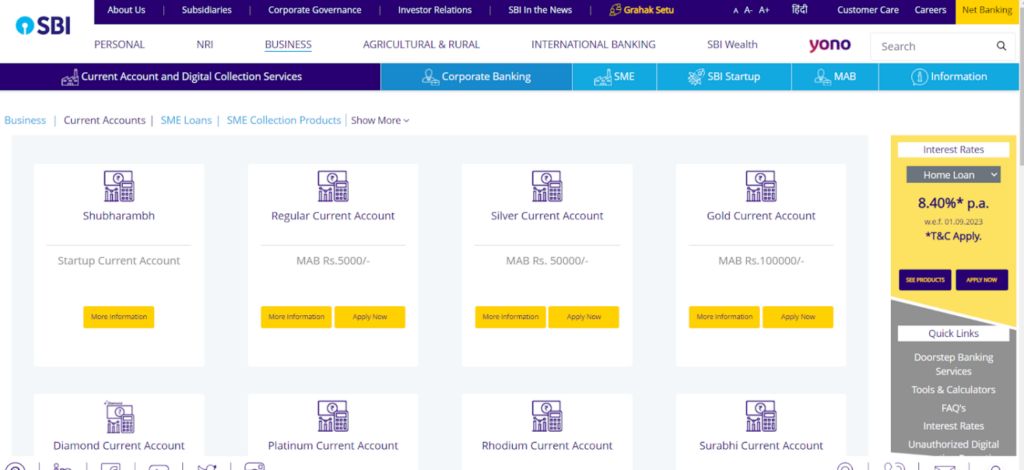

State Bank of India (SBI)

State Bank of India (SBI) is a prominent public sector bank in India, offering a range of business banking solutions through its website tailored for small and medium-sized enterprises (SMEs). The site provides information about various current accounts, business loans, and other financial products and services. Unique points include SBI’s extensive branch network spanning across urban and rural areas, catering to businesses of all sizes and locations. SBI’s reputation as a trusted and reliable banking institution in India adds to its appeal for SMEs seeking banking services.

Pros of SBI’s business banking services include competitive interest rates, a wide range of banking products tailored for SMEs, and a strong focus on financial inclusion with its extensive branch network. Additionally, SBI offers personalized banking solutions and dedicated support for SMEs, making it an attractive option for businesses across various industries.

However, potential cons may include bureaucratic processes, longer turnaround times for certain services, and challenges in accessing specialized support for niche industries.

Also Read ➤ ➤ How to buy Amazon products using Cryptocurrency | STAND OUT!

Axis Bank

Axis Bank’s business banking website offers a variety of banking solutions aimed at meeting the needs of small and medium-sized enterprises (SMEs). The site provides information about different types of business accounts, loans, trade finance, and other financial products and services. Unique points include Axis Bank’s focus on providing user-friendly digital banking platforms, innovative banking solutions, and personalized services for SMEs.

Pros of Axis Bank’s business banking services include competitive interest rates, flexible loan options, and convenient digital banking interfaces designed to streamline business operations. Additionally, Axis Bank offers a dedicated relationship manager for business customers, providing personalized assistance and guidance.

However, potential cons may include complex fee structures, eligibility criteria for certain products, and occasional issues with customer service responsiveness.

Kotak Mahindra Bank

Kotak Mahindra Bank’s business banking website showcases a range of financial solutions tailored for businesses, including SMEs. The site offers information about various business accounts, loans, trade finance, and other banking products and services. Unique points include Kotak Mahindra Bank’s reputation as one of India’s leading private sector banks, known for its innovative financial solutions and customer-centric approach. The bank’s commitment to providing personalized banking experiences for SMEs through digital channels and its extensive branch network sets it apart in the business banking landscape.

Pros of Kotak Mahindra Bank’s business banking services include competitive interest rates, a wide range of banking products tailored for SMEs, and innovative digital banking platforms designed to enhance business efficiency.

Additionally, Kotak Mahindra Bank offers dedicated relationship managers and specialized support for business customers, ensuring personalized assistance and guidance.

However, potential cons may include higher fees compared to smaller banks and potential challenges in accessing specialized services for niche industries. Additionally, some users may experience occasional issues with customer service responsiveness.

Also Read ➤ ➤

Best Gaming Stations | DIVE into the BATTLE ARENA NOW!

Conclusion

In conclusion, navigating the complexities of launching and managing a startup in the thriving ecosystem of India requires a solid financial foundation, and business banking companies play a pivotal role in providing the necessary resources. HDFC Bank, ICICI Bank, State Bank of India (SBI), Axis Bank, and Kotak Mahindra Bank emerge as the top contenders for catering to the diverse needs of small and medium-sized enterprises (SMEs) in 2024.

Each of these banks offers a range of tailored business banking solutions, from current accounts to loans and digital banking platforms. HDFC Bank stands out for its extensive branch network and user-friendly interfaces, while ICICI Bank emphasizes innovation and technological prowess. SBI’s wide-reaching presence across urban and rural areas underscores its commitment to financial inclusion, while Axis Bank prioritizes personalized services for SMEs. Finally, Kotak Mahindra Bank distinguishes itself through its innovative financial solutions and customer-centric approach.

While each bank brings unique strengths to the table, businesses must weigh the pros and cons carefully to make an informed decision based on their specific needs and preferences. With the right banking partner, startups and SMEs can navigate the financial landscape with confidence and propel their ventures towards success in India’s dynamic business environment.