Key Takeaways:

- According to Grayscale, long-term investors have a great opportunity to accumulate wealth during the following 250 days of the bear market.

- The latest market fall, it added, won’t be deadly for the sector.

- Grayscale stated that they believe the current Bitcoin price is a fantastic time to buy the commodity.

The $22k resistance mark was breached by Bitcoin once more, sparking suspicions that the currency has bottomed out. On the basis of prior market cycles, Grayscale has however predicted in a report that the bear cycle may continue for a further 250 days.

According to Grayscale, the cryptocurrency market is cyclical, much like traditional markets, and it is constantly moving through what experts have labeled “the worst bear market” in its lifetime.

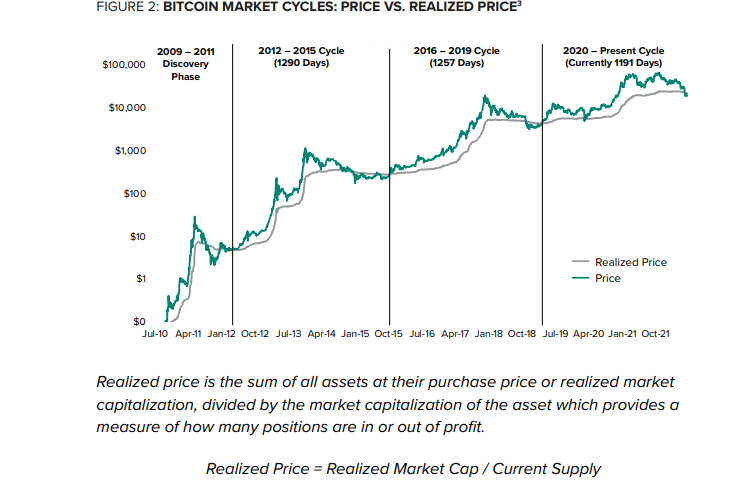

While there are many other ways to spot crypto market cycles, we can use Bitcoin prices as a proxy to quantitatively define a cycle as the point at which the Realised Price falls below the Market Price (the asset’s current trading price).

Realized prices that are lower than market prices suggest that most assets are kept at or above their purchase prices. A Realized Price below Market Price, on the other hand, suggests that most assets are retained below the purchase price.

When the market starts to exit a bear market and enter a new cycle, it can be determined when the majority of assets are held above the price at which they were bought (and vice versa).

According to Grayscale, the bear market began on June 13, 2022, when the realized price of BTC fell below its spot price. Grayscale highlights, that this may be the ideal time to buy for investors. According to past trends, this is the time for long-term investors to accumulate.

The study also found that last year’s movement of bitcoin in the ATH range was lengthier than in previous cycles. The company ascribed this to the sector’s recent acceleration in growth and added that, unlike in prior market cycles, it is now simpler for institutional and ordinary investors to invest in crypto assets.

Digital asset management also notes that, in contrast to earlier market cycles, institutional and retail investors now have more confidence in investing in crypto assets as a result of the cryptocurrency sector’s maturation.

The latest market slump, according to Grayscale experts, won’t be catastrophic to the sector. Instead, it might present another chance for progress. Grayscale Investments’ Matt Maximo, Research Associate, and Michael Zhao, Research Analyst, wrote:

“We already have scaling breakthroughs, battle-tested DeFi and infrastructure protocols, a burgeoning metaverse market, and more thanks to this market cycle. The cryptocurrency sector continues to grow and innovate, pushing the bounds of what is possible despite price dips, liquidations, and volatility.”

Grayscale has been passionately pursuing the launch of a spot Bitcoin ETF from its GBTC product. Grayscale, however, filed a lawsuit against the securities regulator after the SEC rejected its proposal for the spot Bitcoin ETF.

CEO Michael Sonnenshein stated that they were “extremely saddened” and “vehemently disagree” with the SEC’s decision to deny their application.