Key Takeaways:

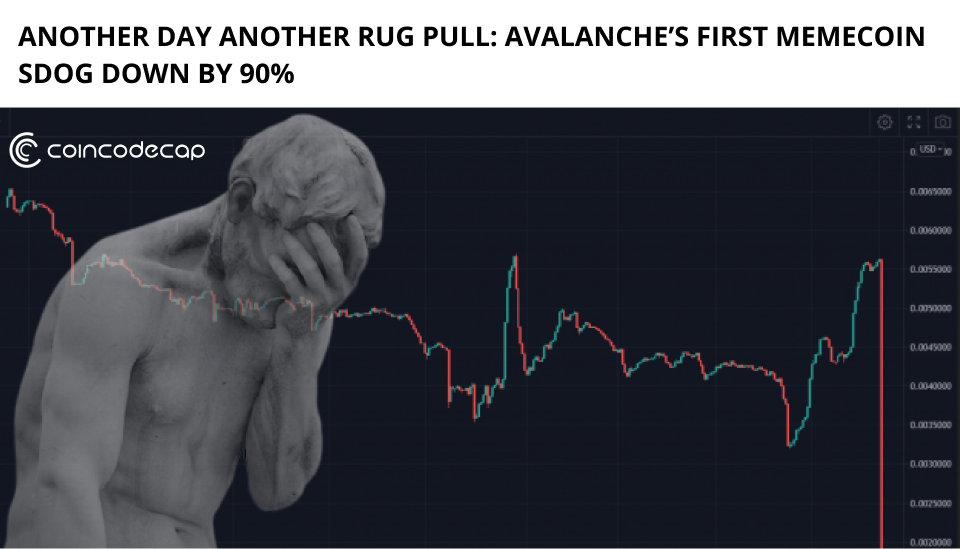

- Avalanche’s first memecoin SDOG down by 90%

- After only eight days on the market, SnowdogDAO failed spectacularly.

- However, the SnowdogDAO team maintains that the event was a “game-theory experiment” gone wrong rather than a rug pull.

The first meme coin to launch on Avalanche, SnowdogDAO (SDOG), lost over 90% of its value yesterday in what many believe was the platform’s largest rug pull. However, despite the loss of millions of dollars in investments, the SnowdogDAO team maintains that the event was a “game-theory experiment” gone wrong rather than a rug pull.

After only eight days on the market, SnowdogDAO, a decentralized reserve meme coin based on Avalanche, failed spectacularly. However, SDOG, which began as an 8-day experiment and ended with a massive buyback, drew much interest from the crypto community. According to the development team, the “game theory experiment” was created to raise awareness for Snowbank.

The development team gave a statement that says,

“We believed that the combination of a decentralized reserve meme coin that would die after eight days, with the perspective of a giant buyback, would create interest and bring exposure to the Snowbank project.”

The pinnacle of the experiment was set to be the giant buyback, which would be financed by assets acquired by the Snowdog treasury through mint sales. The treasury market value increased to $44 million in 8 days, allowing holders to compete for a portion of the funds during the buyback. Unfortunately, only 7% of the SDOG supply was eligible to be sold above market price before the buyback, which the developers failed to disclose to the community or did not make clear enough.

Snowdog tweeted that

“We wanted to organize a fair event, where people, real dedicated Snowdog holders, not robots, would have an equal chance to compete for the buyback. We received countless warnings that MEV experts, flash bot engineers, and bots would steal the buyback. So what did we do? We built our own AMM based on Uniswap v2. We tweaked it lightly to make life harder for bots. Adding a simple mathematical challenge to the AMM made it nearly impossible for bots to adapt and understand how the swap works quickly. Only users using the front-end could swap. We’ll verify the contract soon to show everyone how we achieved this. In the coming days, we will move the liquidity to a regular AMM. But could DEX-owned liquidity be something in the future? Who knows, sounds Pro, Max”.

Snowdog built its own AMM based on Uniswap V2, migrating all SDOG liquidity from Trader Joe, a famous Avalanche DEX, to avoid front running. On the other hand, the buyback failed spectacularly within seconds of going live, with hundreds of users losing the majority of their money. By exchanging SDOG for other cryptocurrencies, a single address made nearly $10 million, wiping out a quarter of the Treasury’s buyback power. Using the same strategy, two other wallets were able to drain $7.7 and $3.3 million, respectively. While the owners of the addresses have yet to be identified, many believe they belonged to people closely associated with the development team.

Snowdog’s development team released a postmortem after receiving a lot of backlash from the crypto community. While the post was intended to clarify that the event was not a rug pull, it failed to persuade the public that the action was not planned ahead of time. The team designed their AMM to be front-run by bots by introducing a simple mathematical challenge that can only be accessed through the Snowbank front-end.

Users reported that they couldn’t solve the challenge because starting a Snowswap contract required a “challenge key,” which almost none had. Snowdog claims they were only responsible for the situation because they failed to disclose the game’s rules.

They mentioned in their postmortem that,

“We understand that the buyback experience created frustration as only 7% of the supply holders would benefit from a price superior to the market price before the buyback. We deeply regret not having communicated more on this. We should have warned the community about the risks that waiting for the buyback to sell represented. But not selling wasn’t a bad decision because exciting milestones are coming up for Snowdog”.

They concluded their postmortem by saying,

“We recognize that Snowdog created confusion and misalignment around what the priority is for Snowbank. A huge part of why we are doing this is because of our amazing community. From now on, every new product or service launch will be submitted to a vote by $SB holders. We want to make sure that our holders are aligned with the priorities the team wants to pursue. We are about to engage in active discussions with promising team members for future project development. We received 500+ applications to Snowbank Labs from top-tier contributors all around the world. Despite the deception around Snowdog’s setback, we are growing at an impressive rate. Snowbank treasury is currently sitting at $40M in reserve funds. This will fuel long-term sustainability for Snowbank”.