As the Reserve Bank of India (RBI) has not yet legalized bitcoin, it is subject to 30% taxation. An investor who makes money by selling cryptocurrency must pay income tax.

How the tax works?

All income is taxed unless it is specifically exempted by the Income Tax Act. Investors must pay income tax on crypto-transactions based on the nature of the transactions until we receive clarification from the income tax department.

Following the adoption of the new crypto tax law, the volume of cryptocurrency trades on Indian exchanges has decreased. According to the new tax law, all earnings derived from virtual digital assets, including cryptocurrencies, are subject to a flat 30% tax. Furthermore, no deductions, set-offs, or carryovers are permitted.

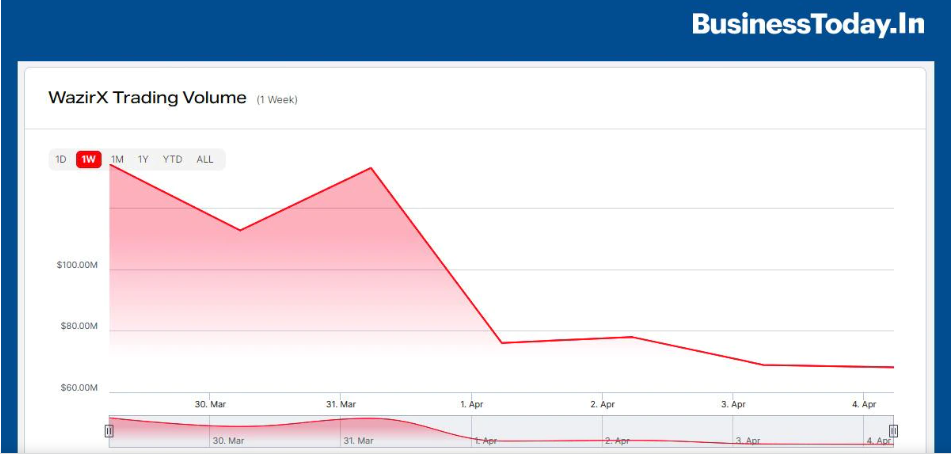

Trading volumes on Indian crypto exchanges like CoinDCX, WazirX, and ZebPay have suffered a significant fall since April 1, according to data from Nomics, a cryptocurrency data compiler.

Since the beginning of April 2022, crypto exchanges in India have seen a huge drop in traded volume, according to on-chain data company Crebaco. The worrying reduction in transactions throughout digital asset trading platforms, according to Crebaco’s analysts, could be due to India’s recently implemented crypto tax regime.

WazirX, ZebPay, CoinDCX, and BitBns were among the four major exchanges investigated by Crebaco. The platform WazirX took the biggest impact, with volume dropping by 72 percent. ZebPay had a 52 percent drop in transactions, while CoinDCX and BitBns observed 52 percent and 41 percent drops in trading volumes, respectively.

What exactly is trading volume and why is it important?

The number of times a coin changes hands in a certain time frame is referred to as crypto trade volume. Investors look at crypto volume based on trading on a certain crypto exchange or all crypto exchanges combined.

When trading coins with limited cryptocurrency liquidity on smaller exchanges, the relevance of volume becomes obvious. Let’s say a trader wants to sell one million bitcoins. However, the hypothetical exchange she is utilising has a little BTCvolume. To sell 1 million bitcoins, you may need to place dozens of buy orders, each one slightly lower than the one before it.

The amount of money traded in a cryptocurrency reflects how popular it is. The greater the number of individuals buying and selling anything, the larger the volume, which might lead to more demand in that coin.

Increases in trade volume indicate either a strong bullish or bearish attitude. During their major market runs-ups, meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB) have seen a lot of volume. Investment in such coins tends to decrease with time, and volume falls in lockstep with the price.

A cryptocurrency with a high amount of transactions can become a cryptocurrency with a low volume of transactions, and vice versa.

Low trading volume indicates that investors aren’t keen to buy or sell a specific item, whereas larger volume indicates greater price stability and lower volatility.

The Indian Digital Currency market is constrained by High Crypto Taxes.

The tax rule was first suggested by Indian MPs in January as part of the country’s 2022 Finance Bill. Authorities revealed intentions to impose a steep 30 percent tax on cryptocurrency transactions after multiple revisions. A 1% tax deduction at source (TDS) regulation is also included in the policy.

Despite strong criticism from crypto enthusiasts and exchange sites, the controversial bill was approved by parliament and took effect on April 1, 2022.

@sidharthsogani The CEO of CREBACO Global believes that taxes are applied without regard for the asset class’s potential. He argues that the 30% Flat #Tax, not putting off losses in the same category, #TDS, and #GST boosts not only compliances for small investors, but also the environment’s growth. According to a survey of 97 blockchain developers, the majority of them are considering moving abroad.

In the next 12 to 18 months, he believes India may review its tax policies. However, the crypto area is predicted to reach a market capitalization of $6 trillion by then.

“The Indian talent wouldn’t wait.. they would move out. Timing is crucial in everything.. even regulations.”

Profits from virtual digital assets are taxed in the same manner that winnings from gambling, the lottery, or horse racing are. There is no exclusion allowed apart from the cost of acquisition. If the value of the cryptocurrency gift exceeds Rs 50,000, it is also taxable at the slab rate.

And to add to the misery, starting July 1, a 1% Tax Deducted at Source (TDS) would be charged on every trade if the total transaction value in the financial year exceeds Rs 50,000. The TDS must be withheld on behalf of the seller by the buyer.

Experts believe that the TDS will rob the market of liquidity by pushing high-frequency traders to reduce their trading volume.

According to UnoCoin CEO Sathvik Vishwanath, the policy has little impact on market innovation and liquidity. People earning less than 10 lakh rupees per year, according to Vishwanath, are subject to a 30% fixed income tax on cryptocurrency. TDS of 1% has an impact on market makers and liquidity providers. Both are required for India’s crypto ecosystem to improve. He also understands that many are concerned not only about paying greater taxes, but also about complying with the law, which includes hiring an auditor to do the computations and filing. Currently, not every CA accepts files containing crypto transactions.

The CEO of UnoCoin also believes that at this rate, braindrain will be unavoidable. He says that brain drain occurs not just when people leave the nation, but also when they start working for a foreign company in India and provide value there.

“Crypto brain drain won’t stop unless our Govt gets its crypto view right. “

In some ways, the tax removes the persistent uncertainty that has plagued the sector in India for the past half-decade. The industry praised the decision while criticizing the high levies, which they say will hasten brain drain and stifle innovation. The regulations must be written in such a way that they can be easily executed, benefiting both investors, exchanges, and the government. The government is conflating cryptocurrency trading with gambling and betting. Without true expertise and learnings, you can’t make money in crypto, yet betting is just based on luck. Crypto is not a form of gambling; rather, it is a new space that may eliminate corruption and a variety of transaction issues while also ensuring security.

Enforcing the TDS becomes difficult due to the nature of the sector, which is based on decentralisation. Because the TDS will reduce liquidity on exchanges, investors will not be able to get the best pricing or deals executed quickly.

This may encourage traders to turn to the black market and create ways to avoid paying taxes.