The global economy has been put to the test since COVID-19 began spreading over the planet in 2020, with supply chain interruptions, commodity price volatility, job market issues, and decreased tourism income. As a result of the pandemic, the World Bank estimates that about 97 million people have been driven into extreme poverty.

Global governments have had to boost their spending to deal with increasing healthcare costs, unemployment, food insecurity and to assist businesses in surviving in this challenging environment. As a result, countries have taken on new debt to offer financial support for these policies, resulting in the highest global debt levels in half a century.

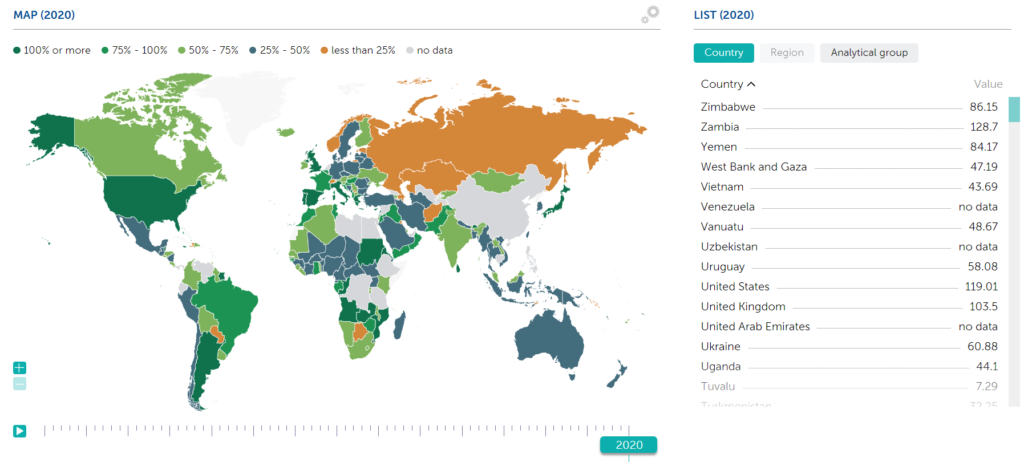

The Global Debt Database (GDD) is the product of a multi-year investigation that began with the Fiscal Monitor in October 2016. Total non-financial sector gross debt (private and public) for an imbalanced panel of 190 advanced economies, emerging market economies, and low-income countries are included in the dataset, which dates back to 1950.

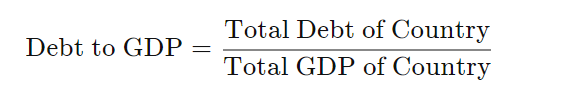

The debt-to-GDP ratio is a measure that compares a country’s public debt to its gross domestic output (GDP). The debt-to-GDP ratio is a reliable indicator of a country’s ability to repay its debts since it compares what it owes to what it generates. This ratio, often stated as a percentage, can also be understood as the number of years required to repay the debt if GDP is allocated to debt repayment.

The following formula is used to compute the debt-to-GDP ratio:

Stability is defined as a country’s ability to continue paying interest on its debt without refinancing or impeding economic progress. External debts (sometimes known as “public debts”), which are balances owed to foreign lenders, are often challenging to pay off in a country with a high debt-to-GDP ratio. As a result, creditors are more likely to seek higher interest rates when lending in such circumstances.

The top ten countries with the highest debt-to-GDP ratio are:

| Rank | Country | Debt-to-GDP (2021) |

| #1 | Japan | 257% |

| #2 | Sudan | 210% |

| #3 | Greece | 207% |

| #4 | Eritrea | 175% |

| #5 | Cape Verde | 161% |

| #6 | Italy | 155% |

| #7 | Suriname | 141% |

| #8 | Barbados | 138% |

| #9 | Singapore | 138% |

| #10 | Maldives | 137% |

Table of Contents

The Importance of Debt-to-GDP Ratio:

When a government defaults on its debt, financial panic ensues in domestic and international markets. In general, the higher a country’s debt-to-GDP ratio rises, the greater the chance of default.

The rapid growth of government debt is a significant source of worry. The higher a country’s debt-to-GDP ratio is, the more likely it is to default on its obligations, causing financial panic in the markets.

A study published by the World Bank found that countries with a debt-to-GDP ratio of more than 77% for extended periods had economic slowdowns.

Governments attempt to reduce their debt-to-GDP ratios, but this can be difficult to accomplish during times of turmoil, such as war or economic hardship. Therefore, governments are more likely to expand borrowing to encourage the economy and enhance aggregate demand in such difficult circumstances. In Keynesian economics, this macroeconomic strategy is a central idea.

COVID-19 has exacerbated a debt issue that has been simmering since the global financial crisis of 2008. According to the International Monetary Fund (IMF) research, at least 100 countries will cut health, education, and social safety spending. In addition, 30 emerging countries are in high debt distress, which means they are having a tough time repaying their debt.

The crisis is wreaking havoc on low- and middle-income countries more than wealthy nations. This is because wealthier countries borrow to launch fiscal stimulus programmes, but low- and middle-income countries cannot, thereby widening global inequality.

Modern monetary theory (MMT) economists claim that sovereign governments that can issue their own money can never go bankrupt because they can generate other fiat currency to pay off their debts.

High debt-to-GDP ratios could signify a country’s elevated default risk. Financial effects can be seen around the world if a country fails.

The IMF Issues a Warning on Interest Rates:

Government borrowing amounted to little over half of the $28 trillion rise, pushing the global public debt ratio to a new high of 99% of GDP. Officials from the International Monetary Fund (IMF) have warned that rising interest rates will reduce the impact of fiscal spending and exacerbate debt sustainability worries.

The officials concluded that the risks would be amplified if the global interest rates rise quicker than predicted and GDP falters.

‘Too early to say if world faces sustained inflation’ -IMF chief Georgieva:

Global policymakers must carefully balance their fiscal and monetary policies in 2022, according to IMF Managing Director Kristalina Georgieva, to ensure that the broad withdrawal of COVID-19 support funds and increasing interest rates do not damage the recovery.

Last week, the IMF revised its economic predictions for the United States, China, and the global economy, citing increased risks from the pandemic, inflation, supply disruptions, and U.S. monetary tightening.

Unlike the first year of the epidemic in 2020, when finance ministers and central bankers collaborated and harmonised their activities, conditions today vary considerably around the world, necessitating more “specificity” in reactions, she explained.

Due to supply chain disruptions, stronger-than-anticipated consumer demand for products, and climatic shocks on food prices, the IMF head said inflation had lasted longer and climbed higher than predicted.

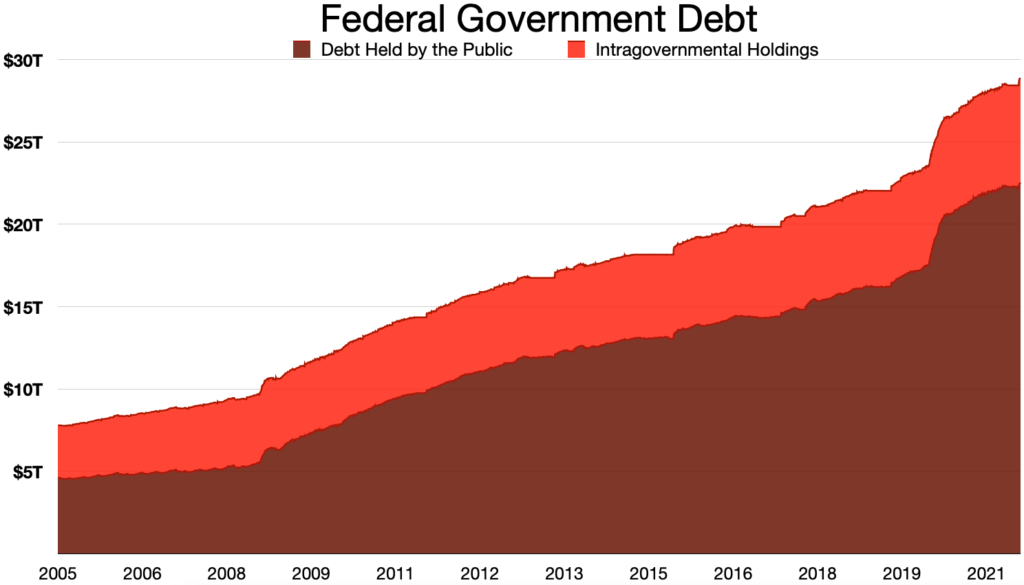

The US National Debt Nears $30 Trillion:

The Treasury Department said this week that the United States’ total national debt had reached $30 trillion for the first time in history, accounting for over 130% of the country’s annual economic output.

The federal debt has been tremendous and rising for decades. Still, the government’s response to the coronavirus outbreak, which included massive cash infusions into the U.S. economy, increased its expansion significantly.

Before the pandemic, the national debt was $22.7 trillion at the end of 2019. It had climbed by another $5 trillion to $27.7 trillion a year later. Since then, the country has added almost $2 trillion to its debt.

The $30 trillion in unpaid debt is owed to a diverse group of creditors, including the federal government.

As of January 31, $6.5 trillion of the national debt was classed as “intragovernmental holdings” by the Treasury Department. This includes Treasury securities held by several federal agencies, the most notable of which is the Social Security Administration, which manages a trust fund to give income to seniors.

Foreign governments own around $7.7 trillion in U.S. debt, with no country owning more than 5% of the total. Japan was the largest foreign holder of U.S. debt, with $1.3 trillion, as of the end of November, the most recent data available.

China was the second-largest holder of U.S. debt, with $1.1 trillion, followed by the United Kingdom, with $622 billion.

The Cost of Debt:

As the country’s outstanding debt has grown, the cost of servicing it has become a significant element of the federal budget. The government paid $562 billion in interest on outstanding debt in 2021. However, with the Federal Reserve prepared to begin hiking interest rates to combat growing inflation, the rate at which the Treasury must pay on the freshly issued debt will almost certainly climb, raising the overall cost of servicing the federal debt shortly.

As a result, the United States is the 12th most indebted country worldwide and the fourth most indebted among the developed economies that make up the Organisation for Economic Cooperation and Development, with a debt-to-GDP ratio of 133%. The average debt-to-GDP ratio in the OECD is 80%.

Is Bitcoin Capable of Solving the World’s Debt Problems?

Bitcoin is quickly establishing itself as more than a passing craze, but rather a genuine invention with far-reaching consequences for the future of investing and global banking.

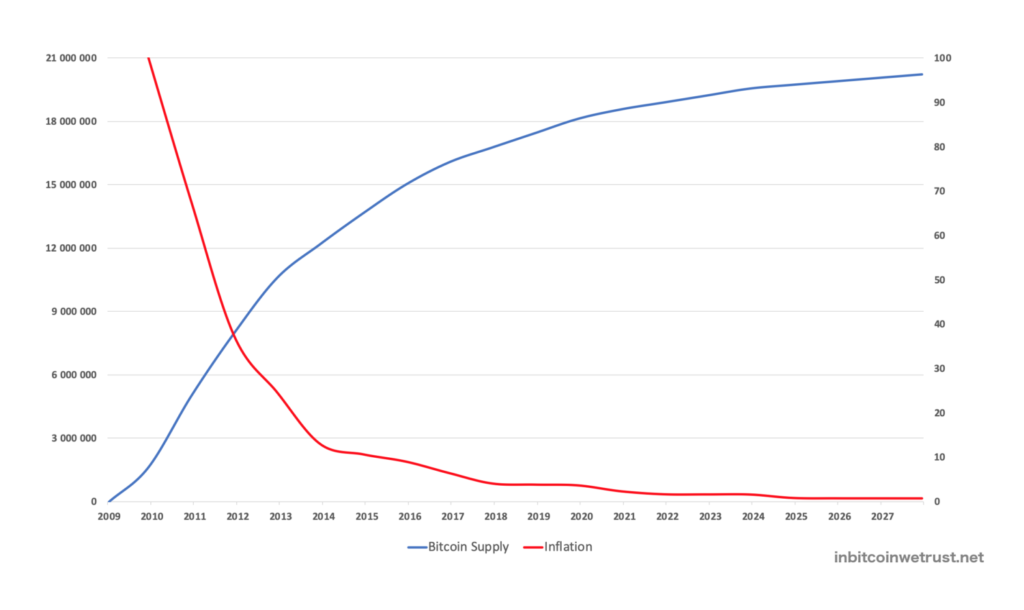

“Bitcoin fixes this,” says on-chain researcher Dylan LeClair most recently. But, to keep things in context, the market capitalisation of Bitcoin would only cover around 2.5% of the $30 trillion deficit. This explains why it remains a ray of hope for a more equitable financial future that does not reflect the current situation. Moreover, Bitcoin can’t be artificially inflated, and it can’t be printed. Thus, it’s a stimulus for better long-term economic stability.

People and businesses continue to buy the dip, both in the background and in the foreground, indicating that accumulation continues. MicroStrategy, led by Bitcoin bull Michael Saylor, acquired $25 million in Bitcoin. The corporation has already invested $3.78 billion in Bitcoin, amassing a staggering amount of over 125,000 BTC. Saylor is open about the Bitcoin future he sees and stays unyielding in his support for the revolutionary asset, drop or no dip.

The idea that Bitcoin could assist alleviate the world’s debt problem is based on two assumptions:

The First Assumption

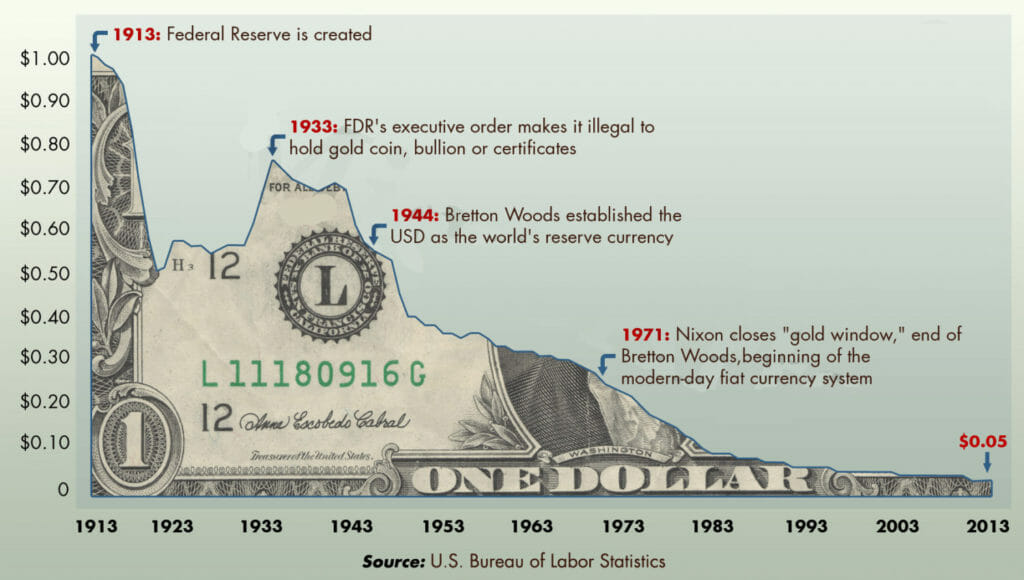

To begin with, Bitcoin is based on the assumption that money has a finite supply that cannot be controlled by governments, banks, authorities, or individuals. Bitcoin’s algorithm is its deity. This algorithm is beyond anyone’s control.

Satoshi purposely created a currency, incapable of being manipulated by inflation or deflation rates, by deciding its value in the free and open market. Demand for government-issued fiat currency would fall if the globe began to gravitate toward Bitcoin as their preferred currency.

Bitcoin would take the role of the U.S. dollar, the Euro, and all other currencies in the world as the ultimate store of value. Governments would be forced to issue debt in Bitcoin rather than their currency (or, more typically, the U.S. dollar), resulting in less debt and lower default risks.

The second Assumption:

The second crucial claim is that Bitcoin will continue to advance technologically to the point where it will handle all of the world’s transactions. Currently, the world’s central banks manage a significant share of global transactions.

Bitcoin can start cutting into the cooperation between governments and central banks once the transaction problem is solved. Bitcoin would become the king of finance if this relationship could be severed.

“The number of holders has grown consistently regardless of price volatility, managing to increase during the recent downturn and even through the precipitous drop witnessed in March 2020,” according to statistics from IntoTheBlock as reported by George Georgiev.

Investors slowly sold a small percentage of their holdings during the early 2021 rise. According to the study’s findings, they have now started to accumulate again as Bitcoin started to plummet in November. If these are the figures that investors are looking at, it’s safe to assume that market optimism is gaining traction. In an interview with Bitcoin bull Anthony Pompliano, Minnesota Representative Tom Emmer stated that he would accept Bitcoin payments as part of his salary and expected others would.

Crypto is becoming a safe refuge for future generations as global inflation reaches unfathomable heights and another zero is added to the national debt crisis total.

When considering the possibility of Bitcoin aiding in the resolution of the world’s debt problem, two key assumptions underpin the theoretical premise that must be overcome for Bitcoin to achieve such an outcome.

Individuals must first acquire a higher level of trust in Bitcoin than in central governments. Bitcoin must overcome the technological challenge of processing many trillions more daily transactions. (I think Lighting Network would be the answer there.)