From data privacy to supply chains, decentralized user-controlled identity could fundamentally change how the internet works.

A person’s identity is unique and unmistakable. It is defined based on characteristic properties, the so-called identity attributes. In the real world, there are physical features such as a facial image, a fingerprint, and personal information such as name, address, or date of birth. Any physical person can prove their identity with an official document, such as an identity card.

However, in the digital world, a digital identity includes the electronic data that characterizes a person with a physical identity. Attributes such as user names and passwords, chip cards, tokens, or biometric data are used.

For example, anyone who wants to use online banking or log into forums, social networks, or e-mail accounts has to authenticate themselves using different methods. Reliable and secure digital identities are becoming the key technology for data sovereignty and are the foundation of the digital economy.

There’s been an increase in demand for innovative digital identity solutions as users carry out their daily activities using trusted IDs on their phones, wearables, smart cards, etc. Ever since the ID2020 summit in May 2016 in New York, where the UN initiated discussions with four hundred experts who shared best practices and ideas on how to provide universal identity to all through digital identity, blockchain, cryptographic technologies, and its benefits for the underprivileged, numerous brands, companies and startups have released new innovative products and solutions, each of which has provided its value in the digital economy.

Below are five different industry leaders creating innovative solutions and breaking the barriers of digital identity and data privacy.

Table of Contents

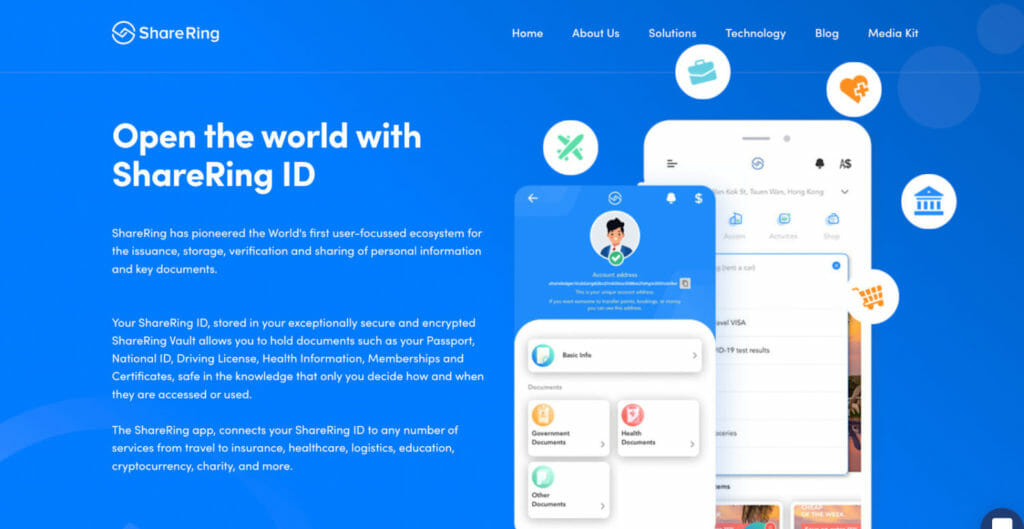

1. ShareRing

ShareRing has created an ecosystem where individuals and organizations can transact in a secure and trusted digital environment. ShareRing’s encrypted self-sovereign ID solution, based on blockchain technology, creates an immutable “fingerprint” of an individual’s verifiable personal identity and documents giving the person complete control over their data since it resides solely on their personal device in an encrypted format, and is never stored centrally.

ShareRing has created several solutions which improve processes across multiple industries and functions. For organizations, the project enables access to in-person and digital events through a secure method. ShareRing’s eKYC provides a more secure, convenient and effective way for users to manage digital security measures. These solutions have already been tested with success by Credit Unions, which indicates that they can also benefit other financial institutions.

2. Socure

Socure is a platform that supports automated machine-learning identity fraud risk management, as well as data-centric Know Your Customer (KYC) and Global Watchlist compliance tools, all returned with reason codes for decision transparency. Businesses rely on Socure to verify their customers and unblock rapid acquisition growth across all channels.

In 2021, the company announced a milestone of 500 customers in various sectors, including financial services, cryptocurrency, online gambling, healthcare, BNPL, government, and telecommunications and a third consecutive record quarter of annual recurring revenue growth, with 126% year-over-year recurring revenue growth in the second quarter. Socure’s product offerings consist of software solutions Sigma Identity Fraud, Sigma Synthetic Fraud, Intelligent KYC, Predictive Doc V, Global Watchlist, BNPL Growth Engine, as well as the flagship product, Socure ID+.

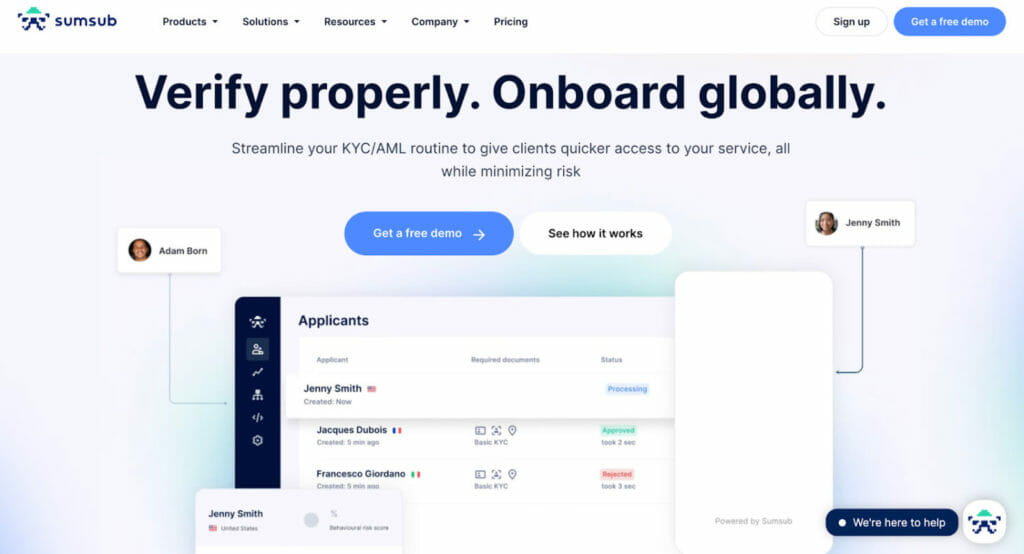

3. Sumsub

Sumsub is an all-in-one verification platform designed to catch fraudsters and aid businesses in meeting compliance regulations worldwide. Sumsub is a platform created for all challenges ranging from fraud prevention and identity verification to AML/KYC and KYT compliances. This AI-based solution uses anti-fraud and compliance procedures to fight money laundering, terrorist financing and online fraud.

Sumsub states on their website that they constantly monitor all the existing user profiles to manage the risks associated with customers. The system will notify a user if they have been put on a Sanctions list or his document has expired. Because of this, users can react immediately in case of any changes.

4. BioCatch

BioCatch was founded in 2011 to address next-generation digital identity challenges by focusing on online user behavior.

BioCatch is a leading platform of Behavioral Biometric, Authentication and Malware Detection solutions for mobile and web applications. BioCatch delivers actionable behavioral insights to create a world of trust and ease across the entire digital identity world from account origination to monitoring online sessions and more. BioCatch delivers behavioral biometrics and analyzes human-device interactions to protect users and data.

5. Trulioo

Trulioo uses a Global Identity Verification Service titled GlobalGateway, developed for the international market. Their product is created specifically to assist businesses in complying with Anti-Money Laundering (AML) and Know Your Customer (KYC).

Today, Trulioo provides a global identity marketplace that services a wide range of industries, including finance, banking, retail, payments, gaming, and online marketplaces through single API integration. Trulioo helps its users meet compliance, prevent fraud, and trust and safety requirements.

Conclusion

As the number and severity of cyberattacks rise, the need to secure and authenticate data associated with identity is paramount. Likewise, companies are offering innovative solutions and a range of product services in Identity Management aimed at targeting fraudsters, managing login credentials, authenticating users’ devices, and more.