Amid the recent market crash, we have chances that bitcoin might be bottoming out, and hence this can be the last opportunity to grab some of the cryptocurrencies at their lowest. Therefore, here’s a list of the three best crypto assets that you can buy during the dip.

What is BYDFI?

BYDFI has many great features that make it a straightforward crypto trading platform for everyone. The platform offers CFDs, leverage trading, and other advanced trading options that are not too common in the crypto trading industry.

Further, there are two types of trading options available on the exchange: classic for beginners getting started and advanced for professional traders. BYDFI is a safe and legit crypto trading platform with a simple interface for easy navigation.

You can learn more from the BYDFI review article. Also, Sign-up using this link [HERE] and get 10% OFF trading fees for 30 days.

Ethereum (ETH) Price Analysis

Started back in 2015, Ethereum is an open-source project powered by blockchain technology. Smart contracts allow applications to be executed & verified safely on the peer-to-peer network without the need for trusting central authorities.

Ether is still one of the more pricey tokens, but it has a huge potential. One reason is the recent switch from Proof-of-Work to Proof-of-Stake, which makes it much easier to use.

Ethereum experienced a plunge in its price in 2022 and has gradually been getting back on its feet. From its all-time high of nearly $4,500, Ethereum has fallen by over 70% to its current price of $1,250.

At the same time, it is still possible that Ethereum will break through this barrier and continue to grow.

In the 1D timeframe, the price action of $ETH/USDT moves inside the horizontal resistance zone. We must wait for a successful breakout or breakdown to confirm its next move.

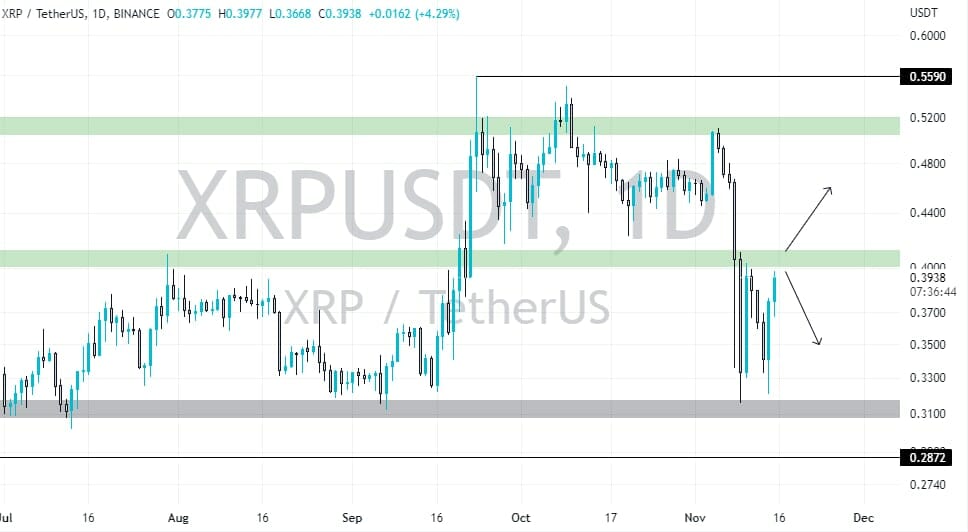

XRP (XRP) Price Analysis

The main goal of XRP is to act as a bridge between two currencies or networks to ensure a temporary settlement. Ripple was first introduced in 2012 and was co-founded by Chris Larsen & Jed McCaleb. Ripple uses a consensus mechanism that relies on bank-owned servers to confirm transactions.

The price of XRP increased by 10% in the last seven days following their victory against the SEC. It is 90% below the all-time high of $3.84.

XRP could be a good option for investing during the bear market. It has a lot of potential, can be used on many platforms & has quite an entry point.

In the 1D timeframe, the price action of $XRP/USDT has broken the horizontal support zone. Currently, the price is retesting the horizontal resistance zone. A downward movement is expected from here. If it breaks its resistance, we can see well gain in it.

Polygon (MATIC) Price Analysis

Polygon is a crypto platform that enables you to connect with other Ethereum-based projects and blockchains. As an investor, MATIC tokens will secure the network and enable you to make transactions and pay transaction fees.

Polygon is a toolkit to facilitate the creation of decentralized applications. It also works with Ethereum virtual machines, so it could be a profitable investment.

Polygon, a protocol designed to make the financial world more equitable and diverse, is showing up in many decentralized finance protocols. Many new cryptocurrency projects have been announced recently, and MATIC is expected to increase by 100%.

The price of MATIC spiked at the start of November when Polygon announced their non-fungible tokens, and Instagram said they would support them.

In the 1D timeframe, the price action of $MATIC/USDT bounces from the strong horizontal support zone. If the price breaks its resistance zone, then it can go upwards. On the other hand, the price may fall from here.

Discipline and Patience are the most critical components of a successful trade. According to the above analysis, the coins we discussed might make you decent gains if other market conditions prevail favorably. Again, it’s your hard-earned money that you’ll be using. Do Your Own Research before investing.

Disclaimer: Our analysis is for educational purposes.