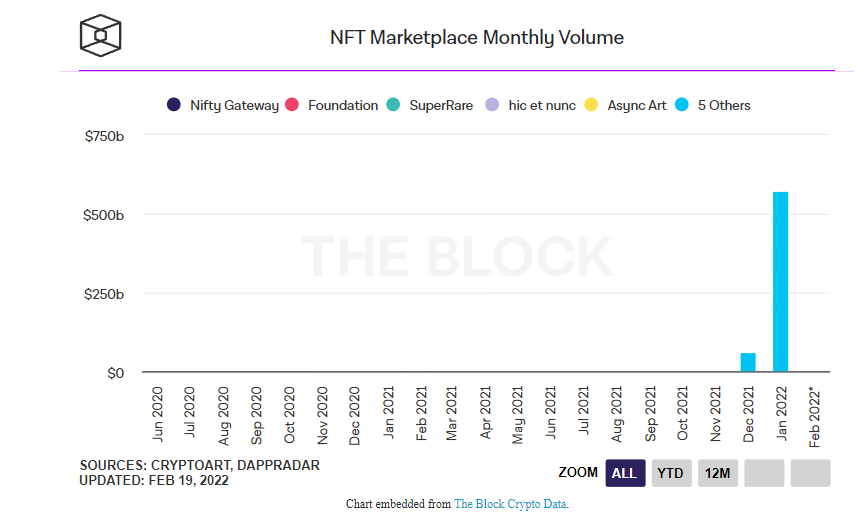

Since the start of the year, the cryptocurrency market has been in the red, but the market for non-fungible tokens (NFTs) has been prospering – at least on paper. According to data compiled by The Block Research, NFT trade volume increased nearly thrice in January, from $2.67 billion in December to $6.86 billion in January.

The majority of the credit for the increase goes to LooksRare, a new NFT platform that is being marketed as a “decentralised” alternative to OpenSea, the market leader in terms of all-time value. This isn’t to suggest that OpenSea didn’t have its share of success. In fact, it increased its trade worth by a factor of two.

Because digital goods such as photos or bits of software can be replicated indefinitely, NFTs arose. Digital items, unlike real-world objects like paintings or diamonds, have no scarcity and consequently no value.

However, the technocrats who now seem to control our lives reasoned that affixing an NFT to a digital object essentially made it unique, and thus something people would pay for. The NFTs and their linked item (image/video/song/whatever) might now be bought and sold using the same blockchain technology that underpins cryptocurrency like Bitcoin.

NFTs have genuine applications in principle, such as allowing digital artists to be compensated for their labour and demonstrating ownership of goods made entirely of bits and bytes.

However, as with any newly emerging technological breakthroughs, NFTs have opened the door to charlatans, with video games serving as a major frontier.

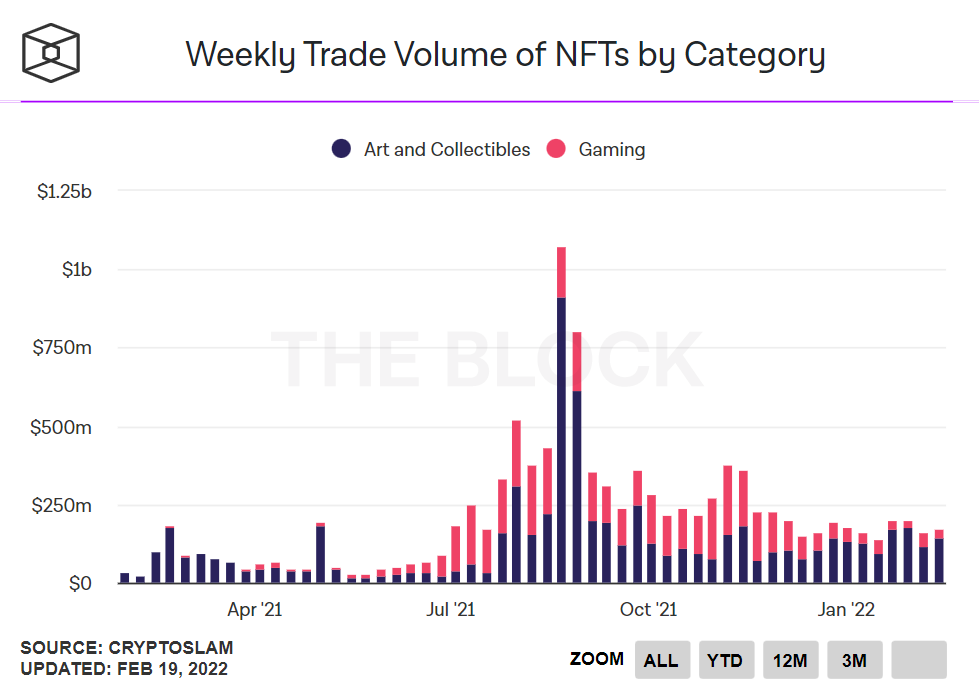

Moreover, according to data from TheBlock, the highest weekly trading volume of NFTs was seen in August 2021; and since then, it has been almost constant.

The End of a Roller-Coaster Ride

Is the NFT craze about to come to an end? According to u/BadDefica, a Reddit user, The National Football League season is just getting started. When you look at NFTs closely, you’ll notice that they don’t look like traditional crypto projects with a lot of crypto jargon.

The user feels that NFTs are straightforward projects and that if any section of cryptocurrency will result in the onboarding of a big number of non-crypto natives, it will be NFTs and NFT projects.

Experts say that while NFTs are still in their early stages, they are here to stay and will draw a far wider audience in the coming years.

“This year, we had a tremendous supply influx of PFP NFT projects, and 95% of them are now selling below their initial mint price,” Malviya stated. “NFT collections that lack utilities will perish in the long run.”

The current internet or web model is simply about exchanging information, whereas Web 3.0 will lead to a new internet led by the community in the future, with NFTs playing a key role.

Experts claim that, given the speed with which the blockchain sector has developed over the last two years, the industry is poised to transform the world; they predict that 2022 will be an even larger year for NFTs.

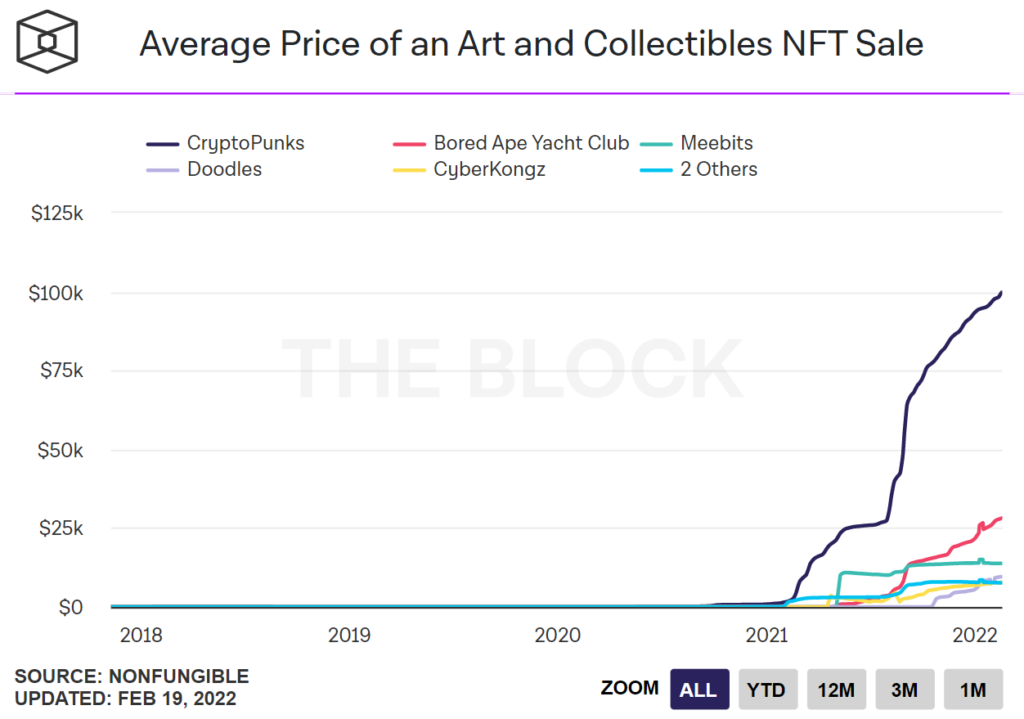

The median sale price is increasing as the number of sales and transactions decreases. The typical NFT sales price was close to $780 as of November 28, up from $250 just a few weeks before.

The problem is that valuable NFTs are becoming more expensive as the demand rises. This could indicate that the market has been filtered out, with just genuine NFTs remaining, commanding greater prices.

Apex Hype Might not be Here Yet

GOBankingRates spoke with Matt Maximo, a research analyst at Grayscale Investments, who believe we haven’t yet achieved peak NFT enthusiasm, as seen by the fact that NFT trading activity has remained strong over the last week despite market volatility.

“The fact that NFTs as art has gained such traction without widespread avenues for people to display and show them off outside of Twitter profile pictures is also a very bullish indicator that the craze isn’t over,” Maximo remarked.

Anyone who buys art does so with the intention of displaying and displaying it. There are few good ways to achieve this with NFTs, but they sell for millions of dollars every day, according to Maximo.

“Just from that perspective, there’s a lot of potentials to promote the growth of that ecosystem, from building NFTs to inventing hardware or new platforms for users to display their art. I expect this trend to continue throughout the remaining social networks — Meta and Instagram in particular,” Maximo added.

People keep forgetting how early it is in the development of NFTs, according to Alex DiNunzio, CEO and co-founder of digital comedic collectables business Jambb, who told GOBankingRates that popular awareness and investigation has only just begun, while actual mass adoption is still “quite a ways out.”

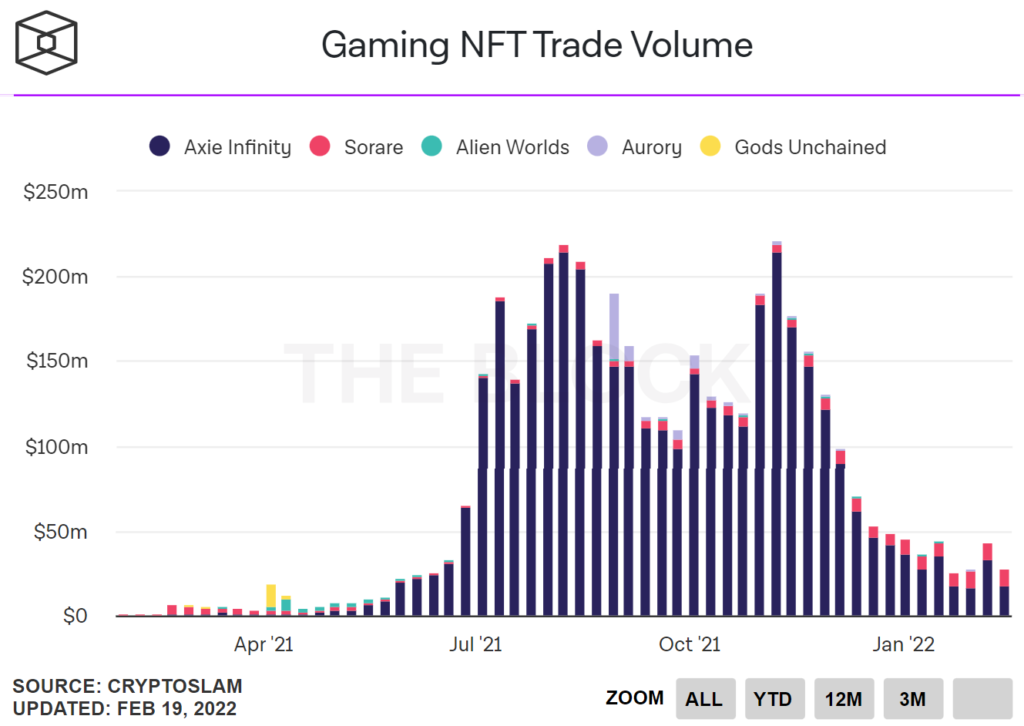

With NFTs booming, it was evident we’d see a tremendous rise in Gaming NFT Trade volume as well, (thanks to Axie Infinity).

“Twitter just began confirming NFT profiles, and word has it that Facebook and Instagram may follow suit soon.” Ubisoft has begun integrating NFTs into its games, paving the way for a market expansion in gaming NFTs, according to DiNunzio.

Related read: NFTs Might Soon be Coming to Instagram and Facebook

Another aspect of NFTs’ potential and endurance, according to Anthony Georgiades, co-founder of NFT marketplace Pastel Network. In an interview with GOBankingRates, he remarked, “The market is not exclusively driven by digital art, collectables, and game assets, but by its accessibility and future possibilities.”

Finally, several experts point out that because NFTs are still a relatively new concept, the vast majority of people are unfamiliar with them. However, Jake Udell, founder of Metalink, a platform that will allow individuals to connect, buy, and trade NFTs, told GOBankingRates that there is a “tremendous amount of utility being put into a lot of these NFT collections.”

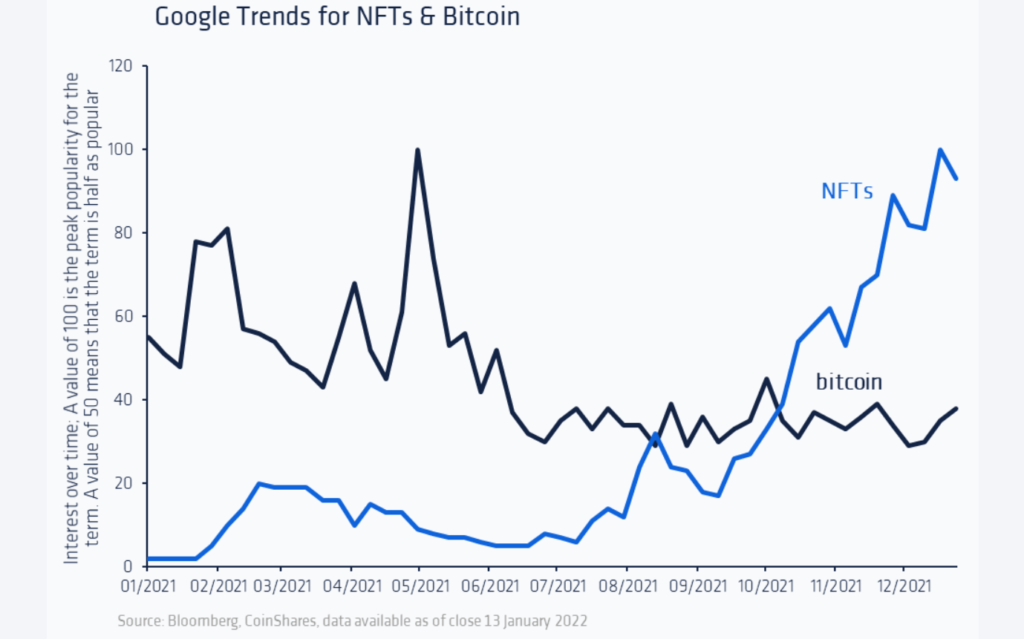

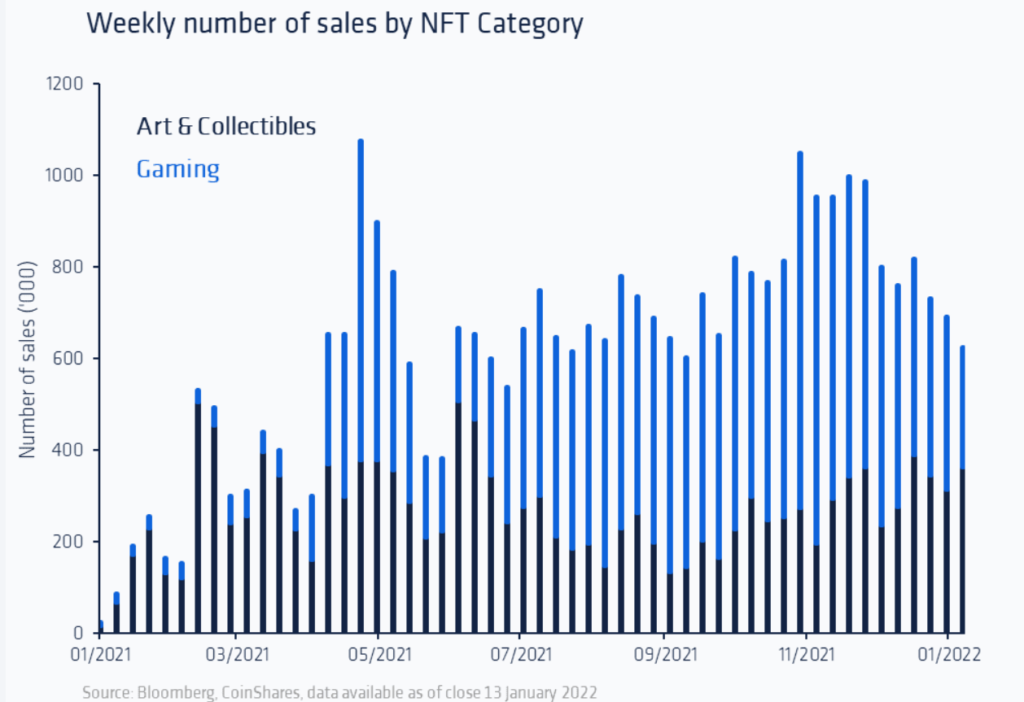

According to a recent CoinShares analysis, we attained peak NFT hype at the beginning of December 2021, based on Google trends data. This is supported by statistics from The Block, which shows that the number of NFTs sold peaked in November 2021.

However, the paper emphasises that it does not wish to “distract from the enormous prospects in the NFT sector, where some intriguing communities are being established.”

NFTs are a powerful tool that helps artists and content creators to monetize their work more effectively. Smart contracts have been the facilitator, allowing creatives to control future royalties in anything they “mint,” with minting referring to the process of creating an NFT and adding it to the blockchain network. As per Chainalysis, around US$45 billion in NFT was exchanged in 2021.

The fundamental value of NFTs, which may be seen as a type of digital provenance, lies in the fact that their transactions and ownership are recorded on the blockchain, making the data unchangeable. NFTs enable artists to earn during the original auction, but the artist will also continue to collect royalties if the NFT is traded in the secondary market.

What does google say?

More assertions regarding the potential for “play to earn” to enable people in developing countries to earn money by playing video games. However, that concept necessitates a long-term, expanding in-game economy – and balancing a video game economy is notoriously difficult. When digital objects have real-world value, that is a terrifying prospect, and if people are playing to gain money in a game, that kind of financial drain will compel a studio to make changes. With the NFT-based game Axie Infinity, this is already occurring. Its studio is battling to keep its NFTs from collapsing, and as a result, gamers’ daily earnings have fallen below the poverty threshold.

Because it’s such an appealing concept, it’s sparked a lot of media attention, as well as the minting or purchase of NFTs by many large businesses and financial organisations. Despite the fact that the NFT has been present since 2014, Google trends data implies that we reached peak NFT enthusiasm in December 2021. This is supported by theblock data, which shows that the quantity of NFTs sold peaked in November 2021. The peak for art and collectables came in May 2021, with the gaming sector picking up a lot of the slack in this NFT sector, as gaming collectables on platforms like AxieInfinity have risen rapidly.

NFTs have a list of challenges inherent to their functionality for some prospective promise. People promote cryptocurrency as a way to conduct private transactions, yet everything on the blockchain is open to anyone who understands how to analyse the data. The technology’s proponents also portray its decentralised structure as inherently more secure, yet launching assaults against an individual’s personal crypto wallet is actually quite simple.

If we have achieved “peak enthusiasm,” we may see a price drop similar to what happened during the end of ICO euphoria in 2018, when there were significant price disparities between excellent and terrible ventures. It’s probable that we’re starting to see this pricing disparity between good and mediocre NFT productions Since the value in the art field is highly subjective and personal. Price discrepancies are most likely to be the biggest in NFT work that is either implicitly or openly imitating originals or being first to market.