Key Takeaways:

- Future of CBDC adoption and China’s influence over it in terms of the CBDC design trade-off for central banks is between fulfilling user privacy demands and enabling authorities access to user identities and transaction data to reduce the risk of illegal financial activity.

- Fears of spamming and identity theft, as well as being stalked or robbed, may influence privacy preferences.

- A completely open CBDC could also raise worries about digital surveillance, particularly in nations where public institutions are distrusted.

Central Bank Digital currencies are frequently hailed as the next step in the development of money, as they have the potential to eliminate the need for real cash. CBDCs are often issued as a virtual token equivalent to a country’s current fiat currency. This means that, like any cryptocurrency, you may potentially manage and transfer your riches via a digital wallet.

According to our CBDC Tracker, at least 64 central banks are considering launching or testing a retail CBDC, with 20 having already done so or being tested in the very early stages of the process. Since our count is based on credible public sources, we say “at least” (almost all from the central banks themselves). However, according to the Bank for International Settlements (BIS), retail CBDC was being considered by 58 of the 65 central banks assessed at the end of 2020.

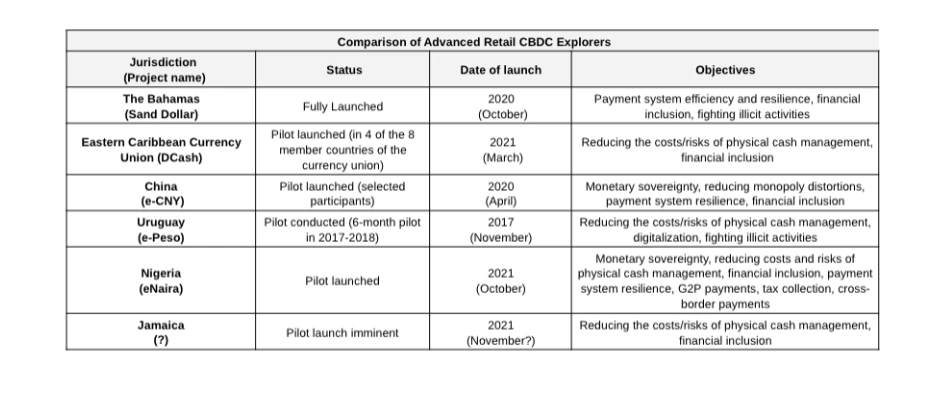

Six jurisdictions have either ultimately launched (Bahamas) or are in the process of launching trial programs (China, Eastern Caribbean Central Bank, Jamaica, Nigeria, and Uruguay)

The most well-known CBDC implementation to date is China’s e-yuan (previously digital yuan) program. The country was one of the first to investigate the feasibility of a CBDC, with a study beginning in 2014. After several years of testing, it’s scheduled to be released to the general public in 2022 or early 2023. In addition, internal test programs have shown that banks and financial organizations will distribute digital currency locally.

Suzhou, Chengdu, and Shenzhen were the first cities in China to participate in e-yuan experiments. In addition, private corporations such as McDonald’s and Starbucks were also asked to participate.

Citizens only need to download a mobile application and verify their identities to get started. As a result, payments made through apps already account for a significant portion of the market.

The Chinese government’s long-term goal for the e-yuan project appears to be dethroning the US currency, in addition to recovering power from private corporations like Alibaba. The dollar, along with the euro and a few other currencies, has held a comfortable lead as the world’s reserve currency for nearly a century. The dominance of these currencies in global commerce and commodities markets is well-known. China intends to take a piece of that pie with the e-yuan project by becoming the first to market with a low-cost cross-border payment system.

The People’s Bank of China official in charge of the CBDC outlined blockchain applications in China’s CBDC and highlighted the challenges in the existing application of blockchain in cryptocurrencies.

The Ministry of Electronics and Information Technology (MeitY) has published a national strategy for implementing blockchain technology in government processes, particularly e-governance. The 52-page paper, released on Friday, aims to “build trusted digital platforms using shared blockchain infrastructure” and support “research and development, innovation, technology, and application development” in the blockchain space.

The text also takes into account blockchain-based platforms run by the Chinese government. China, where the government has been planning the launch of its digital yuan for months, has included a crackdown on other cryptos. In September, China declared all cryptocurrency transactions to be unlawful.

Before that, in May of this year, Chinese bank officials announced that financial institutions would no longer be allowed to conduct services related to cryptocurrencies.

Reduced monopoly powers of private payment systems (e.g., AliPay and WeChat Pay in China) is one reason to consider a retail CBDC for China and some other advanced economy central banks that haven’t started pilot programs yet.

Almost all central banks that have introduced retail CBDC have chosen a similar approach to comply with FATF AML/CFT rules by providing additional privacy on low-value holdings/transactions by using “proportionality.”