Key Takeaways:

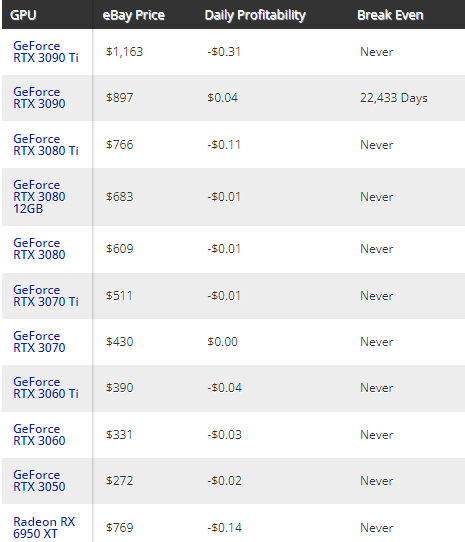

- The profitability of GPU mining has essentially vanished.

- As the Ethereum Merge went live cryptocurrency miners are turning off their rigs and considering selling their GPUs.

Since the Merge, it has become more and more difficult for Ethereum miners to earn a living since too many of them are transferring to alternative coins, which has severely reduced mining profitability.

One of the most profitable cryptocurrencies to mine, Ethereum, eventually phased out GPU-based mining on Thursday morning, which will reduce the amount of energy used.

However, the change is bad news for cryptocurrency miners who use Ethereum as their primary source of revenue.

Crypto miners have been buying up as many GPUs as they can to power their mining rigs in recent years, which has resulted in a shortage of GPUs and sharp price increases for customers who were merely looking for better graphics in PC games.

Although it appears that this trend has since reversed, the majority of cryptocurrencies’ dollar-denominated prices started a protracted decline in late 2021, making GPU mining unprofitable in many regions.

Since GPU prices have already fallen throughout 2022, they frequently sell for far less than their MSRP on auction websites like eBay. Manufacturers of graphics cards are now stuck with an unanticipated oversupply of extra inventory.

Ben Gagnon, the chief mining officer at bitcoin miner Bitfarms, tweeted that GPU mining has ceased less than 24 hours after the Merge (BITF). He continued, “The only currencies showing profit have little market size or liquidity, and the three largest GPU networks have very tiny profits.“

It’s possible to believe that Ethereum miners may easily switch to cryptocurrencies that still rely on proof-of-work mining (including Bitcoin, which is still the biggest cryptocurrency by market cap).

As a substitute, the forked Ethereum Classic has developed and is attempting to play the exact same role by maintaining the token’s original proof-of-work architecture.

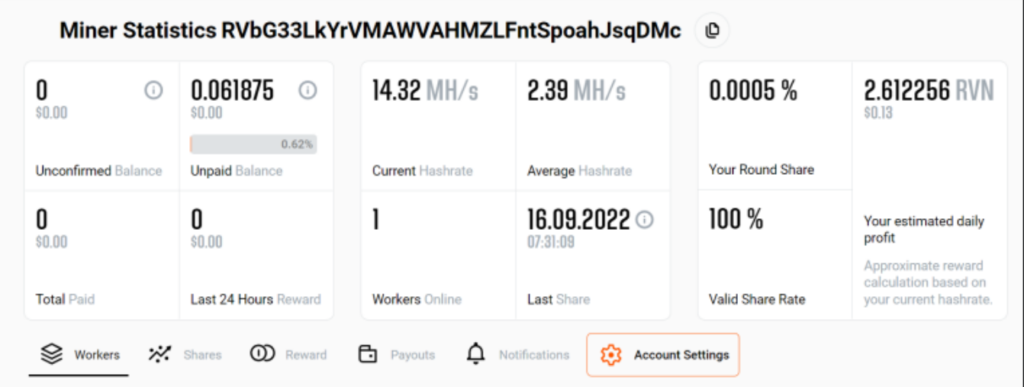

An article on PCMag‘s blog sheds light on the most recent unprofitable pattern that has emerged after the merger.

With an Nvidia RTX 3080 graphics card, they attempted to mine Ravencoin but immediately discovered it was a losing endeavor.

The mining program estimates that they would only generate between $0.13 and $0.26 per day, before deducting the high electricity expenses in California, which would almost certainly result in a net loss.

180 GPUs will be employed at Hut 8 Mining’s British Columbia data center, which earlier this month made the announcement that they “would be designed to pivot on demand to provide Artificial Intelligence, Machine Learning, or VFX rendering services to customers.”

A similar announcement was made by Hive Blockchain, which said it was starting “a test pilot project for cloud computing at a Tier 3 data center, where a part of [Nvidia’s] A40 GPU cards are being used for cloud computing.“

Last but not least, it’s hard to foresee a situation in which a significant number of the former mining GPUs don’t end up being sold on secondary platforms like eBay in the following months.

Even extremely cheap power is insufficient to make GPU mining economically viable when you take into account the need for warehouse space, power costs, human costs, and other infrastructural issues.

It’s an ideal opportunity for mining farms to either cut their losses and shut down, or to pocket their profits and sell off their unsold stock.