Key Takeaways

- Sino Global stated that its “direct exposure to FTX was confined to mid-seven figures held in custody.”

- FTX was a major partner in a big fund Sino raised with outside investors’ capital.

Leading Asian crypto investment firm Sino Global has acknowledged its exposure to now bankrupt crypto exchange FTX. In a series of Tweets, Sino Global stated that its “direct exposure to FTX exchange was confined to mid-seven figures held in custody.”

As per shareholder documents, the value of the company’s portfolio of digital tokens was at $129 million as recently as earlier this year. The majority of these tokens, including Solana blockchain’s native SOL, were among the strongly linked with Sam Bankman-Fried, the former CEO of FTX. The tokens, including Serum (SRM), Oxygen (OXY), Maps (MAPS), and Jet Protocol (JET), suffered price declines of 80% or more as FTX slowly went into bankruptcy.

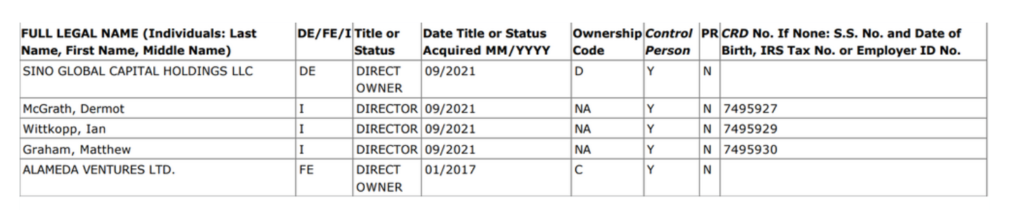

Reportedly, FTX was also a major partner in a big fund Sino raised with outside investors’ capital. According to the United States Securities and Exchange Commission (SEC) filing made earlier this year, SBF participated as an indirect investor in the general partner of the Liquid Value I fund through his trading firm, Alameda Research, and Alameda Ventures.

In addition to its primary investments, Sino Global provided information about a portfolio of assets valued at $6.7 million for which there was no current market price. As per reports, the slide deck states that the “Liquid Value Fund I might reflect a similar breakdown” to Sino’s private investments.

In the filing, FTX was described in the now public slide deck as a “partner” in the fundraising, with the potential to unlock “significant strategic value.” As of January 2022, the fund had raised $90 million, with SBF’s FTX as an anchor investor.

Commenting on FTX’s downfall and Sino’s exposure to the firm, Sino stated, “We trusted FTX to be a good actor devoted to pushing the industry ahead,” adding that the company “truly regrets that misguided faith.” The firm added that Sino Global Capital is operating as normal and is continuing to invest as a fund.

Since Sino’s operations and activities were strongly linked to the bankrupt FTX, even if it doesn’t incur any loss, a dissociation from FTX will only be possible after a while. Even if Sino liquidated some of its shares to reduce its exposure, the returns are likely to be minimal owing to the plummeting prices of cryptocurrency across the market in the year.