Cryptocurrency trading has been around for a few years now. However, the prices of cryptocurrencies vary from one exchange to another. Moreover, every crypto exchange has its values for specific cryptocurrencies. Therefore, crypto arbitrage helps traders to buy cryptocurrencies from one exchange and sell it on another. In this guide, you will get to know how to earn using crypto arbitrage in India.

Table of Contents

Summary

- Crypto arbitrage trading is an opportunity to gain profits by buying an asset at a low price and selling it at a higher price.

- It mainly arises due to variation of liquidity across different exchanges.

- There are two ways to arbitrage: arbitrage between exchanges or arbitrage within an exchange.

- Crypto arbitrage entitles you to earn profits along with low competition quickly.

- However, there are also some risks involved in this process.

- Before trying crypto arbitrage, you should always plan a strategy, look for new listings and avoid BTC transactions.

What is Cryptocurrency Arbitrage?

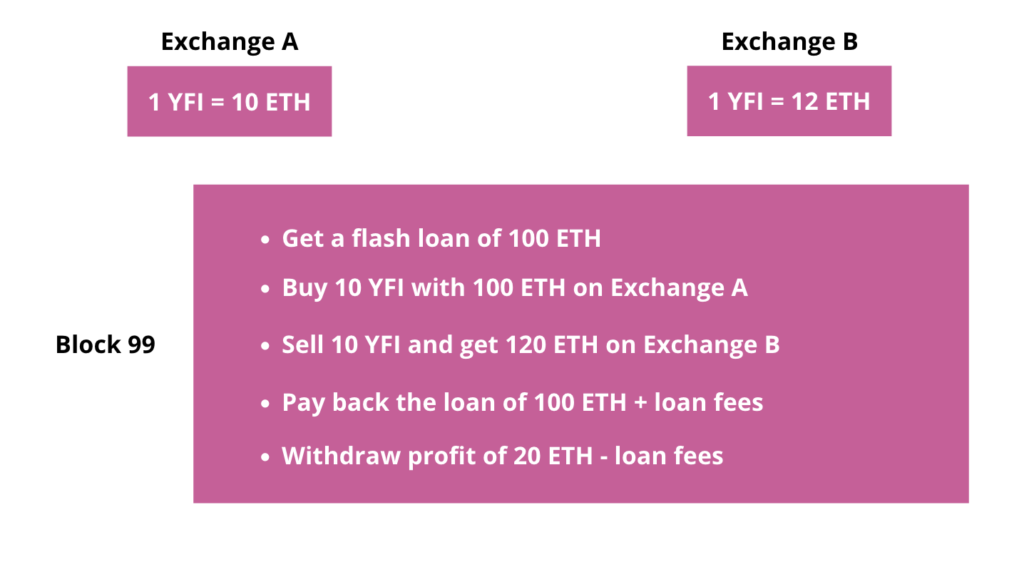

The term ‘arbitrage’ is a familiar concept since a stock, bond, and foreign markets emerged. However, cryptocurrency arbitrage refers to buying and selling similar crypto assets on different exchanges to profit from the differences between the price list of the crypto assets on both exchange platforms. Moreover, crypto arbitrage is different from all the other trading strategies as the user does not take advantage of the price changes over time but instead takes advantage of the price differences between exchanges.

Why does crypto arbitrage occur?

There are several reasons behind the emergence of crypto arbitrage. Below are some of the primary reasons:

- Variation of liquidity across several exchanges.

- Different types of exchanges.

- Different withdrawal and deposit times across other exchanges.

- Variation in supply and demand across different countries.

- Rates of foreign currencies.

How can you find crypto arbitrage opportunities?

There is an arbitrage opportunity to buy a cryptocurrency for a low price and sell it at a higher price. For this purpose, there are two significant types of crypto arbitrage-

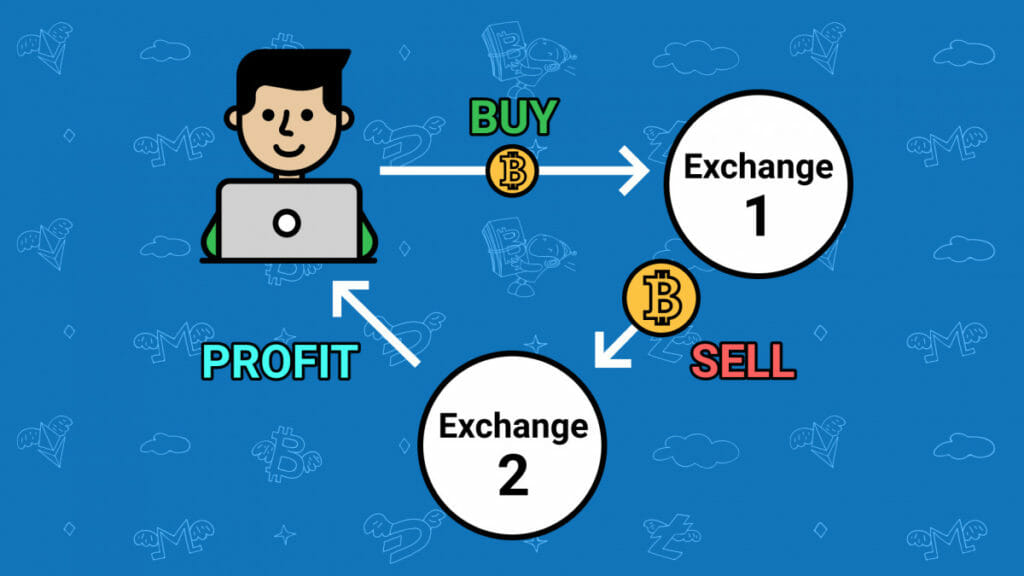

Arbitrage between Exchanges

This type of arbitrage is quite apparent as it is similar to fiat currency arbitrage. This idea is simple: benefit from the differences in prices for identical crypto assets but on different exchanges. For instance, the price of Bitcoin is 6600 US dollars on Exchange 1 and 8730 US dollars on Exchange 2. So, you can buy for 6600 US dollars and sell the same bitcoin for 8370 US dollars. To conclude, you can make a profit of 2130 US dollars on a single transaction.

Arbitrage within an Exchange

This type of arbitrage is also known as cross-currency arbitrage. You can follow the below steps to arbitrage within an exchange.

- First, depositing some fiat on an exchange

- Buying cryptocurrency 1

- Selling cryptocurrency one and then buying cryptocurrency 2

- Repeating steps 1 and 2

- Selling cryptocurrency 2 for fiat currency

- Withdrawing the profit

How to use a bot for Crypto Arbitrage?

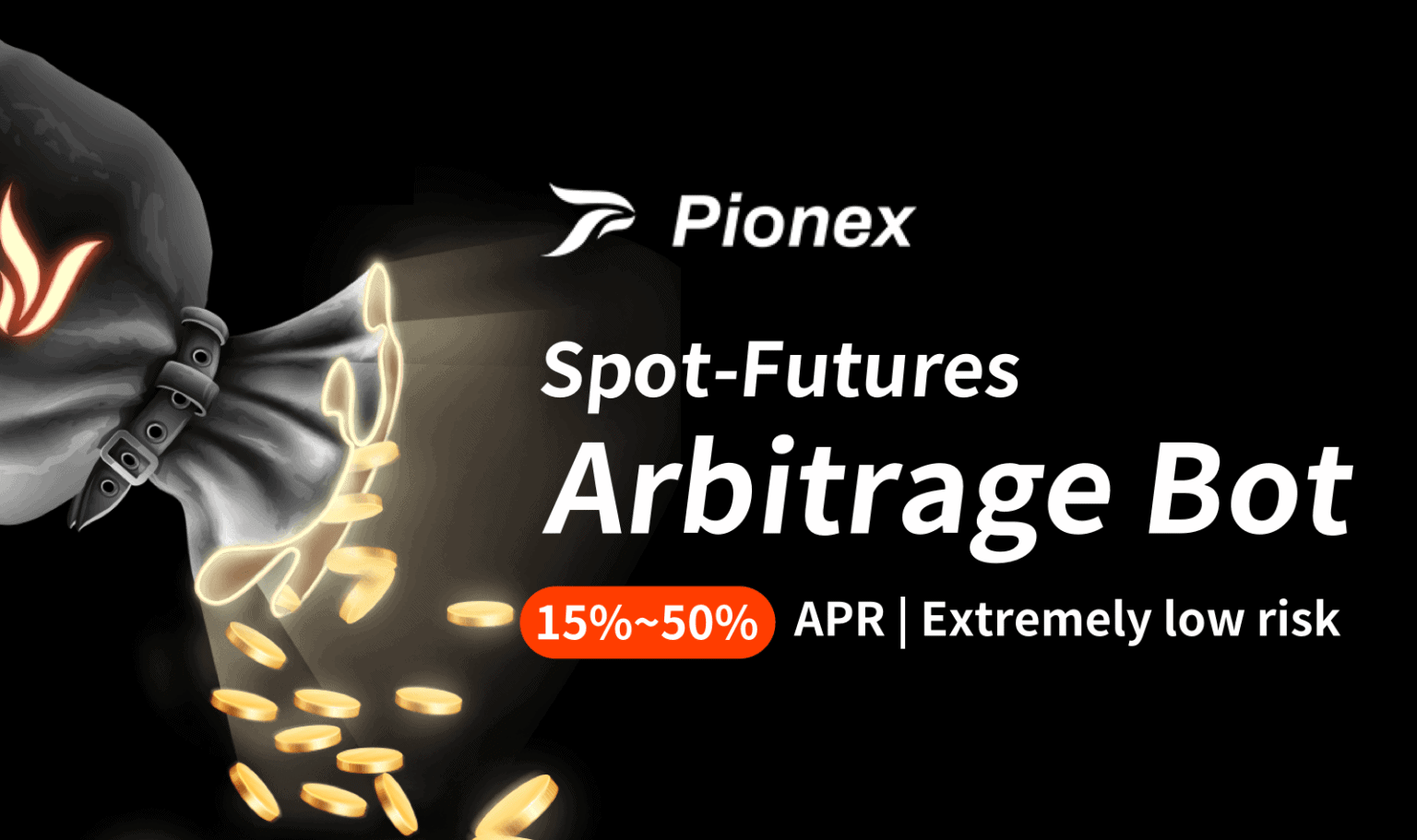

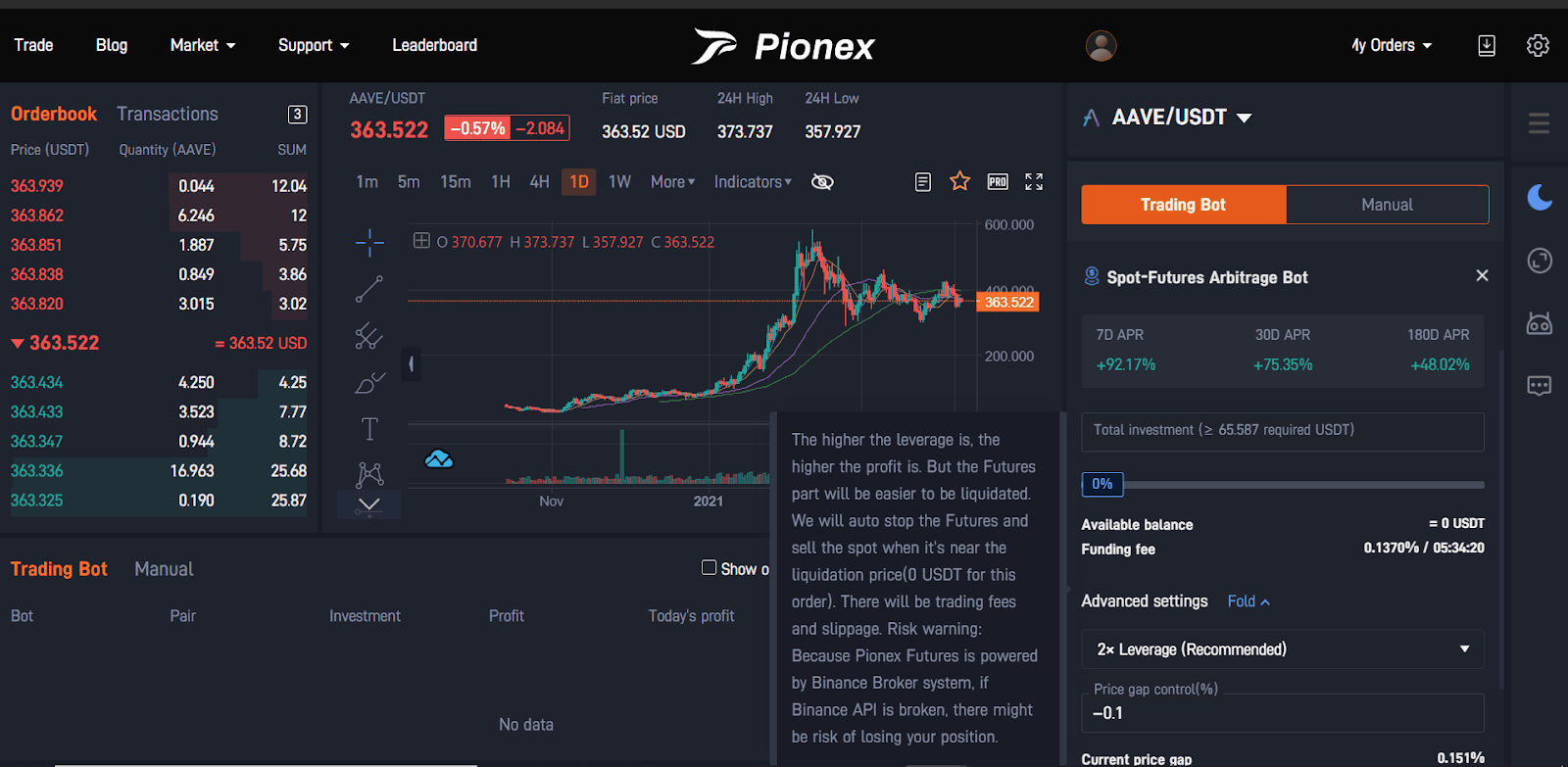

Isn’t it amazing that rather than doing it manually you can earn through crypto arbitrage using a crypto trading bot? The Pionex Crypto arbitrage bot allows you to earn upto 50% APY in the safest manner possible to earn. Furthermore, the bot is available free of charge and you can use it just by signing up using the button below.

Also, read Pionex Arbitrage Bot | Earn through Spot – Futures Crypto Arbitrage

How does crypto arbitrage benefit you?

Crypto arbitrage allows the traders to get benefitted from the inefficiencies in the market.

- Quick Profits: Crypto arbitrage stands at the top among the other trading strategies regarding the quick realization of profits.

- Opportunities: Cryptocurrencies offer a wide range of arbitrage opportunities. Therefore, the traders have a very likely chance to make profits by utilizing the various opportunities provided.

- Competition: Cryptocurrencies have risen in fame and popularity, and they are traded significantly but less than fiat currencies. Hence, there is less competition for crypto arbitrage.

- Price Differences: A considerable feature of crypto arbitrage is the range of price differences. So, the traders can sometimes even get benefitted from the extensive range of price differences.

Create the Pionex Crypto Arbitrage bot and start benefitting from it right now!

What are the risks associated with crypto arbitrage?

- Security: Though it is profitable to store few assets on all of your possible exchanges, this may also increase the security risk. Holding assets in several different crypto exchanges puts at least one of your assets at risk of being hacked.

- Timing: The timing plays an essential role in crypto arbitrage as the opportunities arise and resolve quickly. Therefore, the traders are required to be extra attentive to take advantage of such opportunities.

- Volume Requirements: There is a relatively small profit percentage available with crypto arbitrage. So, this means that the trader must invest a more significant amount of assets to gain meaningful profits.

Things to remember before you try crypto arbitrage

- Plan a strategy

Before starting with crypto arbitrage, consider the various factors that may affect your profits or put you a risk. For instance, calculate the different fees that might minimize your profits.

- Look for new listings

Try to look for the new crypto listings as there are chances that they may have little or no demand on the exchange.

- Avoid transferring BTC

You should avoid bitcoin transactions as they take a lot of time. As arbitrage requires quick transactions, transferring BTC may consume a lot of your time and reduce your profit chances.

- Diversify

If you stick to only two or three exchanges, there are chances that you may earn only a tiny profit. But, if you trade on various exchanges, then your profit-making chances increase a lot more.

- Limit Loss

Crypto arbitrage trading requires you to either trade quickly or not to trade at all.

What things to look for in crypto arbitrage platforms?

There is no particular crypto arbitrage platform that can be considered the best. However, switching between different windows can slow the arbitrage process, so finding a platform that already connects to various platforms is better. Moreover, to maximize profits, you should look for a platform that offers different deposit and withdrawal methods along with low fees. Also, this allows you to withdraw profits quickly.

Crypto Arbitrage: Pros and Cons

| PROS | CONS |

|---|---|

| There is low risk as compared to long-term investments. | The trader might be charged a high transaction fee. |

| Arbitrage trading flourishes even in the volatile market. | Regulations can have an impact on cross-border arbitrage. |

| The trader earns profits regardless of the market direction. | Arbitrage trading requires experience. |

Conclusion: Earn Using Crypto Arbitrage In India

There are several different crypto arbitrage opportunities to get benefitted from the market inefficiencies. But, as the number of traders indulges themselves in arbitrage, these opportunities begin to disappear. Therefore, the prices of the assets become similar across various exchanges. To conclude, if you wish to make maximum profits, you need to know the different concepts regarding trading before trying crypto arbitrage.

Frequently Asked Questions

Which is the best crypto arbitrage bot?

Pionex is one of the best cryptocurrency exchanges that offer 12 free trading bots, including arbitrage bots and grid bots.

Is crypto arbitrage trading profitable?

Yes, crypto arbitrage trading is profitable, but only if you are quick enough to grab the opportunities as the spreads exist for only a few seconds. However, within this short period, you should be able to compare the prices of the assets across different exchanges and do the transactions.

What is risk-free arbitrage?

A risk-free arbitrage is when you buy an asset at a lower price and immediately sell the same asset on some different exchange at a high price. The shorter the time period, the lesser is the risk involved.

Also, read