On-Chain/Derivatives Update

Another exciting week as always for Bitcoin. After breaking below 40k support, BTC now faces 40k as a heavy resistance level. Below support remains 30k across several timeframes, but the area seems to have been front-run for now.

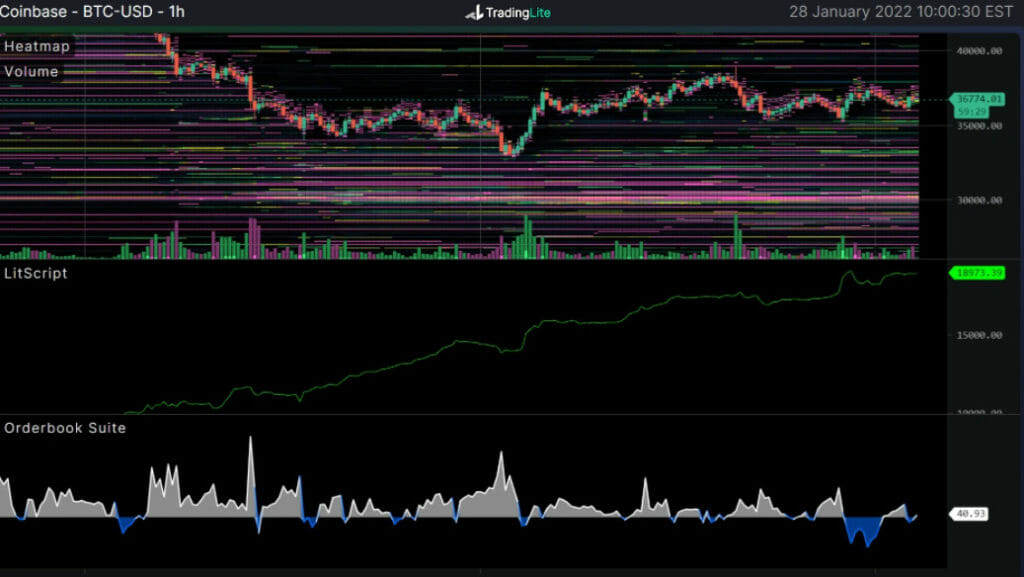

This frontrunning primarily came from an entity on Coinbase. As Bitcoin reached local lows just below 33K, a reasonably aggressive bid stepped in from Coinbase, shown by the heatmap of bids, cumulative volume delta, and volume.

Supply:

The illiquid supply shock ratio continues to climb. This means that coins move from entities that hold less than 75% of the coins they take into entities that hold more than 75% of the coins they take in.

The qualitative aspect of Bitcoin’s float looks very healthy. We can have all the holding behaviour globally, but if there’s no marginal demand stepping in, it doesn’t translate to price appreciation.

Demand:

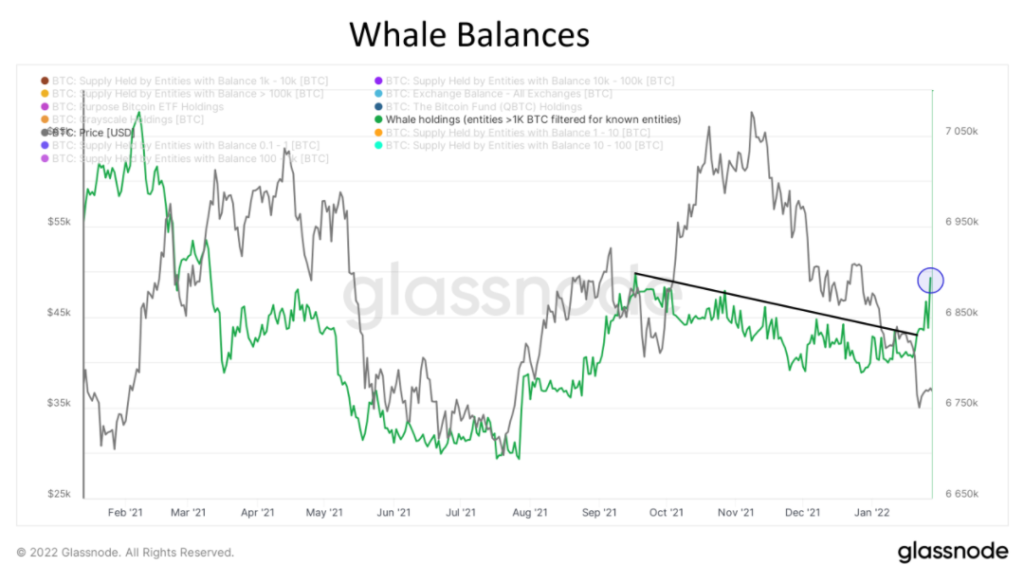

Now to the demand side of things. Generally speaking, I believe demand has been lacklustre over the last few months as illiquid supply has increased because of macro uncertainty and general risk-off behaviour in traditional finance. But from a more tangible data perspective, I like to look at two different things: Whale balances and Spot CVD.

This looks at all entities on the blockchain with more than 1,000 BTC and then filters out exchanges and other known entities.

Whales had been distributing since September, but it seems that this week they are finally adding to their holdings.

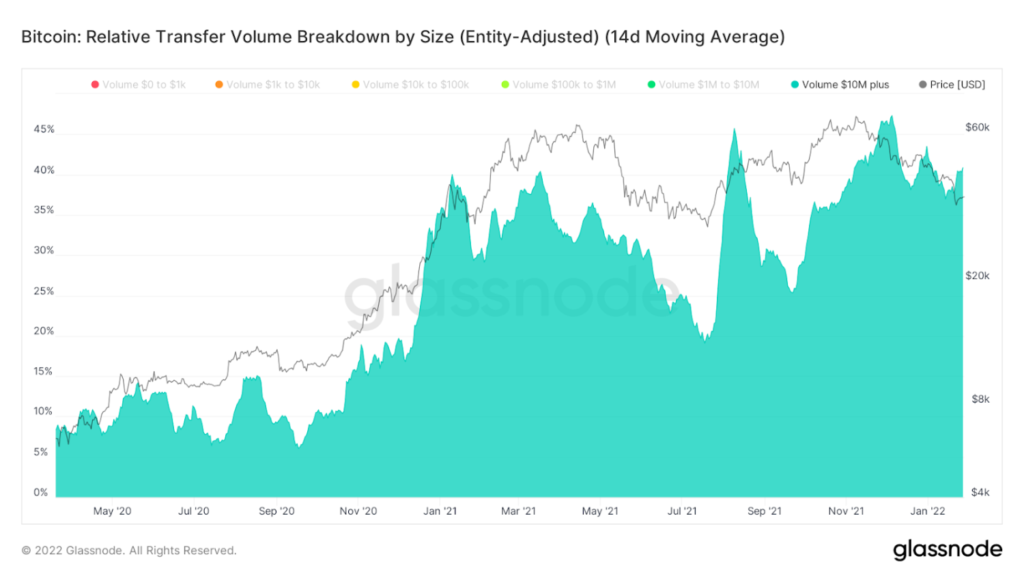

On a side note about prominent market participants: Large transactions dominate volume.

This is a trend that has been growing for over a year now. However, since 2020, the big boys are here, and their share of transfer volume is only growing. This is also likely a reflection of transaction batching becoming more popular with major exchanges.

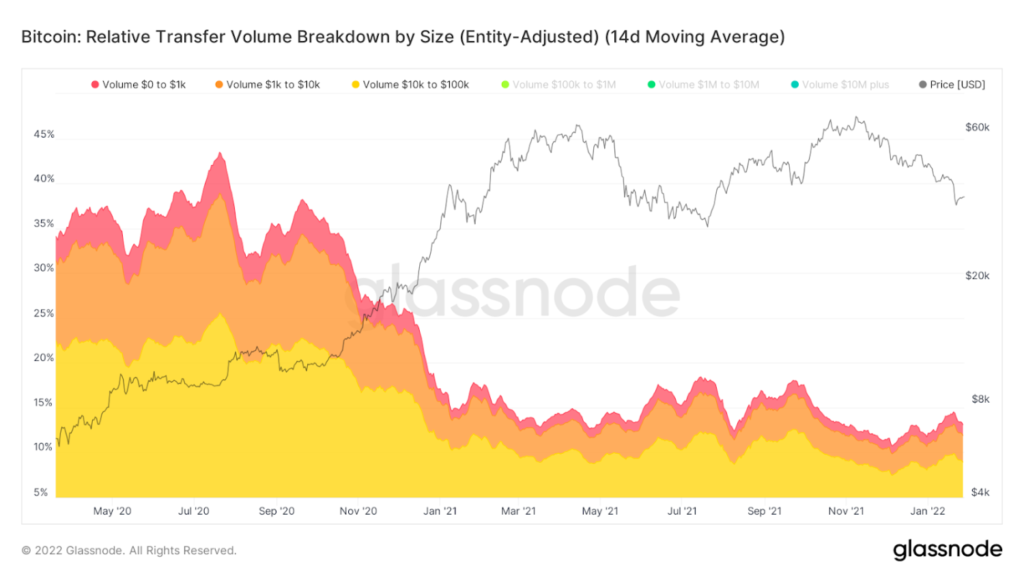

At the same time, we’ve seen a decrease in transfer volume dominance coming from transactions less than $100K.

Correlation to equities continues to be a driving factor for BTC.

We’ve seen some intraday “decouplings” of BTC, with an example being this Monday when the Coinbase buyer stepped in sub 33K, but the general trend has been tight correlation.

This is shown by the blue indicator below: As you can see, the correlation has been the strongest in months.

Part of this is that without a catalyst, there are no distinctive flows to BTC for the time being.

For this correlation to break, we either need traditional finance (particularly QQQ) to rebound, allowing Bitcoin to trade like a high beta asset to rebounding equities or some time of catalyst for BTC to break the correlation.

There is no shortage of exciting news for the asset lately: Russia rumours, Intel getting involved in mining chips, Google looking to store crypto in partnership with Coinbase, Apple and Microsoft talking about the “metaverse” on earnings calls, El Salvador Bitcoin bond raise coming up, rumours of other LatAm countries following them.

I’m not saying you should blindly bet on one of these catalysts occurring, but these are some potential events that could break the correlation.

To wrap up, I think there are two types of players in the Bitcoin market: Momentum buyers and value buyers.

For momentum buyers, particularly from a high time frame perspective, a short-term holder cost basis is the level that I believe is most important to reclaim and flip as support from an on-chain perspective.

The psychology behind this is that above this level, newer market participants are in a state of profit; when below, they are sitting in a state of loss. This currently sits at $41,500. Again this is for momentum-based market participants.

The low 30Ks/upper 20Ks are a value area for value-based market participants for Bitcoin. This is partially based on price action and macro bottom indicators such as the 200W, realized price, and delta price being in the mid 20Ks.

Nothing in this article is financial advice.