Key Takeaways:

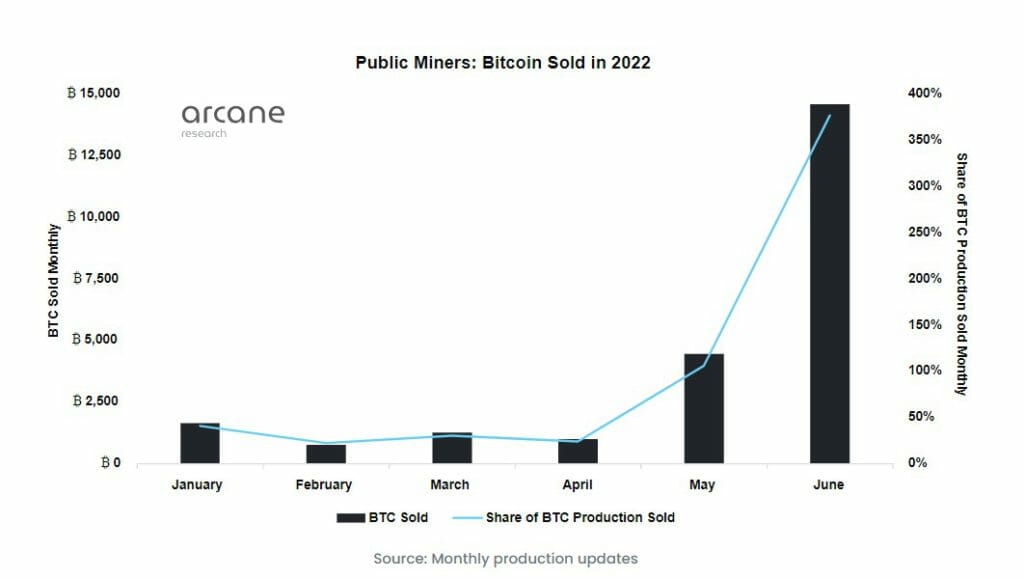

- In June, bitcoin miners liquidated about 14,600 bitcoin on the market.

- May marked the first month where miners sold over 100% of their production.

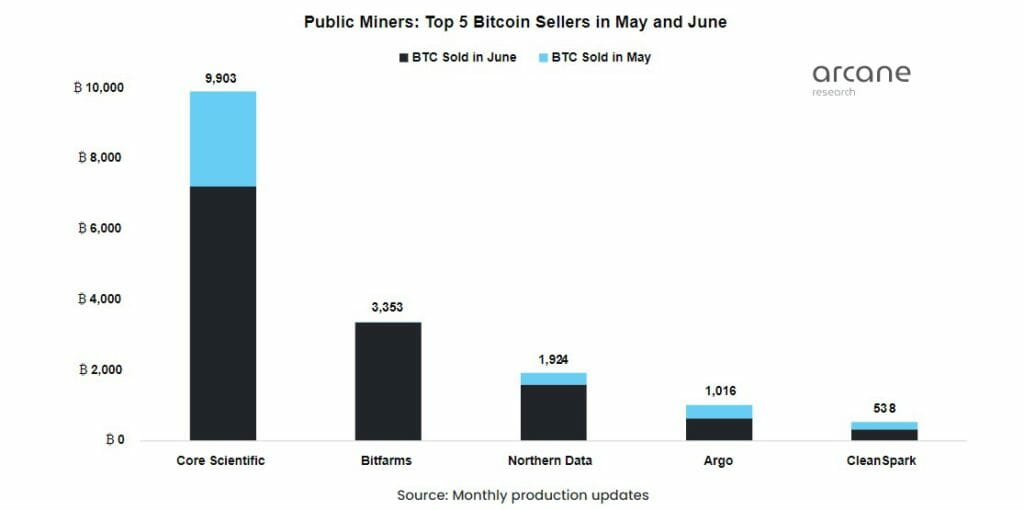

- Core Scientific is the largest bitcoin seller by far, dumping almost 10,000 bitcoin in May and June combined.

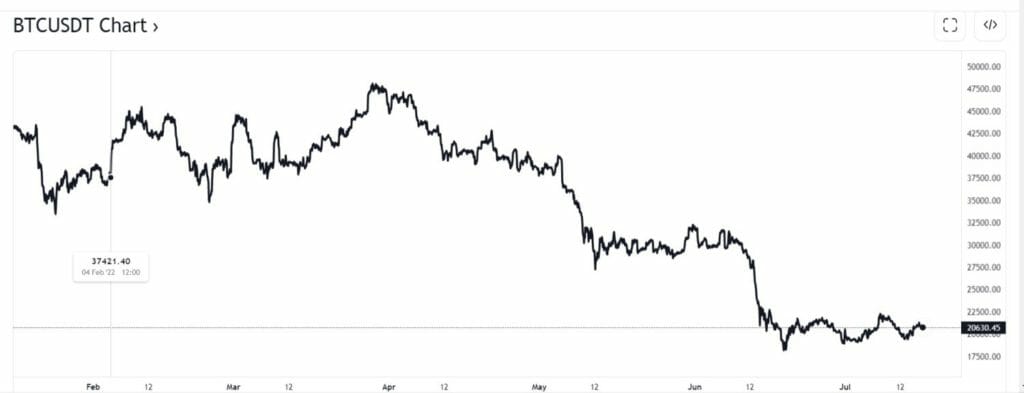

Bitcoin-the world’s most famous cryptocurrency hasn’t really had a good run this year. Bitcoin(BTC) has plummeted over 70% from its record high in November, with around $2 trillion wiped off the value of the entire cryptocurrency market. As the value of the miners’ output relies heavily on the price of BTC, they have had to make tough decisions to survive- including selling off hard-earned coins.

According to Arcane’s research, in June, the public miners sold almost 25% of their bitcoin holdings. The miners liquidated about 14,600 bitcoin last month. Before the onset of the “crypto-winter” public miners rarely sold their BTC. The public miners sold between 20% and 40% of their bitcoin production from January to April 2022, as most of them followed the hodl-at-any-cost strategy.

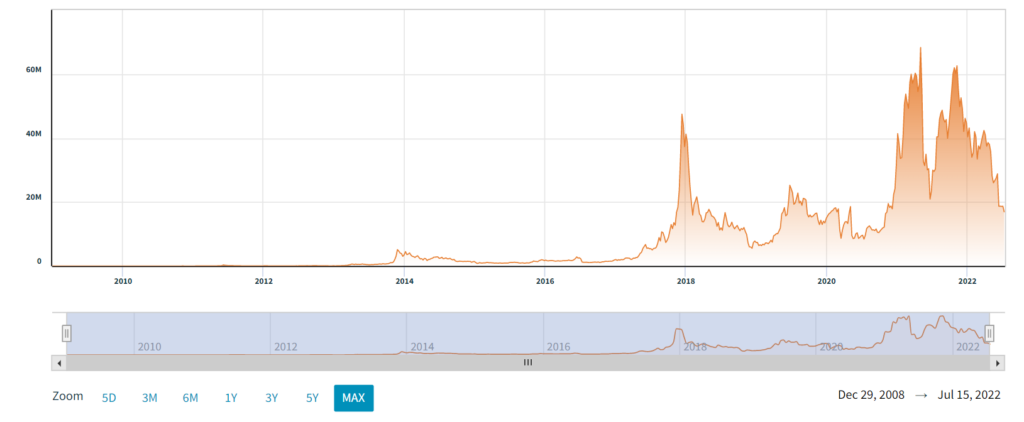

However, bitcoin miners weren’t able to maintain their reserves as after the market crashed the revenue fell significantly as well. Here’s a chart from the Nasdaq data link, representing bitcoin miners’ revenue falling from over a high of $60M to $16M.

When the bitcoin price went from $40k to $30k in May, the wary miners started liquidating their bitcoin holdings. This made May the first month where they sold over 100% of their production. As per the report, public miners only produced 3,900 bitcoin this month, indicating they sold almost 400% of their production, ultimately draining their bitcoin holdings by nearly 25%.

According to the study, Core Scientific, followed by Bitfarms became the largest bitcoin seller by far, dumping almost 10,000 bitcoin in May and June. Bitfarms sold 3,353 bitcoin in June. Despite selling their BTC, Core Scientific is still the biggest company by hash rate, regularly producing around 1,000 bitcoin per month.

The study points out that the weakening capital market coupled with Core Scientific and Bitfarms’ high machine collateralized debt positions forced them to dump more Bitcoin than other miners. Reduced miners’ access to external capital due to increasing interest rates and less investor interest in bitcoin made them utilize saved-up bitcoin to fund their operations.

The study further states that despite many public miners choosing to sell their BTC, not everyone has followed suit. Arcana Research states that Marathon has so far avoided selling and is the biggest hodler with 10,055 bitcoin on their balance sheet, followed by Hut 8 with 7,405 bitcoin.

The researchers behind the study further believes the extreme bitcoin sales in June will not “persist.” The reason cited by Arcane Research is the severe reduction in bitcoin holdings. BTC holdings shrunk by almost 11,000 in June. “Marathon and Hut 8 still have massive amounts of bitcoin on their balance sheets that they could sell, but if they haven’t dumped their holdings yet, they will likely not need to unless BTC price drops further”, the statement justifying their stance reads.

Further to prove the BTC dumping won’t be as severe as it was in June, the study states the reason for the worst miner selling – bitcoin and machine collateralized debt have now reduced drastically.

The price of BTC has been dropping sharply over recent months, owing to major turbulence in cryptocurrency markets. BTC went down 7.1% to $18,993 on June 18, 2022, having earlier touched $18,732, its lowest since December 2020. The price of Bitcoin tumbled on July 13 after news that U.S. inflation hit 9.1% in June, its highest rate in 41 years. Bitcoin dropped under $19,078 at 9:26 a.m following the consumer price index (CPI) report after having a sharp three-day sell-off.

According to recent media reports, many fintech specialists predict that Bitcoin may end in 2022 at $25,473 before falling to as low as $13,676. Currently, one can only speculate if BTC will overcome the bear market with flying colors or will force more public miners to sell their holdings.