Key Takeaways:

- Earlier today, Rune informed people through a Thread that Maker is about to market dump $600 million worth of ETH.

- The 7 siblings dutch auction is over and all 65 million worth of ETH got sold.

- The price went all the way down to 2250 ish before it got arbed in big chunks.

Today early morning, Rune, the co-founder of MakerDAO, informed people through a Thread that Maker is about to market dump $600 million worth of ETH unless someone can phone up this 7 Siblings guy and tell him to top up his vaults in the next 30 mins. I’m confident the Dutch Auctions will hold up but not sure how the market will react.

According to Rune, it would be 65 million worth sold approx in every 30 mins. Rune Tweeted, “Looks like he didn’t react. 600 million in selling is now locked in and will happen over the next hours – exactly how long depends on what happens to the ETH price. Time to scoop that dip.”

After the crashes, we’ve been observing in almost all the global markets for the last couple of days. It was eventually evident that liquidations were going to happen, but nobody really expected someone to stand on a stake to lose around $600 million in a single day. The liquidation didn’t go through at full, but if it had, the market statistics would have been worth nothing.

According to another Thread of Rune, the 7 Siblings woke up and rescued some and only 330 of selling remaining as of right now. Only 65 million have triggered so far; the rest may still be rescuable.

According to stats we’ve received by now, only a part of the total funds was liquidated and that lead to the price of 2250. Imagine what would have happened in the open market if everything was dumped all at once? I believe we’d have observed another set of liquidations driving the prices far lower. Maybe even below $1000.

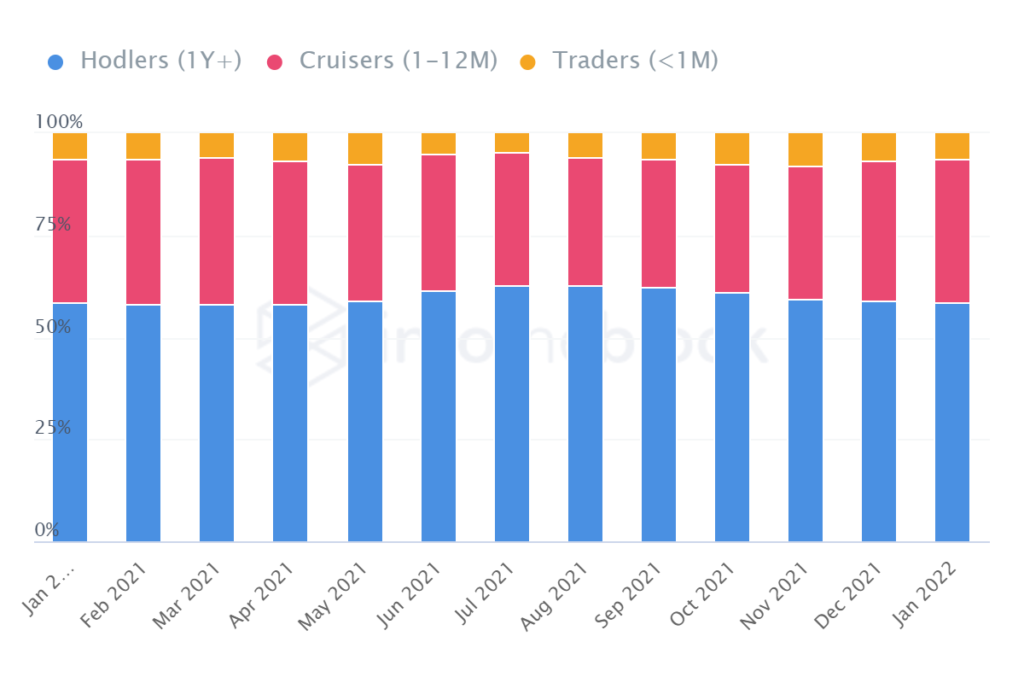

Moreover, fundamentals have been weak recently, and funds have been moving from long term hodlers and Traders to Cruisers since the October high.

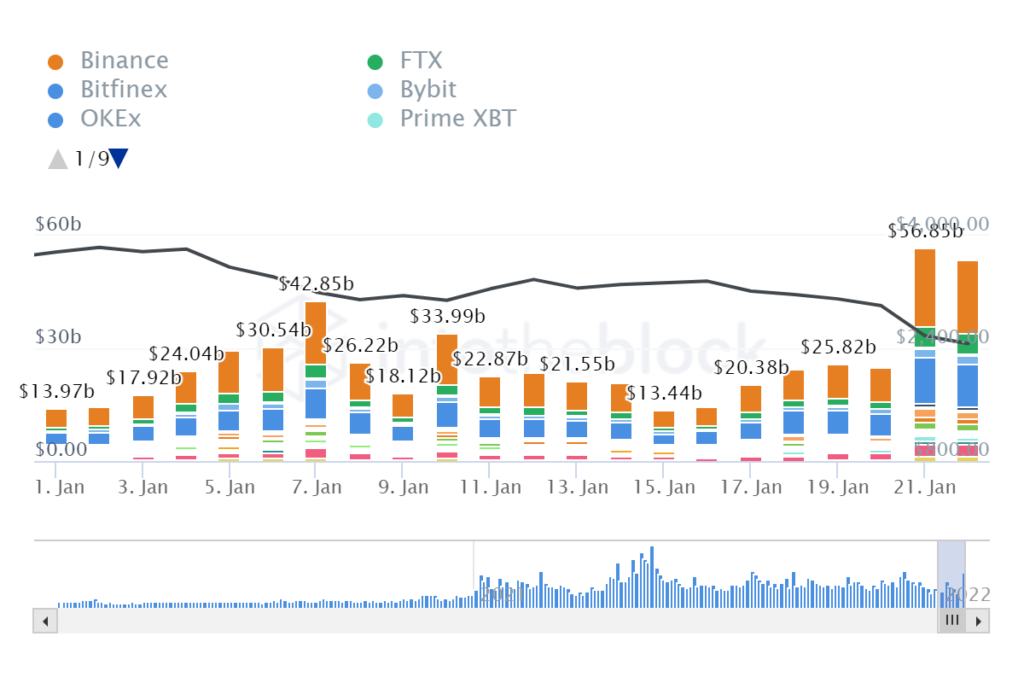

Moreover, amid the recent market scenarios long term hodlers are also moving their funds to exchanges. This is one of the highest levels of funds being moved to exchanges in 30 days. Which could mean we could further see a sell-off in ETH by long term hodlers.

According to Block Analitica, at the time of writing, the number of vaults at risk is 6, the highest risk is $509,474, and the lowest risk is $15,986. Therefore, the total debt amount is $550,776.