Proprietary trading firms, or “prop firms,” are companies that trade financial markets using their own capital rather than client funds. Traders who join these firms are given access to the firm’s capital and operate under defined risk-management rules. In return, traders typically receive a share of the profits they generate, allowing them to trade larger positions than they could with personal funds while helping the firm grow its overall returns. Read on this Lepus Proprietary Trading Review to know more about it as a proprietary trading firm.

Table of Contents

What is Lepus Proprietary Trading?

Lepus Proprietary Trading describes itself as a firm built on “exceptionally talented traders and an investment pathway,” where traders trade the firm’s funds and can earn up to 80% performance profits.

Lepus provides structured mentorship from “expert financial market engineers,” offers a Trader Program covering CFDs and E-mini futures across FX, indices, and commodities, and also connects select investors to its trading operations through an investment vehicle managed by its related entity, Wolverton Investment Group.

Also, you may read 10 Prop Trading Firms Australia

Lepus Proprietary Trading: Key Features

- Lepus trades in Foreign Exchange, Commodities, and Indices.

- Traders trade the firm’s funds, not their own capital.

- The Lepus Trader Program offers traders up to 80% of the performance profits they generate.

- The firm provides online training and mentoring, and beginners with no prior experience are also eligible to join the program.

- Traders have full flexibility to work from anywhere, and can choose to work independently or collaboratively.

- Lepus focuses on trading CFDs and E-mini Futures across FX, indices, and commodities, and does not trade options, equities, crypto, or warrants.

- The firm offers an investment pathway where select wholesale investors can gain exposure to the firm’s trading operations.

- Lepus is the trading name of Wolverton Investment Group Pty Ltd, which operates under an Australian Financial Services License representative structure.

How Lepus Proprietary Trading works: A step-by-step guide

| Step | What You Do | What Lepus States / Requires |

|---|---|---|

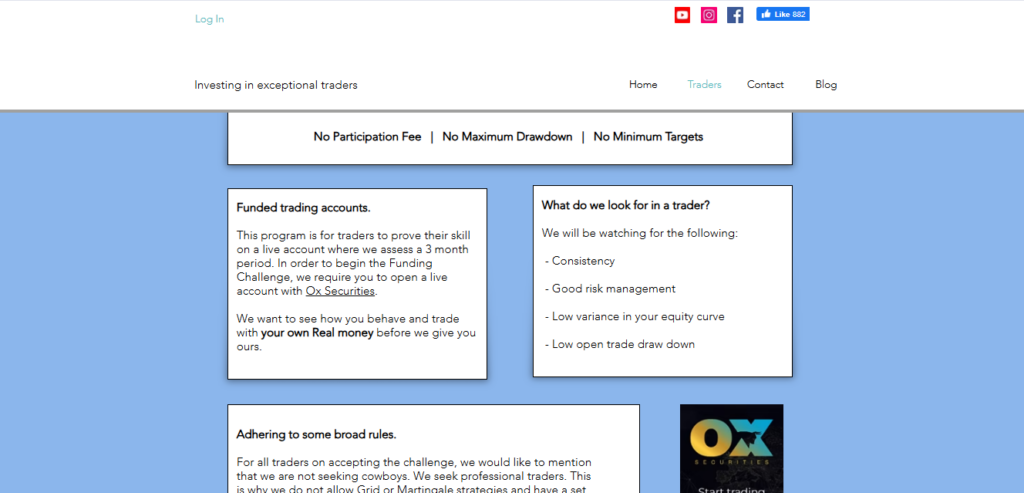

| 1. Understand the Program | Learn what the Funding Challenge is. | 3-month assessment on a live account with no participation fee, no maximum drawdown, and no minimum targets. |

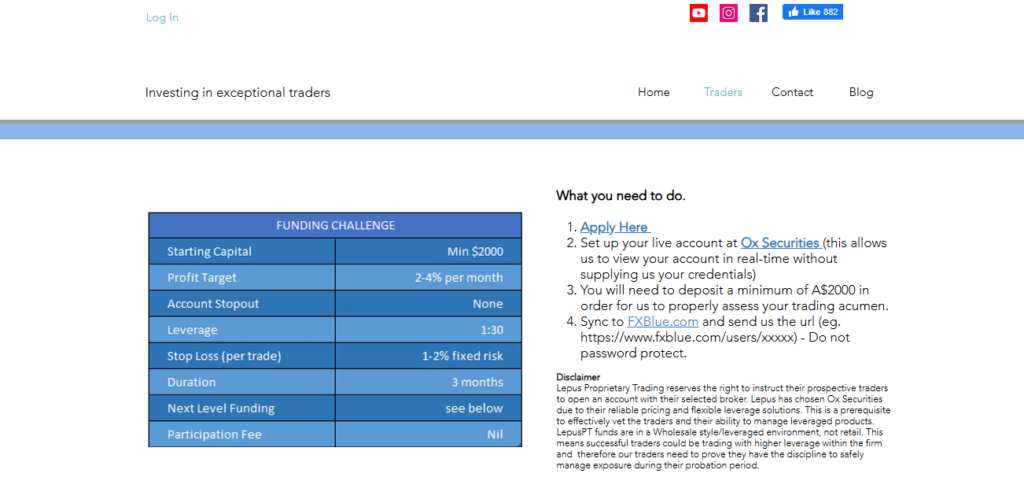

| 2. Apply | Click the “Apply Here” link on the Funding Challenge page. | Starts the challenge process. |

| 3. Open a Live Account | Create a live trading account with Ox Securities. | Lepus can view your account in real time without needing your login details. |

| 4. Deposit Funds | Deposit minimum A$2,000 into your Ox Securities live account. | Used to properly assess your trading acumen. |

| 5. Sync for Monitoring | Sync the account to FXBlue.com and send Lepus your public FXBlue URL. | They specify: do not password protect the FXBlue profile. |

| 6. Trade for 3 Months Under Rules | Trade consistently following all restrictions. | They assess: consistency, risk management, low equity variance, low open-trade drawdown. |

| 7. Selection for Next-Level Funding | If chosen, proceed to contract discussions. | Discuss terms with head traders/CEO (Richard Jackson) |

Lepus Proprietary Trading Funding Challenge — Complete Structured Overview

1. Starting Requirements & Account Conditions

- Starting Capital: Minimum A$2,000

- Profit Target: 2–4% per month

- Account Stopout: None

- Leverage: 1:30

- Stop Loss per Trade: 1–2% fixed risk

- Duration: 3 months

- Participation Fee: Nil (no fee)

These rules create a structure where traders must apply disciplined risk management (mandatory stop-loss and fixed risk), target modest monthly returns, and operate over a controlled 3-month evaluation period.

2. Trading Rules & Restrictions

- Allowed instruments: Currencies, Indices, Commodities

- Not allowed: Crypto

- Maximum 5 open trades at a time

- No grid trading

- No martingale trading

- Stop loss required on every trade

These restrictions eliminate gambling-style methods and reinforce institutional discipline.

3. Funding Challenge Allocation Levels

Next-Level Funding Guide as follows-

| Level | Funding Amount |

|---|---|

| Level 1 | A$10,000 |

| Level 2 | A$40,000 |

| Level 3 | A$150,000 |

| Level 4 | A$450,000 |

| Level 5 | A$750,000 |

| Level 6 | A$2,000,000 |

These levels represent scaling paths, but Lepus states these are guides only and funding is not limited to these amounts.

4. Next-Level Funding Process

If selected after the challenge, you will discuss contract terms with head traders or CEO Richard Jackson, covering:

- Maximum stop

- Risk amount

- Maximum exposure

- Target

- Leverage

Lepus emphasizes:

“We are not a funding scheme; we are a prop firm with contracted traders.”

This shows that funded traders operate under formal professional conditions, not typical retail-style challenge setups.

5. Trader Committee Opportunity

In addition to individual funding, Lepus offers positions on a Trader Committee, where traders:

- Trade much larger accounts

- Use collective decision-making

- Receive a 50% profit share

This pathway mirrors institutional desk trading, giving top performers access to significantly larger capital allocations.

Also, you may read Alpha Capital Review

Support and Community Ecosystem

Lepus’s Trader Coaching Program is designed to train both beginners and experienced traders to become high-level, consistent performers. The program includes a 16+ module online course covering fundamental analysis, technical analysis, trading psychology, and trading behaviour, allowing students to progress at their own pace.

Trainees learn the actual strategies Lepus uses daily, including news-release trading, day trading, and swing trading across instruments such as index futures, forex, and commodities.

The program includes 1-on-1 mentoring sessions directly with their head trader/founder, along with opportunities to watch live trading, observe decision-making in real time, and participate in monthly Trader Development Sessions structured like boardroom discussions on strategy and trade management.

Lepus supports traders through ongoing access to a community channel (Discord) for collaboration and continuous discussion. As traders advance, they may gain access to Lepus’s SRX trading signals, offering the chance to “earn while you learn.”

Overall, the program is presented as a pathway to becoming a professional trader, focused not only on technical skill but on developing discipline, psychological resilience, and behavior suited for real-money trading, ultimately preparing participants for potential placement within Lepus’s own trading structure.

Also, you may read Hola Prime Review: Speed, Funding, Results

Lepus Proprietary Trading vs Fundedfast: Which Prop Firm Fits You Best?

| Feature / Aspect | Lepus Proprietary Trading | FundedFast |

|---|---|---|

| Funding / Challenge Model | Traders deposit their own capital (minimum A$2,000) and are evaluated over a 3-month live-account period. | Traders pay for a challenge to qualify for a funded account. Entry challenges are fee-based. |

| Fee / Deposit / Entry Cost | Requires a minimum A$2,000 deposit. No participation fee. | Entry fees start from approximately $29–$49 depending on challenge size. |

| Account / Assessment Duration | Fixed 3-month evaluation period. | No time limit to complete the challenge. |

| Profit Target / Risk Rules | Profit target is 2–4% per month. Stop-loss required per trade. Risk fixed at 1–2% per trade. Leverage 1:30. | Typical challenge targets around 10% profit. Daily loss and max drawdown rules apply. Leverage up to 1:100. |

| Allowed Instruments | Forex, indices, commodities. Crypto not allowed. | Forex, indices, commodities, and various CFDs depending on challenge. Crypto may be included in some plans. |

| Profit Sharing / Payout | Profit share when funded varies by contract. Trader Committee offers 50% share. | Profit splits advertised up to 90% for funded traders. |

| Scaling / Funding Levels | Funding levels shown up to multiple higher tiers; levels are guides and not limits. | Funding accounts offered from small ($3K) up to $400K, with a scaling plan based on performance. |

| Nature of Capital Used for Evaluation | Traders trade their own real capital during evaluation. | Traders trade a simulated or evaluation challenge account until funded. |

Also, you may read FundedFast: A Quick Analysis

Lepus Proprietary Trading is better suited for traders who prefer real-money evaluation, disciplined risk control, and a professional prop-desk pathway rather than a fee-based challenge. FundedFast is better suited for traders who want fast, low-cost access to funded accounts through a paid challenge with higher leverage and higher potential profit splits.

Safety and Security Overview

- Lepus operates under Wolverton Investment Group Pty Ltd, listed as a Corporate Authorised Representative (No. 1314535) under AFSL 460940, placing it within Australia’s financial services regulatory framework.

- The firm states that its traders trade the firm’s own funds, not client deposits.

- External investors participate through a special purpose vehicle, indicating a separation between investor funds and the firm’s trading operations.

- Lepus warns that trading foreign exchange and futures on margin carries a high level of risk, including the potential loss of all initial capital.

- The website provides general information only, not personalized financial advice.

- Lepus highlights that past performance does not guarantee future results.

- Overall, the firm communicates strong regulatory alignment and risk transparency, emphasizing that leveraged trading remains inherently high-risk.

Overall, the firm communicates strong regulatory alignment and risk transparency, emphasizing that leveraged trading remains inherently high-risk.

Also, you may read Best Risk Management Strategies for Crypto Trading

Who is it best suited for?

Lepus Proprietary Trading is best suited for beginners who want structured training, intermediate traders who are ready to access firm capital through disciplined and consistent trading, and professional traders who prefer an institutional-style environment with the opportunity to trade larger accounts through the Trader Committee.

It is not well suited for traders who prefer high-risk or unrestricted strategies, those who dislike rules such as mandatory stop-losses and limited open trades, or individuals looking for quick profits, guaranteed returns, or complete freedom without oversight.

Conclusion

Lepus appears to be a regulated prop-trading firm under Australia’s financial-services framework, offering traders access to firm capital under structured rules, and providing full transparency about the inherent risks of leveraged trading. For disciplined traders who value oversight, education, and a professional trading environment, Lepus could offer a viable path.

However, the firm itself warns that trading on margin is high-risk and there are no guarantees — success depends on skill, discipline, and consistent performance.

Who founded Lepus Proprietary Trading?

The founder is Richard Jackson, who leads the firm and is described as having over 20 years’ trading experience, and heads the training/mentoring program at Lepus.

Is Lepus only a training school, or a real prop firm?

Lepus states that it is a genuine prop firm, not just an education company. Their model involves trading firm capital via contracted traders once evaluation and training requirements are met.

Can outside investors participate in Lepus’s trading operations?

Yes, through their investment arm under Wolverton Investment Group Pty Ltd, they offer a “special purpose vehicle” through which select (wholesale) investors can invest and gain exposure to the firm’s traders.