Key Takeaways

- On CBOE Australia, ETF Securities introduced Australia’s first cryptocurrency-backed ETFs to give local investors easy access to cryptocurrency’s growing attractiveness.

- The new ETFs may appeal to new investors since they provide a more familiar investing experience. As a result, many of the risks connected with bitcoin investing may be reduced.

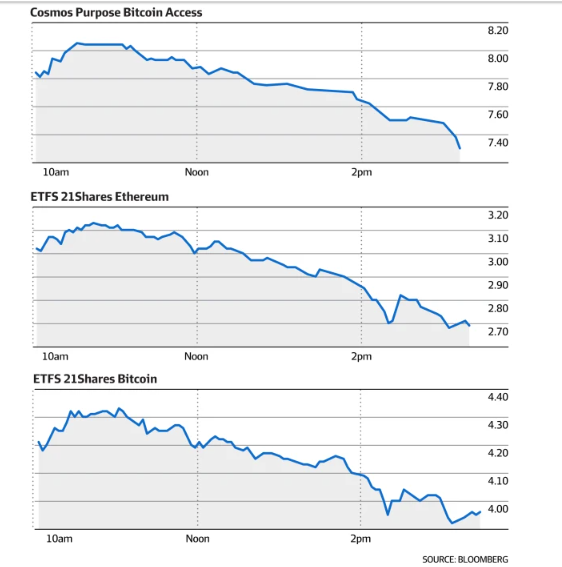

- On Thursday, three new ETFs debuted on the Cboe Australia platform, each with trading volumes below $1 million and underperforming positive market estimates despite the worldwide sell-off in bitcoin and ether underlying values.

On Thursday, a five-year race to launch the first spot bitcoin exchange traded funds in Asia-Pacific came to a halt.

The Securities Exchange ETF and ETF, which were created in collaboration with Switzerland-based 21Shares, began trading on the Australian Cboe Exchange this morning. On the same exchange, the ETF was also introduced today.

The Cosmos Purpose Bitcoin Access ETF (CBTC) from Cosmos Asset Management follows the Toronto Stock Exchange’s Purpose Bitcoin ETF (BTCC-B.TO).

The listings are the latest step in the internationalisation of exchange-traded products (ETPs) that invest in “real” cryptocurrencies, which were previously only available in Canada, Brazil, and a handful of European nations. Only the US has approved crypto-based ETFs thus far, whereas the UK has not.

ETF Securities first approached regulators with the concept of establishing a crypto ETF in 2017, and the Australian launches marked the end of a five-year battle.

The three bitcoin products were supposed to go live on April 27, but last-minute delays were triggered by brokerage concerns.

As a result of the delayed debut, Cosmos announced it will not charge investors fees on their assets for the next two months.

“Australian investor interest in cryptocurrency has not lessened in recent months, despite some underperformance,” Kanish Chugh, Head of Distribution at ETF Securities, said. With the current bitcoin selloff, investors searching for good entry points into this new asset class may have an opportunity.”

As markets plummet, ETFs get a Lukewarm Reception:

The funds were welcomed with scepticism on May 12 as crypto markets continued to plummet after a week of massive losses.

Over the first hour of trading, the Cosmos Purpose fund and 21Shares’ Bitcoin ETF had low trading volumes of around $AU 250,000 ($US 173,000). According to the AFR, the Ethereum fund had volumes of roughly $AU 150,000 ($US 103,000).

The trading volumes were far lower than the record-breaking BetaShares Crypto Innovators ETF (CRYP), which invests in crypto-related stocks and made $8 million in trades within 15 minutes of listing on the main ASX market in November, when bitcoin was at an all-time high.

The announcements came as the price of bitcoin dropped to $41,329, the lowest level in six months and the second lowest in a year. Bitcoin’s price has dropped by 23% in the last month and 17.5% in the last five days. In the last week, Ethereum has lost 25% of its value.

The near-total collapse of $26 billion stablecoin Terra, which was supposed to mimic the US dollar but strayed due to a flawed algorithm, hastened the crypto market fall.

Mr Chugh stated, “The crypto market is really volatile right now.” “The extraordinary volatility in crypto has forced some crypto investors to take a break and wait for things to calm down. This is a difficult market in which to establish a crypto ETF.”